Quantitative Trading Based On Machine Learning: Up To 23.33% Return In 3 Days

Quantitative Trading

This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

- top ten aggressive stocks picks that best fit for long position

- top ten aggressive stocks picks that best fit for short position

- top ten conservative stocks picks that best fit for long position

- top ten conservative stocks picks that best fit for short position

Package Name: Risk-Conscious

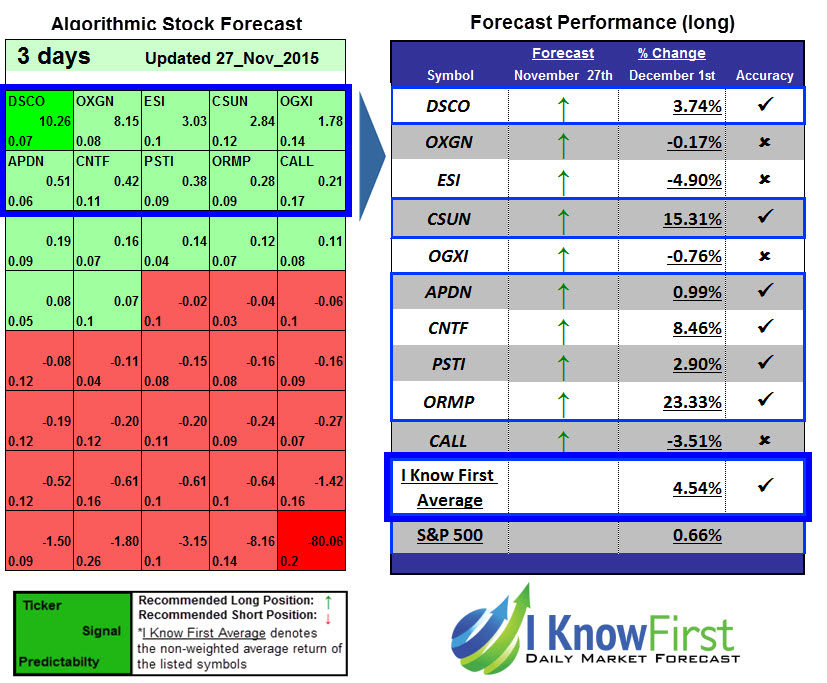

Forecast Length: 3 Days (11/27/2015 – 11/30/2015)

I Know First Average: 4.54%

I Know First’s 3-day forecast from the Risk-Conscious package 6 out of the ten stocks increase in accordance with the algorithm’s prediction. ORMP performed extremely well, returning 23.33% during the time horizon as the algorithm indicated. Likewise, CSUN was also included in the top 10 picks of the Aggressive Stocks forecast and had strong returns of 15.31% over 3 days. The average return of 4.54% during the forecasted time horizon outperforming the S&P 500 return of 0.66% during the same time.

Oramed Pharmaceuticals Inc. (ORMP) is an Israeli based company that focuses on research and development of pharmaceutical solutions for the use of orally ingestible capsules or pills for delivery of polypeptides. The I Know First algorithm successfully foreseen the trend, that came in a response to a $50 million licensing deal in China.

Algorithmic traders utilise these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast