I Know First Review: June 18th 2014

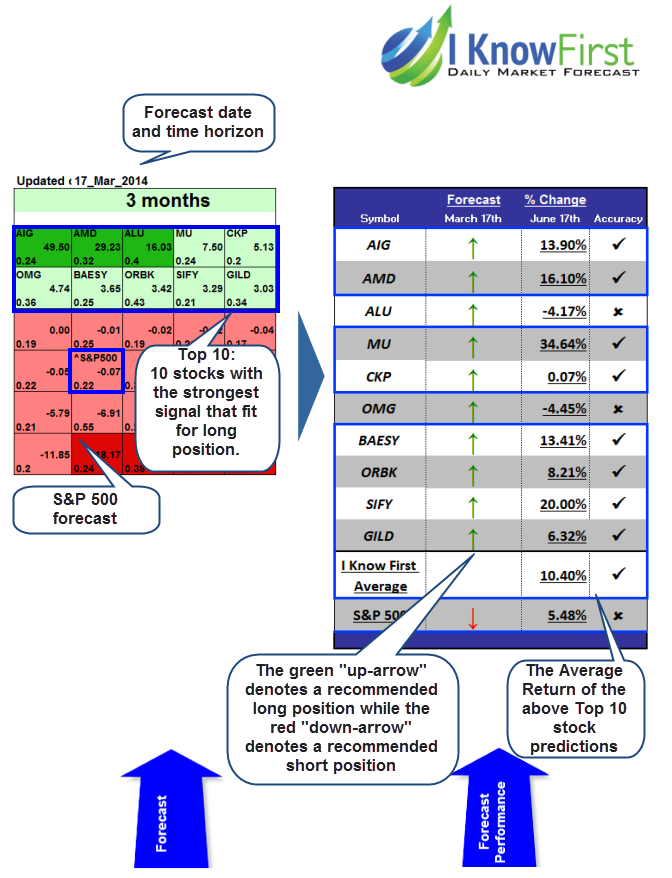

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s May 8th 2014 Stock Forecast titled Predictive Analytics: 10.40% Average Gain in 90 Days. The I Know First Average return was 10.49% versus the S&P 500’s return of 5.48% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (90 days): 49.5

Predictability (90 days): .24

Return: 13.90%

American International Group, Inc. provides insurance products and services for the commercial, institutional, and individual customers in the United States and internationally. The company is split into two segments: AIG Property Casualty and AIG Life and Retirement. Earlier this week, AIG announced a new venture to take part in middle market lending. The company put up 1.5 billion to lend to companies that generate $10-75 million in annual EBITDA. While some are skeptical that AIG is straying away from its traditional business model, Warren Buffett just loaded up on nearly 9 million shares of the company.

![]()

Signal (90 days): 29.23

Predictability (90 days): .32

Return: 16.10%

Advanced Micro Devices Inc. (AMD) received a positive signal 29.32 of and predictability of 0.32. The stock returned 11.11% in accordance with the algorithmic forecast. A few weeks back (5/20) AMD introduced its second generation R-Series embedded processors code named Bald Eagle, which are successors to the original R-Series products. The new processors use AMD’s latest “Steamroller” CPU cores to target a few specific markets including gaming machines, medical imaging, digital signage, industrial control and automation (IC&A), and communications and networking infrastructure. Experts are hailing the new processors as the highest performance embedded devices for 2014, putting AMD in a good position compared to its competitors. Compared to Intel’s Haswell-based Core i7 -4765T’s score of 1424 on the 3DMark 11 benchmark suite, the AMD Bald Eagle scored 2051, a 44 percent increase for the same 35W thermal design profile. A 46 percent improvement from the AMD chip was also seen on the BasemarkCL benchmark. To further encourage users to adopt the new chips, AMD has pledged to provide 10 years of support for the chips, meaning that replacement parts will be available for at least that long. The price has not yet been released.

Signal (90 days): 7.5

Predictability (90 days): .24

Return: 34.64%

Micron Technology, Inc., together with its subsidiaries, manufactures and markets semiconductor solutions worldwide. If offers dynamic random access memory (DRAM) products for data storage and retrieval that are used in computers, tablets, mobile phones, communication equipment, computer peripherals, industrial, automotive, and other electronic devices. The company has been on a nice streaking of beating earnings estimates. When looking at the past 2 reports, MU has beaten estimates by at least 35% in both cases.

Signal (90 days): 5.13

Predictability (90 days): .2

Return: .07%

Checkpoint Systems, Inc. manufactures and provides technology-driven, loss prevention, inventory management and labeling solutions to the retail and apparel industry worldwide. The company operates in three segments: Merchandise Availability Solutions, Apparel Labeling Solutions, and Retail Merchandising Solutions. Despite p Jim Cramer recently describing the network security industry as “lackluster” and “pitiful”, ^CKP reported quarter one EPS of $.04 beats by $.15.

Signal (90 days): 3.65

Predictability (90 days): .25

Return: 13.41%

BAE Systems plc operates as a defense, aerospace, and security company worldwide. Its Electronic Systems segment offers electronic warfare systems and electro-optical sensors, military and commercial digital engine and flight controls, military communication systems and data links, persistent surveillance capabilities, and hybrid electric drive systems. This month, Bae Systems won a 70.1 million contract to supply the U.S. Army with Low-Rate Initial Production of up to 30 tactical signals intelligence payload systems. Engineering support services will also be provided. The estimated completion date for this contract is June 11, 2016.BAE Systems plc operates as a defense, aerospace, and security company worldwide. Its Electronic Systems segment offers electronic warfare systems and electro-optical sensors, military and commercial digital engine and flight controls, military communication systems and data links, persistent surveillance capabilities, and hybrid electric drive systems. This month, Bae Systems won a 70.1 million contract to supply the U.S. Army with Low-Rate Initial Production of up to 30 tactical signals intelligence payload systems. Engineering support services will also be provided. The estimated completion date for this contract is June 11, 2016.

Signal (90 days): 3.29

Predictability (90 days): .21

Return: 20%

Sify Technologies Limited operates as an integrated Internet, network, and electronic commerce services company in India and rest of the world. The company’s services enable businesses and consumers to communicate, transmit, and share information; access online content; and conduct business using its private data network or the Internet. The stock has experienced a 37.84% gain in the past 52 weeks, and the Board of Directors recently recommended the introduction of a 10% dividend on the paid up capital of the equity shares and ADR holders for the years 2013-14.

Signal (90 days): 3.03

Predictability (90 days): .34

Return: 6.32%

Gilead Sciences, Inc., a biopharmaceutical company, discovers, develops, and commercializes medicines for the treatment of life threatening diseases in North America, South America, Europe, and the Asia-Pacific. During 2013, they delivered strong financial performance and continued to invest in their product pipeline. Total revenues grew 15% to $11.20 billion and total product sales grew 15% to $10.80 billion, compared to 2012 driven primarily by an increase in antiviral product sales. The company’s products include Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost, and Vitekta for the treatment of HIV and Sovaldi, Viread, and Hespera products for the treatment of liver disease.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Selected stocks mentioned from this forecast are not an endorsement for making trading decisions with these assets currently. Please make trading decisions only with the most recent forecast.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. This article was written by Joe Stempel, one of our interns. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Read More From I Know First Research:

Amazon Has Been Flexing Its Muscle And This Assertiveness Will Reward Shareholders

Google’s Choice: To Be A Complacent Advertiser Or A Pioneer In The ‘Internet Of Things’

Tesla Stock Forecast Based On Predictive Analytics

Netflix: A Temporarily Overvalued Company With Real Potential

Chipotle Mexican Grill: A Tasty Investment On Our Algorithmic Forecast Menu