I Know First Review: AMD After the Inevitable Rebound

I Know First Review

Advanced Micro Devices, Inc. is a global semiconductor company with facilities across the world. The Company offers x86 microprocessors, as standalone devices or as incorporated as an accelerated processing unit (APU), chipsets, discrete graphics processing units (GPUs) and professional graphics, and server and embedded processors, dense servers, semi-custom System-on-Chip (SoC) products and technology for game consoles.

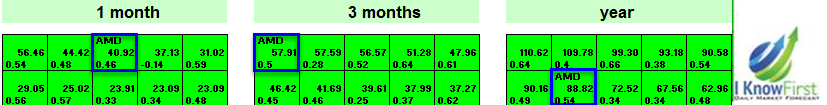

I Know First wrote a Talk Markets Article about Advanced Micro Devices on July 28th 2015. The article argued that the company’s stock was Bullish in the long term even thou they experienced turbulent times recently losing much of its market share to rivals Intel (INTC) amongst challenging times in the PC market. Since that time, the stock price has increased 43%.

At the moment the company is shifting to the gaming industry the are selling their processors to Apple Inc. Microsoft and Sony. At the moment they don’t have a big market share but they are hoping that a jump in sales of the Xbox, Playstation 4 and Macs will help them get back on their feet

AMD entered October on a positive note, having recently announced a radical restructuring plan that was well-received by investors and analysts. That alone was enough to keep AMD trading significantly above Intel and major market indices.

Then, the company reported third quarter results in the middle of October. AMD missed Wall Street earnings targets, thanks to a large inventory writedown and set a low guidance bar for fourth quarter revenuee, the stock slumped the next day.

But the disappointing report was quickly forgotten as independent research reports started painting the PC market in a brighter light, and AMD took off once again.

AMD bulls including Northland Capital Markets believe share prices could more than double within a year as the company rebuilds itself as a technology licensing center in search of big-ticker partner opportunities.

(Figure 1: AMD forecast 21st July ’15)