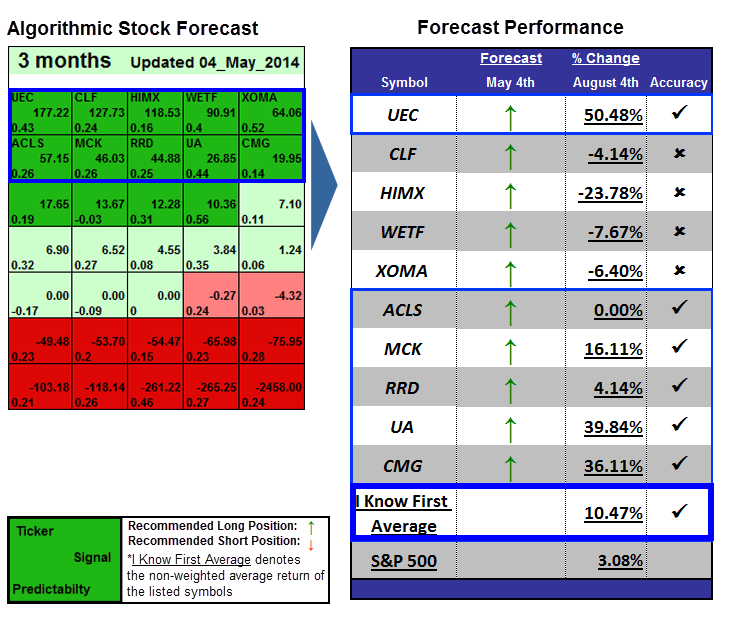

I Know First Review: Top Performing Stocks for August 4th

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s May 4th 2014 Stock Forecast titled, Algorithmic Trading: 50.48% Gain in 3 Months. The “I Know First Average” return was 10.47% versus the S&P 500’s return of 3.08% over the same time period.

Click Here For Full Story

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (3 months): 177.22

Predictability (3 months): 0.43

Return: 50.48%

Uranium Energy Corp. (Uranium Energy) is an exploration-stage company. The Company is a natural resource exploration company engaged in the exploration of properties in the United States.Additionally, the Company controls a pipeline of advanced-stage projects in Arizona, Colorado and Paraguay.

Signal (3 months): 57.15

Predictability (90 days): 0.26

Return: 0.00%

Axcelis Technologies, Inc. designs, manufactures, and services ion implantation, dry strip, and other processing equipment used in the fabrication of semiconductor chips worldwide. It offers high current, medium current, and high energy implanters. ACLS released its second quarter financial results yesterday, August 4th. The biggest piece highlight was news of the first Purion H high current implanter being shipped to a leading Asian-Pacific chipmaker, where it will join the Purion XE and Purion M systems already in place.

Signal (3 months): 46.03

Predictability (3 months): 0.26

Return: 16.11%

McKesson Corporation delivers pharmaceuticals, medical supplies, and health care information technologies to the healthcare industry in the United States and internationally. The company operates in two segments, McKesson Distribution Solutions and McKesson Technology Solutions. The McKesson Distribution Solutions segment distributes ethical and proprietary drugs and equipment, and health and beauty care products. McKesson crushed its first quarter earnings and revenues and is forecasted to continue its strong growth throughout the rest of the fiscal year.

Signal (3 months): 44.88

Predictability (3 months): 0.25

Return: 4.14%

R.R. Donnelley & Sons Company provides integrated communication solutions to private and public sectors worldwide. It operates through Publishing and Retail Services, Variable Print, Strategic Services, and International segments. The company primarily offers magazines, catalogs, retail inserts, books, directories, and packaging products. Despite a mediocre second quarter earnings, Donelley’s new client wins such as ZAGG INC (ZAG) and existing clients such as Williams-Sonoma (WSM) and Office Depot Inc. (ODP) help the company generate incremental revenues.

Signal (3 months): 26.85

Predictability (3 months): 0.44

Return: 39.84%

Under Armour, Inc., together with its subsidiaries, develops, markets, and distributes branded performance apparel, footwear, and accessories for men, women, and youth primarily in North America, Europe, the Middle East, Africa, Asia, and Latin America. The company offers its apparel in compression, fitted, and loose types to be worn in hot, cold, and in between the extremes. Based off of Under Armour’s chart and technicals, Jim Cramer thinks the stock could work higher. Under Armour has been one of the strongest performers in the retail industry when looking at its YTD (year to date) gains.

Signal (3 months): 25.39

Predictability (3 months): 0.15

Return: 36.11%

Chipotle Mexican Grill, Inc., together with its subsidiaries, develops and operates fast-casual and fresh Mexican food restaurants. As of July 21, 2014, it operated approximately 1,600 restaurants; and 7 ShopHouse Southeast Asian Kitchen restaurants. The company was founded in 1993 and is based in Denver, Colorado. Chipotle recently reported an impressive 17.3 percent same-store sales growth during the second quarter and are poised to continue climbing in the future.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Read More From I Know First Research: