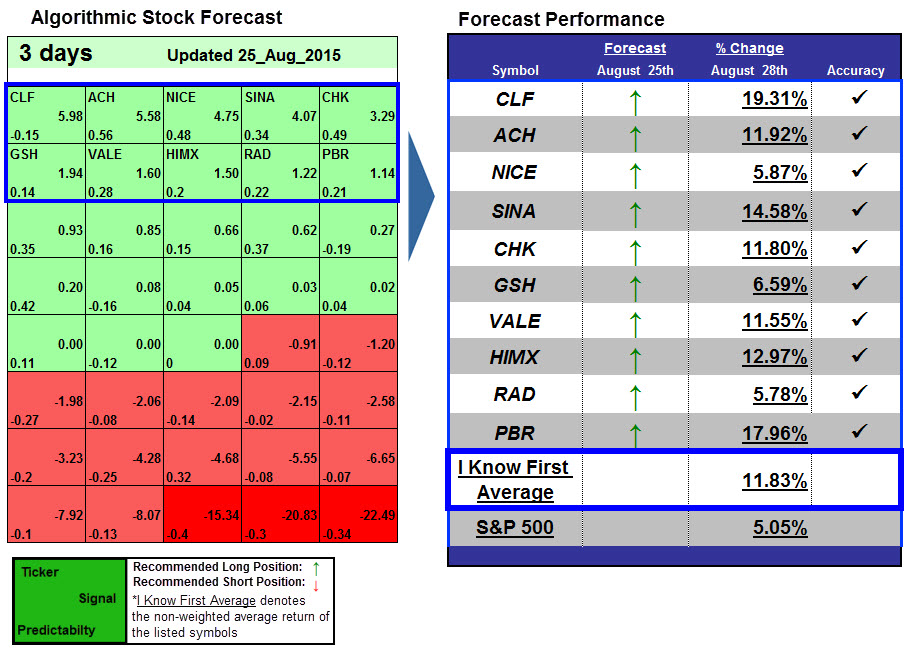

Algorithmic Trading Strategies Using Machine Learning: Up to 19.31% in 3 Days

Algorithmic Trading Strategies Using Machine Learning

This forecast is part of the “Risk-Conscious” package, as one of I Know First’s quantitative investment solutions. We determine our aggressive stock picks by screening our database daily for higher volatility stocks that present more opportunities, but are also more risky. The full Risk-Conscious Package includes a daily forecast for a total of 40 stocks with four main categories:

- top ten aggressive stocks picks that best fit for long position

- top ten aggressive stocks picks that best fit for short position

- top ten conservative stocks picks that best fit for long position

- top ten conservative stocks picks that best fit for short position

Package Name: Risk-Conscious

Recommended Positions: Long

Forecast Length: 3 Days (8/25/2015 – 8/28/2015)

I Know First Average: 11.83%

Get the “Risk-Conscious” Package.

The top 10 stocks for the long position were included in the Risk-Conscious forecast from 08/25/15 that was part of the Risk-Conscious Package. For the long position CLF had the best performance during the predicted time horizon with a remarkable return of 19.31% . Other stocks (long) with quite impressive performances during the time horizon were PBR and SINA with returns of 17.96% and 14.58%.

Cliffs Natural Resources (CLF) is a 165-year old firm that specializes in the mining and benificiation of iron ore and the mining of coal. Having its headquarters located in Ohio, it is undoubtedly a world-leading natural resources company. It is a major supplier of iron ore pellets to the North American steel industry from its mines and pellet plants located in Michigan and Minnesota. Cliffs also produces low-volatile metallurgical coal in the U.S. from its mines located in West Virginia and Alabama.

The company announced the expiration of and final results for its offer to purchase for cash up to $123,694,000 of its outstanding 3.95% Senior Notes due 2018. This announcement helps to reduce Cliffs’ overall debt load. At present, the company has $2.7 billion in debt, which gives it a debt-to-EBITDA ratio of 6.97 times.

Algorithmic traders utilise these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First algorithmic traders.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.