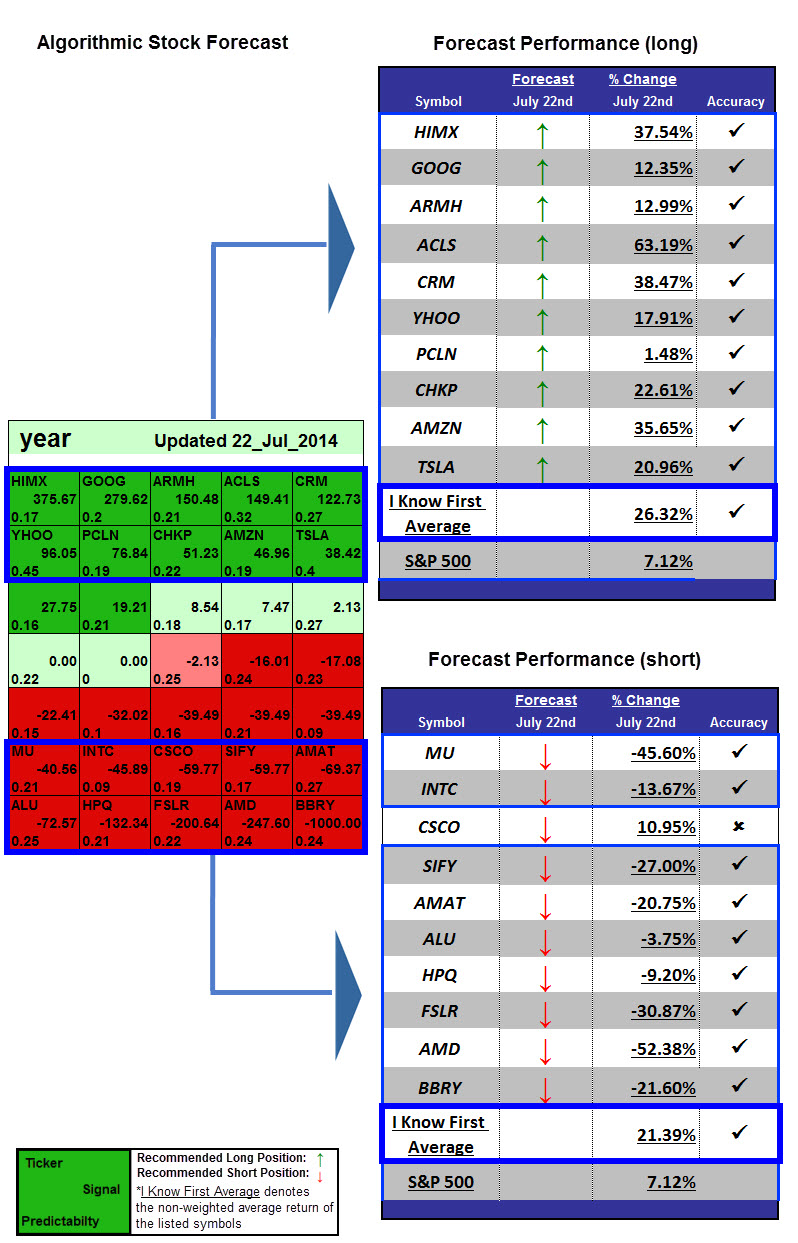

Best Tech Stocks: Up To 63.19% (long) & 52.38% (short) Return in 1 Year

Best Tech Stocks

This Best Tech Stocks forecast is designed for investors and analysts who need predictions of the best performing stocks for the whole Technology Industry (See Industry Package). It includes 20 stocks with bullish and bearish signals and indicates the best tech stocks to buy:

- Top 10 tech stocks for the long position

- Top 10 tech stocks for the short position

Package Name: Tech Stocks

Recommended Positions: Long & Short

Forecast Length: 1 Year (07/22/14 – 07/22/15)

I Know First Average: 26.32% Long; 21.39% Short

The 1 year Tech Package forecast from 07/22/2014 included the top 10 stocks for both the long and short positions. The most impressive stock for the long position was Axcelis Technologies, Inc. (ACLS) with a return of 63.19%. Other top performing stocks from the forecast were salesforce.com inc (CRM) and Himax Technologies, Inc (HIMX) with solid returns of 38.47% and 37.54% respectively. For the short position, the top performing stock was Advanced Micro Devices, Inc (AMD) which decreased 52.38% as the algorithm correctly predicted. The average return for the long position was 26.32%, while the average return for the short position was 21.39%. These average returns significantly outperformed the S&P 500 return during the same time horizon.

Axcelis Technologies received an extra boost to their share price in early 2015 when they announced a follow on order for a major chipmaker in Asia. The order is scheduled to ship at the end of 2015. The chipmaker will use ACLS’s Purion XE high energy implanter in their 3D NAND flash devices. This is in addition to multiple other orders the company received from foundries for the same part.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.