Zillow Stock Predictions For Q3 Based On a Predictive Algorithm (Z)

Zillow Stock Predictions

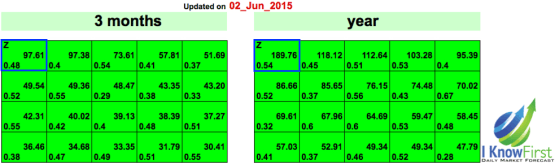

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength, with the strongest up signals at the top, while the down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal, and red indicates a negative signal. A deeper color means a stronger signal, and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically, the predictability ranges from minus one to plus one. The higher this number is, the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

Having explained how I Know First’s algorithm works and demonstrated its success in predicting the stock’s behavior in the past, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company.

Figure 1. Long-Term Algorithmic Forecast For Zillow (3 months and one year).

Zillow’s position on the algorithmic chart, then, indicates a bullish signal for the company in the three months to come. The algorithm contradicts analysts’ opinions and the stock’s algorithmic analysis indicates the price will go up.

The one-year forecast is especially bullish, with a positive signal strength of 189.7 and a predictability of 0.54.

The recent fall of Zillow’s stock price is understandable, but based on this algorithmic forecast, company is now undervalued. With a strong market position in a field that will grow rapidly in the next few years, this growth stock provides great upside potential to investors. When Trulia is fully integrated into the company, it will be the indisputable place to go for real estate solutions on the Internet. Add in continued growth in mobile, as well as its ability to add more MLS listings in the future, and the company’s stock is set to skyrocket next year with solid returns until then.