Rackspace Stock Forecast: Rackspace Can Dominate The Managed Cloud Market

Rackspace Stock Forecast

Rackspace Stock Forecast

Rackspace Hosting, Inc., provides cloud computing services and managing Web-based IT systems for small and medium-sized businesses and large enterprises worldwide. Founded in 1998 by three Trinity University classmates, Rackspace is a global company headquartered in San Antonio, Texas, with more than 200,000 customers and $1.5 billion in annual revenue. Rackspace is the number one managed cloud company, with technical expertise and Fanatical Support allowing companies to tap the power of the cloud without the pain of hiring experts in dozens of complex technologies.

Stock Struggles as New Competitors Enter Market

Rackspace thrived in the technology sector in the company’s early years, but began to struggle when larger companies entered the cloud market. Amazon, Google, and Microsoft all started their own public cloud services, and they had far more spending power and were able to grow much quicker. These companies invested heavily in the cloud market and drove industry wide margins down, as they were able to offer their cloud services for much cheaper than Rackspace. This caused Rackspace to have modest increases in revenues from dedicated hosting, which along with heavy spending on promoting its vision and expanding into new territories, caused investors to be worried. As a result, Rackspace’s stock suffered, losing almost 50% of its value in 2013.

RAX stock plummets

Figure 1 | Source: Money Morning

Rackspace announced in September of this year that they had terminated merger discussions. They had hired investment banker Morgan Stanley to help evaluate offers to acquire the company, but after a four-month strategic review, they decided none of the proposals were as valuable as a stand-alone plan. Chairman Graham Weston asserted that maintaining financial flexibility was crucial in order for the company to drive their strategy forward. This announcement spent the stock price tumbling further downward.

Rackspace Differentiates and Rallies

However, since then Rackspace stock has begun to rally with a few strong quarters, even as their larger competitors continue to invest in the market. This is possible because Rackspace has successfully differentiated themselves from their rivals, dispelling the notion that they cannot compete in the cloud market. Rackspace CEO Taylor Rhodes wrote a blog post about this very idea. He contends that the market giants fight over the commoditized part of the cloud computing market, with massive scale and minimal customer interaction. Meanwhile, Rackspace focuses on the managed cloud market, offering exceptional support and expertise so companies can focus on their core business. The hybrid markets that Rackspace focuses on provide considerable room for growth.

Cloud Usage and Growth

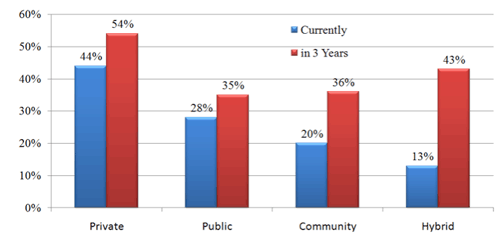

Figure 2 | Source: Sand Hill

Rackspace customers are willing to pay a premium, making it possible for the company to accelerate sales growth by 18.3%, the fastest rate in six quarters, and improve profit margins hit hard in 2013 in the third quarter while their competitors continue to cut prices. Rackspace also launched a $500 million stock buyback, the first in its history. The positive third quarter earnings report, which exceeded expectations, calmed fears that large competitors would eviscerate Rackspace’s market share, causing the stock price to rally.

Algorithmic Analysis

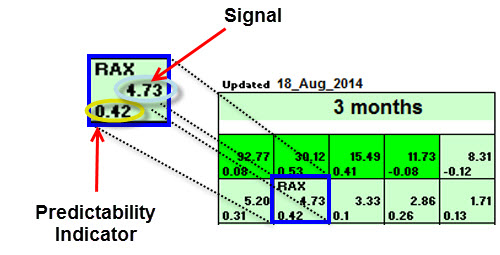

I Know First is a financial services firm that utilizes an advanced self-learning algorithm to analyze, model and predict the stock market. The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions.

Figure 3 | Source: I Know First

The signal represents the predicted movement direction or trend, and is not a percentage or specific target price. The signal strength indicates how much the current price deviates from what the system considers an equilibrium or “fair” price. The signal can have a positive (predicted increase) or negative (predicted decline) sign. The heat map is arranged according to the signal strength with strongest up signals at the top, while down signals are at the bottom. The table colors are indicative of the signal. Green corresponds to the positive signal and red indicates a negative signal. A deeper color means a stronger signal and a lighter color equals a weaker signal.

The predictability indicator measures the importance of the signal. The predictability is the historical correlation between the prediction and the actual market movement for that particular asset, which is recalculated daily. Theoretically the predictability ranges from minus one to plus one. The higher this number is the more predictable the particular asset is. If you compare predictability for different time ranges, you’ll find that the longer time ranges have higher predictability. This means that longer-range signals are more important and tend to be more accurate.

Figure 4| Source: I Know First

The figure above is an algorithmic forecast for tech stocks made on August 18th, 2014 for the three-month time horizon. Rackspace had a signal strength of 4.73 and a predictability indicator of 0.42. In accordance with the algorithm, Rackspace stock price increased 36.85% over the next three months.

Future Outlook

Rackspace has put itself in a position to dominate the managed cloud segment. Their increased spending on advertising their vision in 2013 appears to have paid off, as third quarter earnings report showed room for further growth in the company and the stock has rallied as the company has effectively differentiated themselves from their competitors. They have also recently announced partnerships with Google and Microsoft, using their Fanatical Support team for managed IT support and services, and they plan to roll out more partnerships in the future providing even more room for growth. The most positive sign for Rackspace’s positive future outlook might be their Chairman Graham Weston’s purchase of an additional $5 million in stocks. A co-founder of Rackspace, Weston already holds a 13.2% stake in the company, and the additional purchase will not have a significant impact on his stake, but it shows confidence in the company’s management and that the company’s performance and stock should continue to improve.