I Know First Reviews: July 5th, 2015

I Know First Reviews

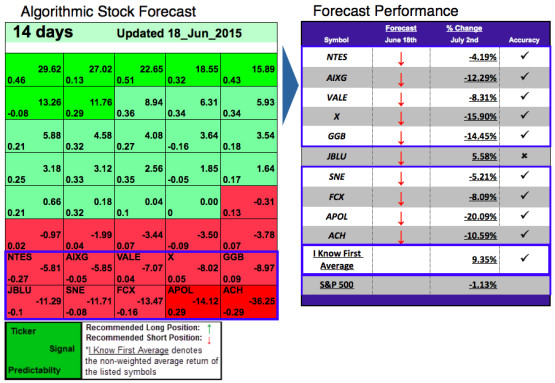

The stocks selected here are the top performing stocks from I Know First: Daily Market Forecast’s July 5th, 2015 stock forecast titled “Stock Market Predictions: Up to 20.09% (Short) in 14 Days”.

This forecast is part of the “Risk Conscious” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return for the short position was 9.35% over 14 days versus the S&P 500’s return of -1.13% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategise with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal: -5.81

Predictability: -0.27

Return: -4.19%

NetEase, Inc., through its subsidiaries, operates an interactive online community in the Peoples Republic of China. The company operates in three segments: Online Game Services; Advertising Services; and E-mail, E-commerce and Others. The company had a signal strength of -5.81 and a predictability indicator of 0.27. In accordance with the algorithm’s prediction, the stock price decreased by -4.19%.

Despite the negative return of the stock market price of NetEase, no relevant negative feedbacks or news are linked to the company, probably this slight negative return is due to the expectations for the future, that have only been announced; since then the investors prefer to wait for more consistent signals to start investing on NetEase, another relevant reason could be the growing financial bubble which is bursting in the Chinese financial market.

Signal: -5.85

Predictability: –0.05

Return: -12.29%

AIXTRON SE, together with its subsidiaries, provides deposition equipment to the semiconductor industry in worldwide. The company develops, produces, and installs deposition equipment for the deposition of semiconductor materials; provides process engineering, consulting, training, and ongoing customer support services; and offers peripheral equipment and services. The company had a signal strength of -5.85 and a predictability indicator of 0.05. In accordance with the algorithm’s prediction, the stock price decreased by -12.29%.

The company’s stock price has been falling down for the last few weeks; meanwhile the investors are waiting for the annual report of the company, the last 2 quarters’ earnings per share reported a negative sign. On top of that, also the future projections of the company’s EPS are negative: this has lead to resize the company’s stock price over the last weeks.

Signal: -7.07

Signal: -7.07

Predictability: 0.04

Return: -8.31%

Vale S.A., together with its subsidiaries, engages in the research, production, and sale of iron ore and pellets, nickel, fertilizer, copper, coal, manganese, ferroalloys, cobalt, platinum group metals, and precious metals in Brazil and internationally. Its Bulk Material segment produces and extracts iron ore and pellet.

The company had a signal strength of -7.07 and a predictability indicator of 0.04. In accordance with the algorithm’s prediction, the stock price decreased by -8.31%.

As lots of analysts said, the past year has been one of the worst years for energy companies and this is the result of the weak oil and energy commodities prices. The company’s CFO Luciano Siani said that they will be focusing on high grade iron ore in order to get premium prices and recover from the last negative stock’s price returns. Anyway for the moment the expectations are quite negative, there has to happen something big to the energy industry in order to set up a new start both for energy supply and investors.

b

Signal: -8.02

Signal: -8.02

Predictability: 0.05

Return: -15.90%

United States Steel Corporation produces and sells flat-rolled and tubular steel products in North America and Europe. It operates through three segments: Flat-Rolled Products (Flat-Rolled), U. S. Steel Europe (USSE), and Tubular Products (Tubular). The Flat-Rolled segment offers slabs, rounds, strip mill plates, sheets, and tin mill products.

The company had a signal strength of -8.02 and a predictability indicator of 0.05. In accordance with the algorithm’s prediction, the stock price decreased by -15.90%.

The same topic is applies to United States Steel Corp. and moreover the Chinese supply, which alone accounts for almost half of the total steel consumption, has slowed down due to the country’s tepid property market and weaker infrastructure investment. The mix of those two elements are putting a selling pressure to the investors, which are focusing on more profitable markets.

Signal: -8.97

Predictability: 0.09

Return: -14.45%

Gerdau S.A. produces and commercialises steel products worldwide. It operates through Brazil, North America, Latin America, Special Steel, and Iron Ore segments. The company provides semi-finished products, which include billets that are bars from square sections of long steel that serve as inputs for the production of wire rod, rebars, and merchant bars; blooms for use in the manufacture of springs, forged parts, heavy structural shapes and seamless tubes; and slabs, which are used in the steel industry for the rolling of various flat rolled products, as well as to produce hot and cold rolled coils, heavy slabs, and profiles. The Company’s operational segments include Wireless and Productivity & Graphics. The company had a signal strength of -8.97 and a predictability indicator of 0.09. In accordance with the algorithm’s prediction, the stock price decreased by -14.45%.

The company figures in the 52 week low stocks ranking; the recent weak revenues and a rating downgrading added to a period of lower energy related prices have contributed to quite strong signals by the community of worldwide investors.

Signal: -11.29

Predictability: -0.1

Return: 5.58%

JetBlue Airways Corporation, a passenger carrier company, provides air transportation services. As of December 31, 2014, the company operated a fleet of 13 Airbus A321 aircrafts, 130 Airbus A320 aircrafts, and 60 EMBRAER 190 aircrafts. It also served 87 destinations in 27 states in the United States (the U.S.), the District of Columbia, the Commonwealth of Puerto Rico, the U.S. Virgin Islands, and 17 countries in the Caribbean and Latin America. JetBlue Airways Corporation was founded in 1998 and is based in Long Island City, New York.

Signal : 11.71

Predictability : -0.08

Return: -5.21%

Sony Corporation designs, develops, manufactures, and sells electronic equipment, instruments, and devices for consumer, professional, and industrial markets worldwide. The company had a signal strength of 11.71 and a predictability indicator of -0.08. In accordance with the algorithm’s prediction, the stock price decreased by -5.21%.

Microsoft Corporation announced several upgrades for Xbox One at the E3 conference, furthermore the famous game Fallout 4 will only be released for Xbox One and PlayStation 4 owners will not be able to purchase this game; what’s more in a trading report Zacks downgraded shares of Sony Corp from a strong-buy rating to a hold.

Signal: -13.47

Predictability: -0.16

Return: -8.09%

Freeport-McMoRan Inc., a natural resource company, engages in the acquisition of mineral assets, and oil and natural gas resources. It primarily explores for copper, gold, molybdenum, cobalt, silver, and other metals, as well as oil and gas. The company had a signal strength of -13.47 and a predictability indicator of -0.16. In accordance with the algorithm’s prediction, the stock price decreased by -8.09%.

The company recently figured out in a report from TheStreet as 10 worst materials stocks, in addition the last trading reports were all negative. As said before, the energy sector is suffering of a long term price drop and also of the recents decline of China’s economic growth.

Signal : -14.12

Signal : -14.12

Predictability : 0.29

Return: -20.09%

Apollo Education Group, Inc. provides private education services. It offers online and on-campus undergraduate, graduate, professional development, and other non-degree educational programs and services primarily to working learners in the United States and internationally.The company had a signal strength of -14.12 and a predictability indicator of 0.29. In accordance with the algorithm’s prediction, stock price decreased by -20.09%.

The company recently reported disappointing negative earnings and those are the result of the deterioration of the company’s business; the group has reduced its workforce by 900 employees nationwide, but the CEO plans to rebuild University of Phoenix’s reputation as a leader in online education. Despite the good intentions, for the moment the group has to suffer and thus downsize its business, but the premises for the future could be promising if the company proves its investors that it is able to cope with the present decline of its businesses.

Signal: -36.25

Predictability: -0.29

Return: -10.59%

Aluminum Corporation of China Limited, together with its subsidiaries, engages in the manufacture and distribution of alumina, and primary aluminum and aluminum fabricated products in the mainland of China and internationally. It operates through Alumina, Primary Aluminum, Trading, and Energy segments. The company had a signal strength of -36.25 and a predictability indicator of -0.29. In accordance with the algorithm’s prediction, stock price decreased by -10.59%.

As most Chinese stocks fell after inflation data signalled weaker demand for energy related commodities, the result is that the company had to cut down its aluminium prices in order to meet the demand and confine its economic losses. Investors are now focusing their assets on more profitable stocks, after they have been waiting for a sudden rise in the stock prices due to the recent weak economic recovery.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specialises in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- Electric Buses Vs. Fuel Cell Buses: Plug Power Has A Stake In The Winner (View)

- Why BlackBerry Holds Long-Term Value For Investors (View)

- Tata Motors Is An Attractive Opportunity: An Algorithmic Analysis (View)

- Applied Material’s Venture Group Invests Into UV LED, An Interesting Portfolio Expansion With Growth Potential (View)

- Can Apollo Fight Online Education Any Longer? (View)