I Know First Review: December 18th

I Know First Review: Stock Picks Based On Algorithms

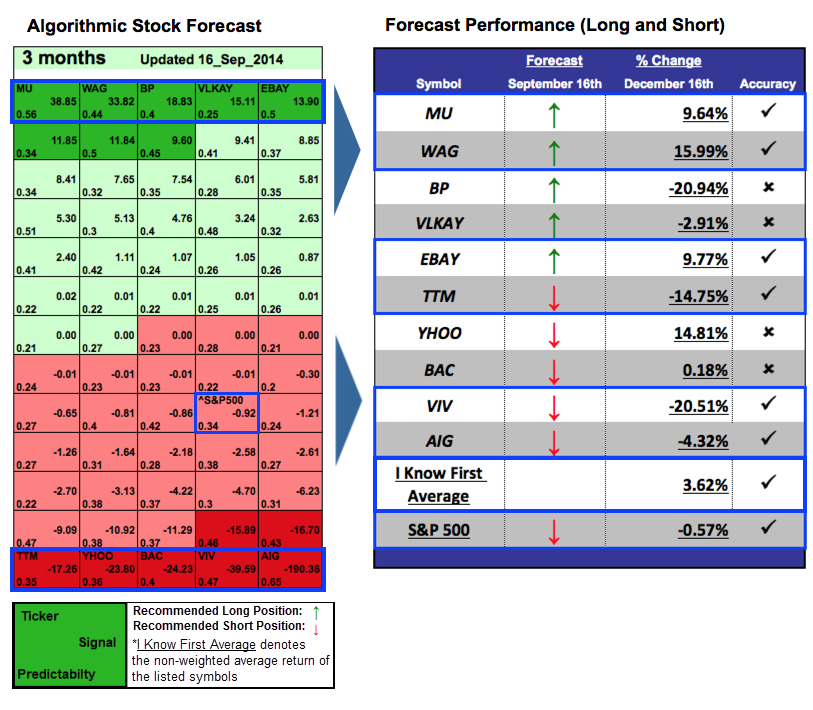

The stocks selected here are the top performing aggressive stocks from I Know First: Daily Market Forecast’s December 16th, 2014 stock forecast titled Stock Forecast: Up To 15.99% (Long) & 20.51% (Short) Return In 3 Months. This forecast is part of the “Tech Stocks” package, as one of I Know First’s quantitative investment solutions. The “I Know First Average” return was 3.62% versus a S&P500’s return of -0.57% over the same time period.

Learn how to read the predictions: Instructions

Learn how to strategize with the forecast: Algorithmic Trading Strategies

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Signal (3 Months): 38.85

Predictability (3 Months): 0.56

Return: 9.64%

Micron Technology, Inc., together with its subsidiaries, provides semiconductor solutions worldwide. The company manufactures and markets dynamic random access memory (DRAM), NAND flash, and NOR flash memory products; and packaging solutions and semiconductor systems. Micron Technology was founded in 1978 and is headquartered in Boise, Idaho. The company had a signal strength of 38.85 and a predictability indicator of 0.56. In accordance with the algorithm prediction, the stock returned 9.64% in a three-month time horizon. MU has received Buy calls from 27 out of 35 analysts rating the stock, after company announces expansion plans and as NAND and DRAM demand meets supply.

Signal (3 Month): 33.82

Predictability (3 Months): 0.44

Return: 15.99%

Walgreen Co. (Walgreens) together with its subsidiaries, operates as a retail drugstore chain in the United States. The Company provides its customers with access to consumer goods and services, pharmacy, and health and wellness services in communities across America. The company had a signal strength of 33.82 and a predictability indicator of 0.44. In accordance with the algorithm prediction, the stock returned 15.99% in a three-month time horizon. Apart from the increase in population the demographics are also changing with an increased number of people in the higher age brackets. This is likely to increase sales for the entire industry and Walgreen with its greater presence can capitalize on this. In addition, the expected acquisition of Alliance Boot, Europe’s largest pharmaceutical wholesaler, has increased positive feeling around the stock as it could become the first global pharmacy-led, health and wellbeing enterprise. The marriage between the two multinationals has been announced end of August and should be finalized the 29th of December.

Signal (3 Months): 18.83

Predictability (3 Months): 0.4

Return: -20.94%

BP p.l.c. (BP) is an integrated oil and gas company. The Company provides its customers with fuel for transportation, energy for heat and light, lubricants and the petrochemicals products used to make everyday items as diverse as paints, clothes and packaging. The Company operates in two business segments: Exploration and Production, and Refining and Marketing.

Signal (3 Months): 15.11

Predictability (3 Months):: 0.25

Return: -2.91%

Volkswagen AG is a Germany-based automobile manufacturer. The Company consists of four business segments namely: the Passenger Cars and Light Commercial Vehicles segment, engaged in the development of vehicles and engines, the production and sale of passenger cars and light commercial vehicles, and the genuine parts business.

Predictability (3 Months): 0.5

Return: 9.77%

ebay Inc., is a global technology company. The Company enables commerce through three reportable segments: Marketplaces, Payments, and GSI. The Company is providing online platforms, tools and services to help individuals and small, medium and merchants around the globe engage in online and mobile commerce and payments. ebay had a signal strength of 13.9 and a predictability indicator of 0.5. In accordance with the algorithm prediction, the stock returned 9.77% in a three-month time horizon. The company’s strengths can be seen in multiple areas, such as its revenue growth, growth in earnings per share, increase in stock price during the past year, good cash flow from operations and expanding profit margins. Also, as the growing payments business sector is growing considerably, PayPal’s leading market position in this industry will be able to capture a large chunk of this opportunity.

Predictability (3 Months): 0.35

Return -14.75%

Tata Motors Limited is an automobile company. Through its other subsidiary, the Company is engaged in providing engineering and automotive solutions, construction equipment manufacturing, automotive vehicle components manufacturing and supply chain activities, machine tools and factory automation solutions. TTM had a signal strength of -17.26 and a predictability indicator of 0.35. In accordance with the algorithm prediction, the stock returned 14.75% in a three-month time horizon, for those that took a short position. The decline in TTM stock price is mainly due to Indian and Chines sales faltering, both being important markets for TTM.

Signal (3 Months): -23.80

Predictability (3 Months): 0.36

Return: 14.81%

Yahoo! Inc. operates as a technology company worldwide. Yahoo was founded in 1994 and is headquartered in Sunnyvale, California, with additional offices in the Americas, Asia Pacific, Europe, the Middle East, and Africa.

Signal (3 Months): -24.23

Predictability (3 Months): 0.4

Return: 0.18%

Bank of America Corporation (Bank of America) is a bank holding company and a financial holding company. The Company is a financial institution, serving individual consumers, small and middle market businesses, institutional investors, large corporations and governments with a range of banking, investing, asset management and other financial and risk management products and services.

Signal (3 Months): -39.59

Predictability (3 Months): 0.47

Return: -20.51%

Telefonica Brasil SA (ADR) (VIV) provides fixed-line telecommunications services to residential and commercial customers in Brazil. The company offers voice services, including activation, monthly subscription, measured service, and public telephones. The company had a signal strength of -39.59 and a predictability indicator of 0.47. In accordance with the algorithm prediction, the stock returned 20.51% in a three-month time horizon, as for a short position. Although the company registered revenue growth in its mobile business segment in the first quarter, the fixed line segment suffered due to poor performance in fixed voice and access business. Further, weak economic growth, competitive pressure, increased wireless penetration, a weak Brazilian real and regulatory pressure continues to weigh on the stock.

Signal (3 Months): -190.36

Predictability (3 Months):0.65

Return: -4.32%

American International Group, Inc. (AIG) is a global insurance company. The Company provides a range of property casualty insurance, life insurance, retirement products, mortgage insurance and other financial services to customers in more than 130 countrie. The company had a signal strength of -190.36 and a predictability indicator of 0.65. In accordance with the algorithm prediction, the stock returned 4.32% in a three-month time horizon, for a short position.

Business Disclosure: I Know First Research is the analytic branch of I Know First, a financial startup company that specializes in quantitatively predicting the stock market. We did not receive compensation for this article, and we have no business relationship with any company whose stock is mentioned in this article. Read More From I Know First Research:

- IBM Fundamental And Algorithmic Analysis: Will Big Blue Bring Big-Time Blues?

- Google Can Grow Forever, But Is It The Best Investment Right Now?

- BlackBerry Is A Risky Fruit: Making 232% In A Year Using Fundamental And Algorithmic Trading

- Coca Cola – Undervalued: Stock Valuation Using A 10-Year Cash Flow Projection And Algorithmic Analysis

- Tesla Motors – Summative And Algorithmic Evaluation