Google Stock Forecast: The Algorithmic Perspective

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) reported a fantastic second quarter and Wall Street reciprocated with shares jumping in the following days. Results surged way beyond last year’s second quarter report and the company successfully beat most analysts’ revenue expectations. As this jump in value is certainly justified, there are still some concerns that we should not forget including Google’s declining cost-per-click, and the Facebook’s (NASDAQ:FB) growing share of the mobile advertising market. On the other hand, Google has future prospects that should have investors excited about the company’s future. From utilizing YouTube ads to pushing the innovation envelope with Google Glass, the long-term prospects are certainly interesting and if executed correctly, shareholders will be rewarded.

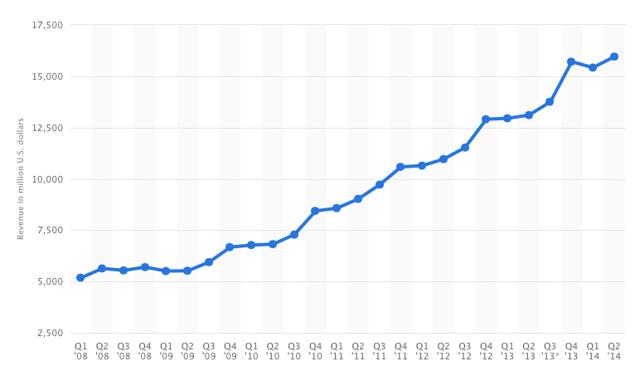

The company’s performance this past quarter was impressive on most figures including increased revenue that was up 22%, from $12.67 billion in the second quarter of 2013 to $15.96 billion in 2Q14. Google’s Non-GAAP net income came in at $4.18 billion in the second quarter, beating $3.36 billion in the same quarter last year. “Other revenues” jumped significantly this past quarter by an impressive 53% from last year’s 1.05 billion to 1.6 billion. This segment includes app download revenue, including a large array of games, which is an area of focus for Google. Figure 1 shows how Google has been able to successfully increase revenue since the first quarter of 2008.

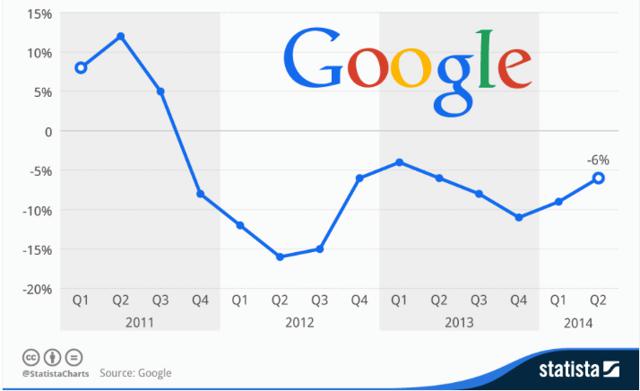

While there were many strong points reported within this earnings report, Google’s declining cost-per-click (CPC) for Google’s sites were down 7% and average CPC declined 6% since last year. Pricing pressure has increased and will continue to increase due to Facebook’s strong mobile ad growth. Figure 2displays the year-over year change of the average cost-per-click of Google ads.

In 2012, Google controlled a 52.6% slice of market share while FB only had 5.4%. This year, it is expected that Google will attain 46.8% of all mobile ad spending, while Facebook is expected to increase its presence in mobile ads to nearly 22%. Currently the I Know First self-learning algorithmic forecast for Google is bearish for the short-term time horizon and bullish for the long-term time horizon time horizon. Shares are expected to fall in the short and mid-term because of a continued weakness in CPC growth as well as pricing pressure from competition for mobile ad pricing but shares are expected increase over the long term due to the company’s various strengths.