I Know First Algorithmic Review: August 25th

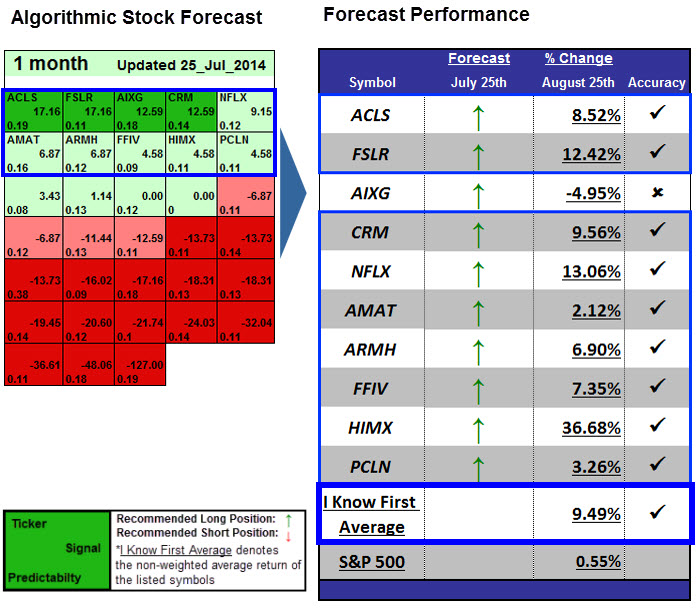

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s August 25th 2014 Stock Forecast titled, Tech Stocks to Buy: 36.68% Gain in 1 Month. The “I Know First Average” return was 9.49% versus the S&P 500’s return of 0.55% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (30 days): 17.16

Predictability (30 days): 0.19

Return: 8.52%

Axcelis Technologies, Inc. designs, manufactures, and services ion implantation, dry strip, and other processing equipment used in the fabrication of semiconductor chips worldwide. It offers high current, medium current, and high energy implanters. ACLS released its second quarter financial results on August 4th. The biggest piece highlight was news of the first Purion H high current implanter being shipped to a leading Asian-Pacific chipmaker, where it will join the Purion XE and Purion M systems already in place.

Signal (30 days): 17.16

Predictability (30 days): 0.11

Return: 12.42%

First Solar Inc. provide solar energy solutions through two segments, Components and Systems. The component segment designs, manufactures, and sells solar modules. The Systems segment provides turn-key solar photovoltaic (PV) power systems, such as project development, operating and maintenance, and PV power system owners. The Solar Energies Industries Associated reported a 79% jump in PV units installed year over year. This translated into a 26% revenue gain for FSLR and a 3% jump in their profit margin. First Solar has just received the approval for financing Latin America’s largest photovoltaic solar power plant.

Signal (30 days): 12.59

Predictability (30 days): 0.14

Return: 9.56%

salesforce.com, inc. is a provider of enterprise cloud computing and social enterprise solutions. CRM provides customer and collaboration relationship management, applications through the Internet or cloud. Salesforce has grown revenue at an exceptional pace for the last four years, yet the company has lost a combined $500 million in its last two fiscal years.

Signal (30 days): 12.59

Predictability (30 days): 0.18

Return: 4.59%

Aixtron SE is a provider of deposition equipment to the semiconductor and compound-semiconductor industry. The Company’s technology solutions are used by a diverse range of customers worldwide to build advanced components for electronic and opto-electronic applications based on compound, silicon, or organic semiconductor materials. Such components are used in fiber optic communication systems, wireless and mobile telephony applications, optical and electronic storage devices, computing, signaling and lighting, displays, as well as a range of other technologies. The Company’s business activities include developing, producing and installing equipment for coating semiconductor materials, process engineering, consulting and training, including ongoing customer support. The Company supplies to customers both full production-scale complex material deposition systems and small scale systems for the Research and Development (R&D) use and small-scale production use.

Signal (30 days): 9.15

Predictability (30 days): 0.12

Return: 13.09%

Netflix, Inc. is an Internet television network with more than 44 million members in over 40 countries. Netflix members can watch as much online content as they want, no matter the time or the place. Netflix is currently trading at a historical high: the stock is up 43.7% since last January. Netflix plans to enter 6 European markets by the end of 2014, and it should reach over 60 million customers by 2017 (compared to 10.9 in 2013).

Signal (30 days): 6.87

Predictability (30 days): 0.16

Return: 16.25%

Applied Materials, Inc. (Applied) provides manufacturing equipment, services and software to the global semiconductor, flat panel display, solar photovoltaic (PV) and related industries. Applied’s customers include manufacturers of semiconductor wafers and chips, flat panel liquid crystal displays (LCDs), solar PV cells and modules, and other electronic devices. AMAT reported significant earnings per share improvement in the most recent quarter compared to the same quarter a year ago: the net income increased by 303.1%

Signal (30 days): 6.87

Predictability (30 days): 0.12

Return: 6.90%

ARM Holdings plc (ARM) designs microprocessors, physical intellectual property (IP) and related technology and software, and sells development tools. As of December 31, 2012, the Company operated in three business segments: the Processor Division (PD), the Physical IP Division (PIPD) and the System Design Division (SDD). ARM licenses and sells its technology and products to international electronics companies, which in turn manufacture, markets and sells microprocessors, application-specific integrated circuits (ASICs) and application-specific standard processors (ASSPs) based on ARM’s technology to systems companies for incorporation into a range of end products. In August 2013, the Company announced that it has acquired Sensinode Oy, a provider of software technology for the Internet of things (IoT). In December 2013, ARM Holdings PLC acquired Geomerics. In August 2014, the Company acquired Duolog Technologies.

Signal (30 days): 4.58

Predictability (30 days): 0.09

Return: 7.35%

F5 Networks, Inc., is the developer and provider of application delivery services. The Company’s core technology is a full-proxy, programmable, software platform called TMOS (Traffic Management Operating System). The Company’s principal products are Application Delivery Controllers (ADCs). The Company’s TMOS-based offerings include software products for local and global traffic management, network and application security, access management, Web acceleration and a number of other network and application services. These products are available as modules that can run individually or as part of an integrated solution on the Company’s high-performance, scalable, purpose-built appliances and chassis-based hardware, or as software-only Virtual Editions designed to run on standard servers and hypervisors. In May 2014, F5 Networks Inc acquired Defense.Net, Inc.

Signal (30 days): 4.58

Predictability (30 days): 0.11

Return: 36.68%

Himax Technologies, Inc. operates as an IC design house with LCD manufacturing capability. The Company focuses on display IC products for display device and offers LCD technical consulting to customers to provide them with value-added technical support and integrated solutions. HIMX published its earnings data last Thursday: the company reported $0.14 earnings per share for the quarter, HIMX’s revenue was down 5.1% on a year-over-year basis.

Signal (30 days): 4.58

Predictability (30 days): 0.11

Return: 3.26%

Priceline Group Inc, formerly Priceline Com Incorporated, is an online travel company that offers its customers hotel room reservations at over 295,000 hotels worldwide through the Booking.com, priceline.com and Agoda brands. The group is still expanding, as Priceline bought OpenTable, a massive international real-time restaurant-reservation service, on June 13th for 2.6 billion in cash.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article.

Read More From I Know First Research:

- Algorithm Predicts That Amazon Is Still Hot, Even If The Fire Phone Goes Up In Smoke

- Algorithmic Market Check-Up: Pfizer

- Amazon Has Been Flexing Its Muscle And This Assertiveness Will Reward Shareholders

- Google’s Choice: To Be A Complacent Advertiser Or A Pioneer In The ‘Internet Of Things’

- Tesla Stock Forecast Based On Predictive Analytics