I Know First Review: March 14th 2015

I Know First Algorithm Review

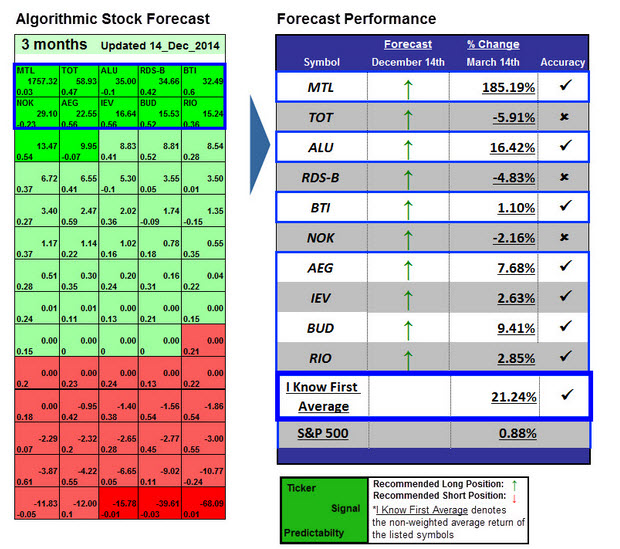

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s December 14th, 2014 stock forecast titled Quantitative Finance Using Algorithms: Up To 185.19% Return In 3 Months. This forecast is part of the “Best European Stocks” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 21.24% over 3-month versus the S&P 500’s return of 0.88% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal : 1757.32

Predictability : 0.03

Return: 185.19%

Mechel OAO, together with its subsidiaries, is engaged in mining and steel businesses in the Russian Federation, other CIS countries, Europe, Asia, the Middle East, and internationally. The company operates through four segments: Mining, Steel, Ferroalloys, and Power. The Mining segment is engaged in the production and sale of metallurgical and steam coal, coke, iron ore, and limestone, as well as chemical products, such as coal tar, naphthalene, and other compounds.The company had a signal strength of 1757.32 and a predictability indicator of 0.03. In accordance with the algorithm prediction, the stock returned 185.19% in 3 Months. Mechel shares lumped as much as 27 percent to 89.20 rubles in Moscow after Kostin said he was open to a resolution with the mining company, which has more than $6 billion in total debt mostly to state-controlled VTB, OAO Sberbank and OAO Gazprombank.

Signal : 58.93

Predictability : 0.47

Return: -5.91%

TOTAL S.A. operates as an oil and gas company worldwide. The company operates through three segments: Upstream, Refining & Chemicals, and Marketing & Services. The Upstream segment explores and produces oil and gas; ships, trades, and markets natural gas, liquefied natural gas, and liquefied petroleum gas (LPG); generates power; and mines and markets coal.

Signal : 35.00

Predictability : -0.1

Return: 16.42%

Alcatel-Lucent provides Internet protocol (IP) and cloud networking, and ultra-broadband fixed and wireless access to service providers and their customers, enterprises, and institutions worldwide. The company operates in three segments: Core Networking, Access, and Other.The company had a signal strength of 35.00 and a predictability indicator of -0.1. In accordance with the algorithm prediction, the stock returned 16.42% in 3 Months. Alcatel expects profit margins to improve this year. The company finished the fourth quarter with gross margins of 34.7%, and Alcatel’s CEO said the company expects gross margins to be 34% or more in 2015. Gross margin has continuously improved, which is an indicator of the success of the turnaround efforts undertaken by Alcatel.

Signal : 34.66

Predictability : 0.42

Return: -4.83%

Royal Dutch Shell plc operates as an independent oil and gas company worldwide. It operates through Upstream and Downstream segments. The company explores for and extracts crude oil, natural gas, and natural gas liquids.It also converts natural gas to liquids to provide fuels and other products; markets and trades natural gas; extracts bitumen from mined oil sands and converts it to synthetic crude oil; and generates electricity from wind energy.

Signal : 32.49

Predictability : 0.6

Return: 1.10%

British American Tobacco p.l.c. manufactures and sells tobacco products. It provides cigarettes, roll-your-own tobacco, cigars, and snus, as well as other nicotine products, and electronic cigarettes.The company had a signal strength of 32.49 and a predictability indicator of 0.6. In accordance with the algorithm prediction, the stock returned 1.10% in 3 Months. For the full FY14, BAT’s (fundamental: 1.35; valuation: 1.30) net profit rose 9% to RM898.1 million, from RM825.8 million in the year before, while revenue climbed 6% y-o-y to RM4.80 billion from RM4.52 billion.

Signal : 29.10

Predictability : -0.23

Return: -2.16%

Nokia Corporation engages in the network infrastructure, location-based technologies, and advanced technologies businesses worldwide. The company operates through four segments: Mobile Broadband, Global Services, HERE, and Technologies. The Mobile Broadband segment provides mobile operators with radio and core network software together with the hardware needed to deliver mobile voice and data services.

Signal : 22.55

Predictability : 0.56

Return: 7.68%

Aegon N.V. provides life insurance, pension, and asset management products and services. It offers various life and protection products, including traditional and universal life, as well as endowment, term, employer, and whole life insurance products; and supplemental health, accidental death and dismemberment, critical illness, cancer treatment, credit/disability, income protection, and long term care insurance.The company had a signal strength of 22.55 and a predictability indicator of 0.56. In accordance with the algorithm prediction, the stock returned 7.68% in 3 Months. Shares of AEGON N.V. rose by 2.52% in the past week and 10.41% for the last 4 weeks. In the past week, the counter has outperformed the S&P 500 by 1.87% and the outperformance increases to 7.35% for the last 4 weeks.

Signal : 16.64

Predictability : 0.56

Return: 2.63%

The company with over 700 exchange-traded funds (ETFs) globally and more than $1 trillion in assets under management, iShares helps clients around the world build the core of their portfolios, meet specific investment goals and implement market views.The company had a signal strength of 16.64 and a predictability indicator of 0.56. In accordance with the algorithm prediction, the stock returned 2.63% in 3 Months. Operating margins increased substantially due to strict discipline and the control of the company’s administrative expenses. Overall, EPS grew by 17% in 2014 to $19.34 compared to 2013.

Signal : 53.64

Predictability : 0.52

Return: 9.41%

Anheuser-Busch InBev SA/NV, a brewing company, engages in the production, distribution, and sale of beer, alcoholic beverages, and soft drinks worldwide. It offers a portfolio of approximately 200 beer brands, which includes Budweiser, Corona, Stella Artois, Becks, Leffe, Hoegaarden, Bud Light, Skol, Brahma, Antarctica, Quilmes, Victoria, Modelo Especial, Michelob Ultra, Harbin, Sedrin, Klinskoye, Sibirskaya Korona, Chernigivske, Cass, and Jupiler.The company had a signal strength of 53.64 and a predictability indicator of 0.52. In accordance with the algorithm prediction, the stock returned 9.41% in 3 Months. Shares of Anheuser Busch Inbev SA (ADR) (NYSE:BUD) rose by 1.52% in the past week and 3.04% for the last 4 weeks. In the past week, the counter has outperformed the S&P 500 by 0.88% and the outperformance increases to 0.19% for the last 4 weeks.

Signal : 15.24

Predictability : 0.36

Return: 2.85%

Rio Tinto plc (Rio Tinto) is an international mining company. Rio Tintos business is finding, mining, and processing mineral resources. Major products are aluminium, copper, diamonds, gold, industrial minerals (borates, titanium dioxide and salt), iron ore, thermal and metallurgical coal and uranium. The Company has activities worldwide and is represented in Australia and North America with businesses in Asia, Europe, Africa and South America. Rio Tinto plc had a signal strength of 15.24 and a predictability indicator of 0.36. In accordance with the algorithm prediction, the stock returned 2.85% in 3 Months. Global iron ore shipments of 302.6 million tonnes (Rio Tinto share 239.9 million tonnes) were 17 per cent higher than 2013 and production of 295.4 million tonnes (Rio Tinto share 233.6 million tonnes) was an 11 per cent increase year on year. Rio Tinto’s share of production in the period was 12 per cent higher than in 2013.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Gilead Sciences, Inc.: Still In The Lead Or Lagging Behind? An Algorithmic Perspective (View)

- Even With Poor February Results, Ford Is Still Bullish (View)

- Procter & Gamble Co: Despite Negativity, We’d Go All In – An Algorithmic Perspective (View)

- IBM Is Undervalued And Provides Vast Upside In 2015: Algorithmic Analysis (View)

- Bullish On Intel: Fundamental And Algorithmic Analysis Summary (View)

- Bullish Sentiment On Silver Wheaton – Fundamentals And Algorithmic Analysis (View)