Algorithmic Forecast Is Bullish On Las Vegas Sands

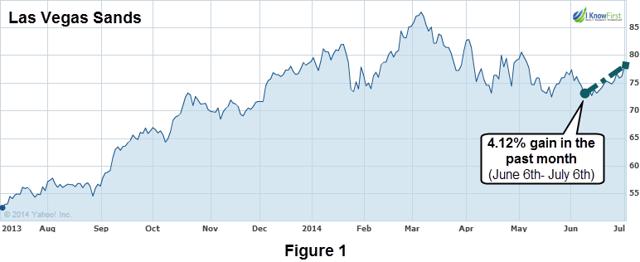

Las Vegas Sands (LVS) has recently seen a slight rebound in its stock price, gaining approximately four percent in the past month, as shown in Figure 1. LVS is the largest US-based integrated resort developer and operator. The company’s main operations occur in Macao, Singapore, and the United States. However, Macao alone provides LVS with just over 80% of its overall sales and is one of the world’s fastest growing consumer and gaming markets. Macao is constantly evolving as income levels rise, more hotels are created, and more transportation infrastructure is built. Projects such as the bridge between Macau and Hong Kong and the high speed rail connection to the mainland will ensure that China’s ascending middle class can go to Macao and play in the future.

The stock is up 48.5% during the last year and has been recognized as a buying opportunity by the I Know First self-learning algorithm.

Macau

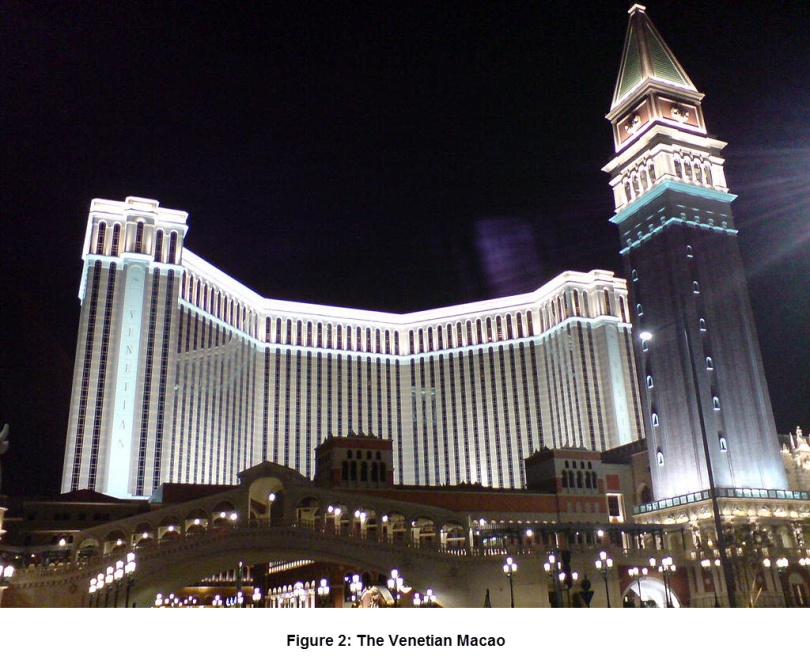

LVS has firmly established itself in Macao’s market, with its portfolio consisting of the Venetian Macau, the Sands Cotai Central, the Plaza Casino (Four Seasons), Total Cotai Strip, and Sands Macau (Peninsula).

LVS continues to experience accelerated growth in the mass table games, the most important gaming segment. The company’s mass table wins increased to reach a record of $1.34 billion for the first quarter of 2014, with a growth trade 40 percent faster than the rest of the Macao market as a whole. The first quarter of 2013 generated roughly $867 million in mass table game revenues and this number has subsequently increased each quarter to $930 million, $1.06 billion, $1.22 billion, and finally $1.34 billion for the first quarter of 2014. Las Vegas Sands has also been meaningfully returning capital back to its shareholders through the form of increased dividends and share buybacks.