I Know First Review: July 14th 2014

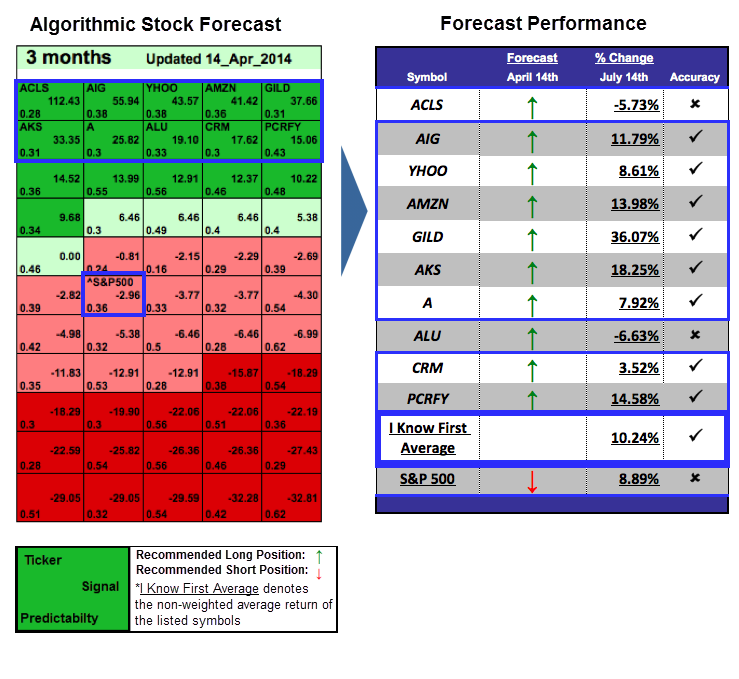

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s July 12th 2013 Stock Forecast titled, Predictive Analytics: 36.07% Gain in 3 Months. The “I Know First Average” return was 10.24% versus the S&P 500’s return of 8.89% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (3 months): 55.94

Predictability (365 days): 0.38

Return: 11.79%

Micron Technology, Inc., together with its subsidiaries, manufactures and markets semiconductor solutions worldwide. If offers dynamic random access memory (DRAM) products for data storage and retrieval that are used in computers, tablets, mobile phones, communication equipment, computer peripherals, industrial, automotive, and other electronic devices. The company has been on a nice streaking of beating earnings estimates. When looking at the past 2 reports, MU has beaten estimates by at least 35% in both cases.

Signal (3 months): 43.57

Predictability (3 months): 0.38

Return: 8.61%

Yahoo is a global technology company involved in many different aspects of Internet and digital content and experiences across many devices. Yahoo has many plans for the near future : Yahoo recently acquired Blink, a Snapchat-like messaging app. Yahoo is also poised to release a Youtube-like video platform this summer in an effort to compete with Google and other online video providers. Finally, Yahoo is debuting Yahoo Movies, a digital magazine that is focused on all things film from blockbusters to indie movies.

Signal (3 months): 41.42

Predictability (3 months): 0.36

Return: 41.42%

Amazon.com, Inc. (Amazon.com) serves consumers through its retail websites and focus on selection, price, and convenience. Amazon offers programs that enable sellers to sell their products on its Websites and their own branded Websites and to fulfill orders through them. On June 18th, Amazon (AMZN) unveiled the Fire Phone after five years in the making. The Fire Phone marks Amazon’s first step into the smartphone hardware market.

Signal (3 months): 37.66

Predictability (3 months): 0.31

Return: 36.07%

Gilead Sciences, Inc. (Gilead) is a research-based biopharmaceutical company that discovers, develops and commercializes medicines. Gilead’s primary areas of focus include human immunodeficiency virus (HIV)/AIDS, liver diseases, such as hepatitis B and C and cardiovascular/metabolic and respiratory conditions. The stock has increased by 58.9% since last year’s American Society of Clinical Oncology meeting and analysts are expecting a 228% increase of GILD’s second quarter earnings.

Signal (3 months): 33.35

Predictability (3 months): 0.31

Return: 18.25%

AK Steel Holding Corporation (AK Holding) is an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products. The Company’s operations consist primarily of nine steelmaking and finishing plants and tubular production facilities located in Indiana, Kentucky, Ohio and Pennsylvania. The Company’s operations produce flat-rolled value-added carbon steels, including coated, cold-rolled and hot-rolled carbon steel products, and specialty stainless and electrical steels that are sold in sheet and strip form, as well as carbon and stainless steel that is finished into welded steel tubing.

Signal (3 months): 25.82

Predictability (3 months): 0.30

Return: 7.92%

Agilent Technologies, Inc. (Agilent) is a measurement company providing bio-analytical and electronic measurement solutions to the communications, electronics, life sciences and chemical analysis industries. During the fiscal year ended October 31, 2011, it had three business segments: electronic measurement business, chemical analysis business and life sciences business. Its electronic measurement business addresses the communications, electronics and other industries. Agilent’s chemical analysis business focuses on the petrochemical, environmental, forensics and food safety industries. Its life sciences business focuses on the pharmaceutical, biotechnology, academic and Government, bio-agriculture and food safety industries. In April 2014, the Company acquired electrothermal analysis technology from Gradient Design Automation, the maker of HeatWave electrothermal analysis software.

Signal (3 months): 17.62

Predictability (3 months): 0.30

Return: 3.52%

Salesforce.com, inc. is a provider of enterprise cloud computing and social enterprise solutions. CRM provides customer and collaboration relationship management, applications through the Internet or cloud. Salesforce has grown revenue at an exceptional pace for the last four years, yet the company has lost a combined $500 million in its last two fiscal years.

Signal (3 months): 15.06

Predictability (3 months): 0.43

Return: 14.58%

Panasonic Corporation is a Japan-based electronics manufacturer. The Audio-Visual Computer (AVC) Network segment offers audio and video equipment. The Appliance segment provides household air-conditioning machines. The System Communications segment provides system network and mobile communications-related products and services. The Eco-solutions segment consists of riding, energy system, housing system and others. The Automotive systems segment provides automotive multimedia-related equipment and others. The Device segment provides electronic components, semiconductors and optical devices. The Energy segment provides solar system and lithium-ion batteries. The Others segment consists of health care, manufacturing solutions and PanaHome

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Read More From I Know First Research: