Algorithmic Trading: Up to 31.55% Return in 14 Days

Algorithmic Trading

This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

- top ten aggressive stocks picks that best fit for long position

- top ten aggressive stocks picks that best fit for short position

- top ten conservative stocks picks that best fit for long position

- top ten conservative stocks picks that best fit for short position

Package Name: Risk-Conscious

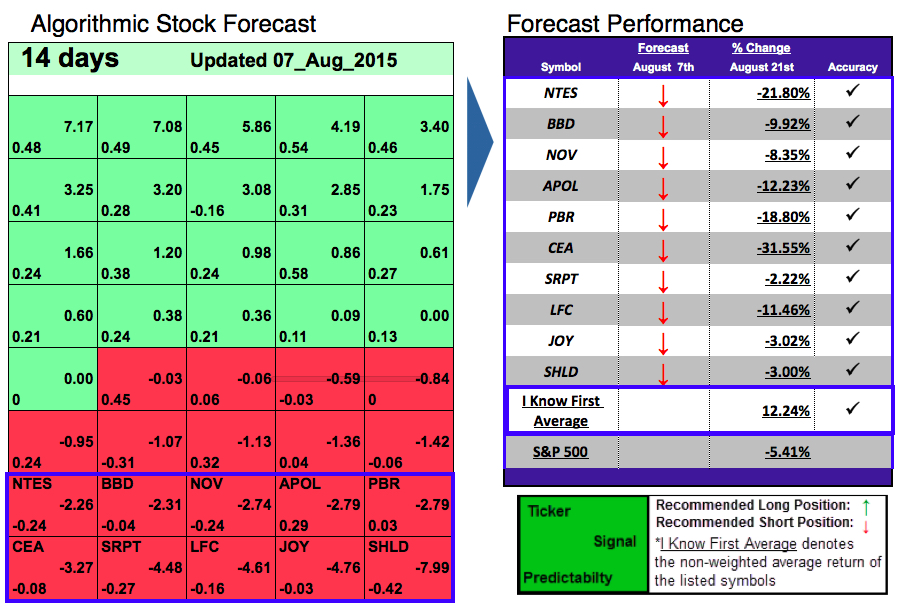

Forecast Length: 14 Days (8/7/2015 – 8/21/2015)

I Know First Average: 12.24% (Short)

Get the “Risk-Conscious” Package.

The top 10 stocks for the short position were included in the Risk-Conscious forecast from 8/7/15 that was part of the Risk-Conscious Package. For the short position CEA had the best performance during the predicted time horizon with a remarkable return of 31.55% (short). Other stocks (short) with quite impressive performances during the time horizon were NTES and PBR with returns of 21.80% and 18.80%.

China Eastern Airlines’s stock (CEA) declined due to the yuan devaluation. In fact, the China’s central bank decided to cut its daily reference rate for the yuan. The currency’s weakness increases the amount of their dollar debt and hurts its earnings. At the end of 2014, 97% of China Eastern’s debt was in dollars and so on with the drop of the yuan the amount of its debt will be heavier.

NetEase (NASDAQ:NTES) was downgraded by Zacks from a “hold” rating to a “sell” rating in a research note. NetEase is also a Chinese company. It operates in the Internet industry. The firm runs a popular Chinese website which is called 163.com

Algorithmic traders utilise these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.