NVDA Stock Prediction: Taking Their Punches And Rolling Strongly Ahead

This NVDA stock prediction article was written by Ari Herzog, a Financial Analyst at I Know First

This NVDA stock prediction article was written by Ari Herzog, a Financial Analyst at I Know First

“We’ve always believed that robotics were important. And robotics are autonomous machines. The simplest autonomous machine is the self-driving car. But it’s the most impactful.” – Nvidia CEO Jensen Huang

Key Takeaways

- Short-term risks, including its exposure to China as well as ambiguous GPU demand and uncertain positioning within the gaming sector, should not affect NVDA’s earnings more so than its semiconductor competitors

- Nvidia’s footprint in major technological advancements including AI, autonomous vehicles, and data centers are strong long-term growth areas to point to

- Over 40% drop in NVDA stock price since late 2018, with the price sitting near 2-year lows, signals a current buying opportunity

- I Know First AI Algorithm keeps bullish NVDA stock prediction for long term

All Aboard ‘The Green Team’

Nvidia (NVDA) arrives today as a dominant force within the industry of semiconductors. Founded in 1993 and based in Santa Clara (the heart of Silicon Valley), Nvidia designs graphics processing units (GPUs) for the gaming and professional markets. The firm powers the PC gaming market, has refined modern computer graphics, and is revolutionizing parallel computing and aiding advances in the next generation of artificial intelligence. Nvidia’s GPU segment accounts for 85%, a level made even more impressive by the fact that it is the clearcut leader in the GPU market. Despite the large dependency on the GPU market, its strong cash flow generation and proactive positioning for future technologies are what separates them from the pack. Namely, Nvidia either already is or has plans to provide services to every major technological advancement including Artificial Intelligence, Self-Driving Cars, cloud gaming software, and blockchain technology. In short, the semiconductor industry is responsible for supplying the software and processing power for every major technology platform currently in existence as well as those that have yet to be commercialized. This second area, the one about Nvidia supplying the products that have yet to be fully created, is what makes the stock so enticing, and is exactly where investors should focus on when deciding whether to make a bullish bet on ‘The Green Team.’

Three Primary Risks To Watch Out For…

Significant Exposure to China Could Lead to A Larger Issue

The ongoing trade tensions between the US and China have not helped Nvidia’s performance and will continue to depress its numbers as it drags on. Though it is highly unlikely the US government will block the sales of gaming or even generic GPUs to Chinese customers, the likelihood of them blocking the sale of data center and software-related services remains high. The domino effect of Nvidia losing out on the Chinese market extends far beyond lessened short-term sales, as many startup chip makers in China, which are benefiting from large national investments in the semiconductor industry, are itching to grab a hold of Nvidia’s enormous market share. Either way, Nvidia is definitively exposed to China’s market, due to the nature of the semiconductor industry, as nearly a quarter of its revenue stems from the Chinese economy.

Potential For a Drastic Downward Shift in GPU Demand

Demand for GPUs 5 years down the road is uncertain, especially considering how vulnerable the industry is to technological and algorithmic development. How Nvidia reacts and adjusts to the change in demand over the next 6-12 months will be crucial for understanding if Nvidia can hold their strong market share moving forward. As of now, GPUs play a primary role in AI, Machine Learning, Autonomous Vehicles, and other related software. But, this may not always be the case as processing chips could be designed to specialize in particular tasks. One such case in which specialized tasks might have the upper hand in specific applications is Google’s TPU chip, which is manufactured to maximize flexibility and performance in machine learning workload. Similarly, the opportunity of a lessened application for or delayed commercializing of related industry such as Artificial Intelligence or Software-As-A-Service (SAAS) – two areas that are projected to grow exponentially over the next decade while using GPUs as their driving chip – remains something to keep an eye on.

Next-Gen Gaming Market Could Spell Doom for NVDA if Not Approached Properly

If Nvidia fails to supply next-generation consoles, such as those similar to the Nintendo Switch, with its Tegra processor, it could miss a massive growth opportunity and allow smaller competitors, such as AMD and Intel, to gain vital market positioning. On top of this, if the gaming market continues its trend towards adapting mobile gaming, Nvidia will have a tough time catching up as it currently does not have a major presence in the market.

Three Main Growth Areas…

NVidia Can Ride The Wave of AI Through its GPU Market Dominance

Despite the challenges discussed above relating to its China exposure and unstable footing in the gaming sector, NVDA looks steady long-term due to its diverse clientele and product offering. Mainly, they have a stronghold in the artificial intelligence, autonomous driving, and data center sectors. With this wide range of products comes a vast amount of high-profile clients, as NVIDIA is touting the likes of Apple to Daimler to SpaceX as a few of their many clients or partnerships. I spoke earlier to the fact that task-specific chips are gaining traction, mainly due to the concerns about power consumption and efficiency of general chips. However, these specialized chips not only have many obstacles to circumvent before they are fully integrated into machine learning processes, but they are also predicted to be used primarily as accelerators alongside GPUs, which will continue to be the essential chip used for data center applications. Along the same lines, the growth of AI-related products, and the spending to produce and maintain those services, will play nicely into NVDA’s hands. In particular, the AI market for enterprise applications is expected to have a CAGR of 64% from 2016 to 2025, with rises of 134% and 93% already occurring in 2017 and 2018 respectively.

Continuing with the theme of AI applications, Nvidia’s recent partnerships with self-driving startups and established automakers could pay off big. Mainly, Nvidia announced two main products centered around the nascent sector: its DRIVE APX 2 platform, which offers automated driving features, and NVIDIA DRIVE AutoPilot, a semi- and fully-automated driving system expected to be commercially available as soon as 2020. If one takes a look at the forecasted rise of autonomous vehicles, which is expected to grow at a CAGR of 14% from 2016 to 2025, they can see why Nvidia has thrown so much effort and capital into the field.

Pending Acquisition of Mellanox Could Lead to Vertical Leverage

Mellanox, which is a provider of the computer networking technology InfiniBand, announced that it was acquired by Nvidia on March 11 for $7.36 billion in an all-cash deal. The deal values Mellanox at $125 per share, a 14.28% premium at the time of the initial announcement. Nvidia’s strong cash flow, which totaled $7.8 billion at the end of Q1 FY20, allowed them to negate the step of intaking any debt to finance the purchase. While the deal is still awaiting approval over regulatory concerns, Nvidia is determined to push it through as they are obligated to pay a $350 million termination fee in the case of a failed attempt. As Mellanox shareholders just recently approved the deal with a resounding 99.5% voting in favor, the prospects for the transaction are looking bright. Assuming the deal maintains its current positive trajectory, the combined entity creates an extreme business opportunity for two main reasons. The first being the potential for cutting costs within their sales teams. Currently, about 10-15% of Mellanox’s revenue goes towards sales and marketing. With the acquisition, Mellanox can significantly decrease this expense by joining its sales forces with Nvidia’s data center sales team, as both groups are focused on the same type of product and target market, thus strengthening its margins. The other catalyst for the deal is the ability to leverage their existing clientele in creating stronger customer development for both sides. Mellanox has an established, high-quality data center customer base – with HP and Dell consisting of more than 25% of its total revenue from the segment. Nvidia can tap into this widespread and exceptional client base for its own data center services, as well as introduce them to its other existing products. On top of this, the united firm will be able to create even more comprehensive solutions than its competitors and, thus, will create a seller’s market by charging higher prices for their services.

Inventory Recovery In Full Swing

Although the crypto bubble in late 2018 led to a massive misjudgment of demand in GPUs for Nvidia (as well as its competitors), its management team is working hard to retrace its steps and put its supply in line with the GPU market demand. To reiterate, the decline in cryptocurrency mining shattered the demand for graphics card from PC gamers in the second half of 2018, thus creating excess inventory for Nvidia. The inventory spike resulted in major declines in both sales and earnings and led to an extreme price drop for graphics chips that many semiconductor companies are still recovering from. But things are looking up for Nvidia, as their CEO Jensen Huang earlier this year quieted fears related to its inventory management with the following comment,

“It’s completely a crypto hangover issue. Remember, we basically shipped no new GPU in the market, to the channel, for one quarter. We said that it would take one to two quarters for all the channel inventory to sell out. 1080Ti has sold out. 1080 has sold out. 1070 has sold out. 1070Ti has sold out. In several more weeks, 1060s will sell out. Then we can go back to business.”

Valuation

As it currently stands, NVDA stock is trading at a trailing-twelve-months (TTM) P/E of 32.03, EPS of 5.3, and EV to EBITDA ratio of 31.02. When peering into the future of the semiconductor industry and considering Nvidia’s positioning within the GPU market, it becomes clear that these numbers, albeit at a premium to their close competitors, become warranted. Nvidia, as mentioned above, has integrated the next-generation markets of Artificial Intelligence, Autonomous Vehicles, and data center software as well as, if not better than, their peers. As QCOM’s PEG ratio indicates they are slightly undervalued despite having the highest P/E ratio of the group, it is not a stretch to assume NVDA can match their P/E value of 40.00. This prediction becomes even more apparent when one considers NVDA’s extreme share buyback plans over the next few years, a move that typically leads to a jump in stock price. If NVDA can match QCOM’s P/E of $40, and we infer their EPS of 5.3 and amount of shares outstanding remain consistent in the short term, we arrive at a price target of $207.55 per share.

Technical Analysis

As Nvidia is down over 40% from its 52-week high of $292.76 on October 1 of last year, its current price of $169.71 indicates the potential for a buying opportunity. When one considers that the price drop was largely due to extreme investor fears over Nvidia’s inventory glut, the stock appears even more enticing. Looking at the first chart below, NVDA has traded between the $200 and $125 level since it downwardly broke the $200 barrier in late October, only quickly peaking above $200 for a few days in early November. This is an important trading range and one way to trade it would be buying it at its current level and placing a stop loss at $125 to prevent losses in a bearish scenario.

Taking a look at the second chart, which shows the YTD performance of NVDA alongside its two peers – AMD and QCOM, NVDA has underperformed both stocks in terms of percentage growth. This comes despite NVDA having the greatest mix of established profits and growth potential, and further demonstrates that the price target of $207.55 is within reach.

Conclusion

Despite the market risks associated with their short-term exposure to the Chinese economy, unknown demand for GPUs in future technologies, and Nvidia’s uncertain positioning within the cloud gaming software, their market preeminence and focus on innovation will carry them to consistency in the long-term. Particularly when the pricing for GPUs normalize to levels before the industry-wide inventory glut, Nvidia should see enhanced margins and a heightened market cap to match. NVDA is a buy, as its strength in capital, a wide array of partnerships, and dominant market position all point to Nvidia being the main supplier of chips for when the next-generation of technology – primarily AI, AV, and data center software – realizes its true financial potential.

I Know First NVDA Stock Prediction

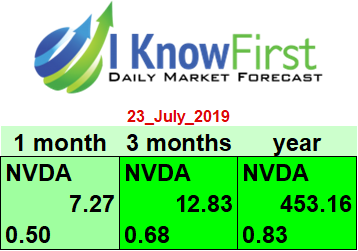

This is the I Know First NVDA stock prediction for the next year. It currently has a positive outlook with a signal strength of 453.16 and predictability indicator of 0.83.

Past I Know First Success With NVDA Stock Prediction

I Know First has been bullish on the NVDA stock prediction in the past. On December 27, 2018, an I Know First algorithm issued a bullish 3-month forecast for NVDA with a signal of 5.92 and a predictability of 0.65, and the algorithm successfully forecasted the movement of the NVDA share. After the forecast was published, NVDA shares rose 34.56% within 3 months – in line with I Know First’s algorithmic forecast. See the chart below.

This Bullish NVDA stock prediction was sent to current I Know First subscribers on December 27, 2018.

To subscribe today click here.

Please note – for trading decisions use the most recent forecast