Home Depot Stock Forecast: Home Depot Builds Momentum

Home Depot Stock Forecast

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

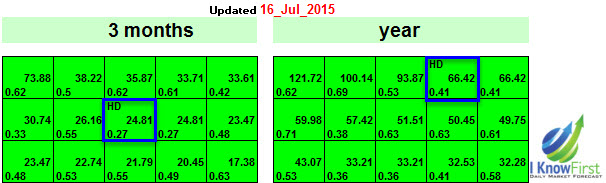

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First recently published a bullish article on Seeking Alpha about The Home Depot, Inc. Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The one-month and three-month forecasts for the stock are included.

The above forecast is the most-recent forecast from July 16th 2015 and are for the long-term periods of three months and one year. The forecasts are highly bullish, with strong signal strengths of 24.81 and 66.42 respectively with predictability ratings of 0.27 and 0.41. The algorithm correlates with the fundamental analysis in which The Home Depot has benefited from the upswing in the housing market and skillfully absorbed the backlash of their data breach while keeping the company strong.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as The Home Depot. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.