Costco Stock Price: 11.67% Increase Since Our Bullish Forecast

Costco Stock Price

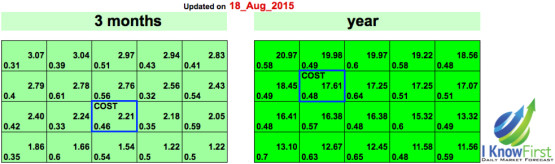

I Know First Research recently published a bullish article on Seeking Alpha on COST. on August 21th 2015. In accordance with I Know First predictions, the stock price has increased 11.67% since the publication.

Costco Wholesale Corporation (COST), together with its subsidiaries, operates membership warehouses. The company offers branded and private-label products in a range of merchandise categories. In the past year Costco has significantly expanded the organic offerings in their super-markets.

In this era consumers change their behaviour on constant basis because of the large range of new products and activities available. Costco keeps customers happy and in September came up first place with 84/100 satisfaction from the American Consumer Satisfaction Index. What made this possible? the maintenance of low prices while competition prices rose by 3%.

Another interesting event was the brake-up from 16-year old partner AmEx and a new alliance with Visa and City group. The Costco Club Card is the most used in this industry and it one of the reasons of the company’s increase during this last period. The new director, Maggie Wildrotte, has already put in place a program to increase the consumer engagement and better the stability of Costco towards their customers.

Not only customers benefit from Costco’s generosity is treating their employees fairly and paying high salaries maybe this is not what the shareholders want to hear where those extra funds are going but their corporate environment brings a wide range of job seekers, including highly trained professionals who were not desperate to land the first minimum-wage job they can find. These high-quality workers also stick around longer, creating an army of experienced and knowledgeable partners. At the end of the day more customers come to branches where they are treated well and the branch is well managed. So it is a win win situation.

In every quarter they announce dividends and they usually pay something bellow the industry average. Costco pays $1.60 dividend per share as of 2015 that equals dividend yield of 1.2% that is the lowest compared to Home Depot Inc., Target Corporation & Wal-Mart. Wal-Mart pays 2.5% dividend yield. All and all Costco has a dividend strategy for special dividends to investors. These special dividends in the past three years were comprised of a $5 payout per share in 2015 and a $7 payout per share in 2012. Giving an average payout of dividend yield of 5% over the last three years

I know first algorithm is was right on both predictions of medium and long term on COST and these are just a few things that influenced the asset to rise as it did by 11.67%. Stay tuned for further algorithmic news for COST.

Before making any trading decisions, consult the latest forecast as the algorithm constantly updates predictions daily. While the algorithm can be used for intra-day trading the predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.

Missed the latest trend? Looking for the next best market opportunity? Find out today’s stock forecast based on our advanced self-learning algorithm