Gilead Sciences Stock Predictions: An Algorithmic Analysis (GILD)

Gilead Sciences Stock Predictions

I Know First supplies financial services, mainly through stock forecasts via their predictive algorithm. The algorithm incorporates a 15-year database, and utilizes it to predict the flow of money across 2000 markets. The self-learning algorithm uses artificial intelligence, predictive models based on artificial neural networks, and genetic algorithms to predict money movements within various markets.

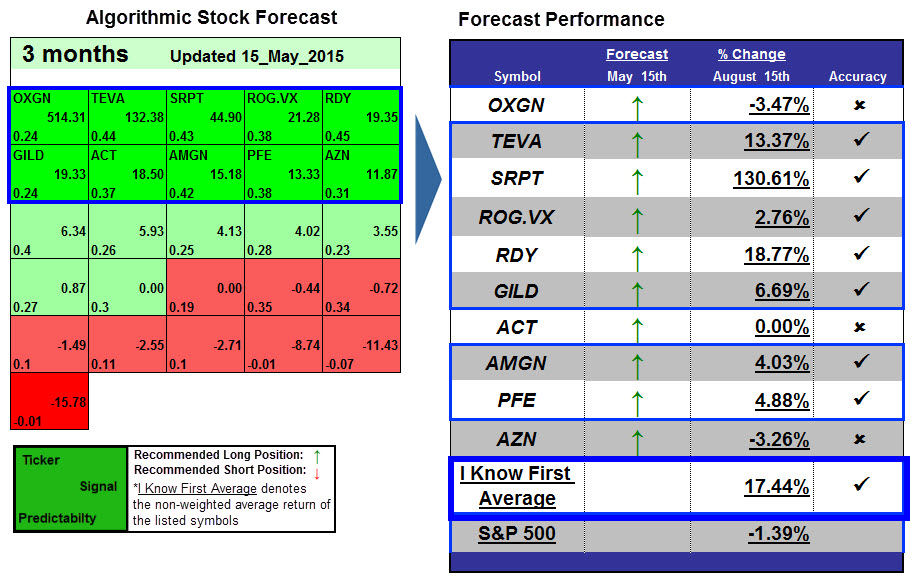

The algorithm produces a forecast with a signal and a predictability indicator. The signal is the number in the middle of the box. The predictability is the number at the bottom of the box. At the top, a specific asset is identified. This format is consistent across all predictions. The middle number is indicative of strength and direction, not a price target. The bottom number, the predictability, signifies a confidence level.

I Know First has had success predicting the movement of Gilead’s stock price in the past. In this 3 months forecast from May 15th, 2015, Gilead Sciences had a bullish signal strength of 19.33. In accordance with the algorithm’s prediction, the stock price increased 6.69% during that time.

Having explained how I Know First’s algorithm works, it is worthwhile to see if the algorithm agrees with the bullish fundamental analysis of the company. The three-month and one-year forecasts for Gilead Sciences are included.

Gilead Sciences is among the top stock picks for both time horizons. The stock has a strong, bullish signal for both, especially during the one-year time horizon. Over the predicted time horizons, the stock price will resume its surge from last year, as concerns over the company’s HCV drugs profitability are addressed. The company has a strong balance sheet and an experienced executive team that knows how to create value, making this stock a strong pick for long-term investors.

Positive signal strength does not mean investors should automatically buy the stock. Dr. Roitman, who created the algorithm, created rules for entry for a stock such as Gilead Sciences. Using this trading strategy, an investor should buy a stock if the last 5 signal strength’s average is positive and if the last closing price is above the 5-day moving average price. When both of these conditions are met, it is a good time to initiate a position in the stock.

Conclusion

Many of the concerns over Gilead Sciences, from its “waning” share of the HCV market to the potential of a price cap on its drugs, have been far overblown. This has presented a strong buying opportunity for long-term investors, as the company’s dividend is likely to offer significant growth moving forward. Further, the current stock price does not match the massive earnings of the company, and these earnings are likely to grow based off of the company’s successful track record of developing new, ground-breaking drugs. With a proven management team and a strong pipeline, I Know First continues to be bullish over the long term, with our algorithmic analysis agreeing with the fundamental analysis moving forward.