Quantitative Trading Based on Self-Learning Algorithm: 174.29% Return in 14 Days

Quantitative Trading

- P/E (price to earnings ratio)

- PEG (price/earnings to growth ratio)

- price-to-book ratio

- price-to-sales ratio

Our algorithms help you find best opportunities for both long and short positions in stocks within each fundamental screen.

Package Name: Fundamental – Low P/E Ratio Stocks

Package Name: Fundamental – Low P/E Ratio Stocks

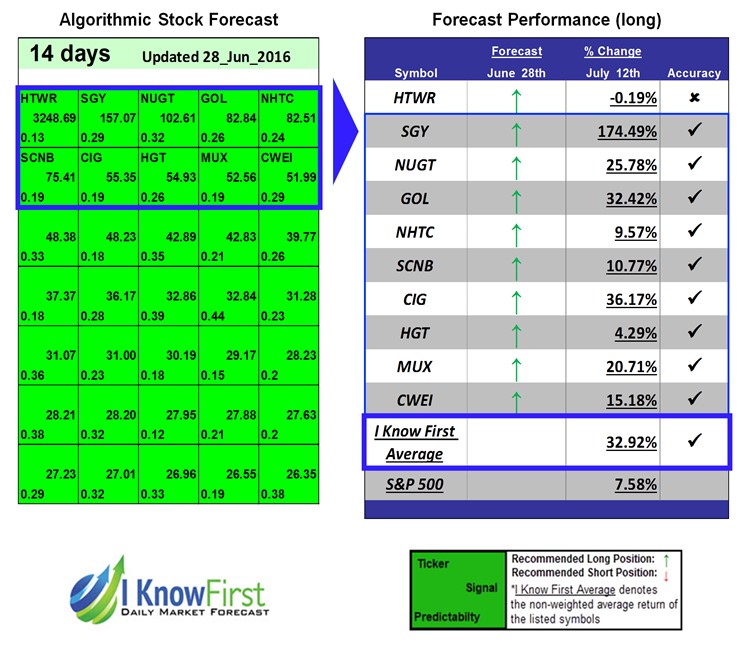

Forecast Length: 14 Days (6/28/16– 07/12/16)

I Know First Average: 32.92%

9 out of 10 stocks in the long position for this forecast increased as predicted by the algorithm. The highest returning stock for the short-term was SGY with an impressive growth of 174.49%. CIG followed closely returning 36.17%, plus GOL returned 32.42% and NUGT returned 25.78%. The package’s overall growth was 32.92% compared to the S&P 500’s dip of 7.58% for the same period.

The Stone Energy Corporation (SGY), is an American oil and gas corporation based in Lafayette, Louisiana, USA

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.