Yelp’s New Advertising Plan Shows Great Insight For The Company’s Future

This article was written by Grant Goldstein, a Financial Analyst at I Know First

Yelp’s New Advertising Plan Shows Great Insight For The Company’s Future

“Sharing is good, and with digital technology, sharing is easy.”

-Richard Stallman

Highlights:

- Yelp’s New Contracts Help Grow the Company

- Technical Analysis for Yelp

- There is Value in Buying Yelp

Yelp (NYSE: YELP) is an online platform for businesses and consumers to engage and transact. Incorporated on September 3rd, 2004, the company provides the ability for consumers to voice their opinions on business experiences for others to see. The company competitors include Google, Bing, Facebook, and Microsoft.

Surprisingly Well Q2

YELP had a very positive second quarter for 2018. Of all the sectors to grow, Yelp’s advertising revenue grew a total of 21% year over year. The company contributes this success to the pulling out of fixed term contracts, as they found customer retention is much stronger over a non-term contract. These shorter term ads really helped fuel the quarter. Analyst for Jefferies, Brent Thill, stated, “We continue to believe that this is a sign that Yelp can capture substantial incremental spend from advertisers with more pronounced seasonality that were hesitant to sign 12-month ($3,000 to $4,000) contracts before.”

However, the most important aspect of growth comes from EBITDA, which saw a 248.59% increase to $18.14 million. This crushed Yelps own guidance for this quarter. Revenue was $234.9 million, beating analyst average expectations of $232.2 million.

As always, EPS is one of the biggest factors investors look at to gauge the effectiveness of a firm. Zacks estimate gave a prediction of $0.25 EPS for Yelp in Q2. However, Yelp crushed that number with a reported EPS of $0.38, a YoY increase of 533.33%.

One worrying sign on the reports is that free cash flow decreased by 42.18%. However, capital expenditures increased by 39%, so the company very well may be investing into their future.

After this great quarter, the company adjusted their full year outlook to $952 million to $967 million. This is an increase of $9 million from previous outlook, a strong sign for the company’s future.

Of course, due to EPS beating expectations and the increase in guidance, stock price jumped 15% after hours.

(Source: Yahoo Finance)

Technical Analysis of Yelp

Examining the moving averages of YELP, there are bearish signs. Around June 24th, there was a “Death Cross”, a signal in which the 50 day moving average (short term), moves under the 200 day moving average (long term). Thus, the indicator is recommending a long term bearish signal for the stock.

(Source: Yahoo Finance)

Examining the MACD, we can see a bullish outlook as the MACD (purple) is above the signal (orange). This is known as a crossover and demonstrates that YELP will likely experience upwards momentum. Also, on August 8th, the MACD crossed over zero, another bullish sign showing upwards momentum.

(Source: Yahoo Finance)

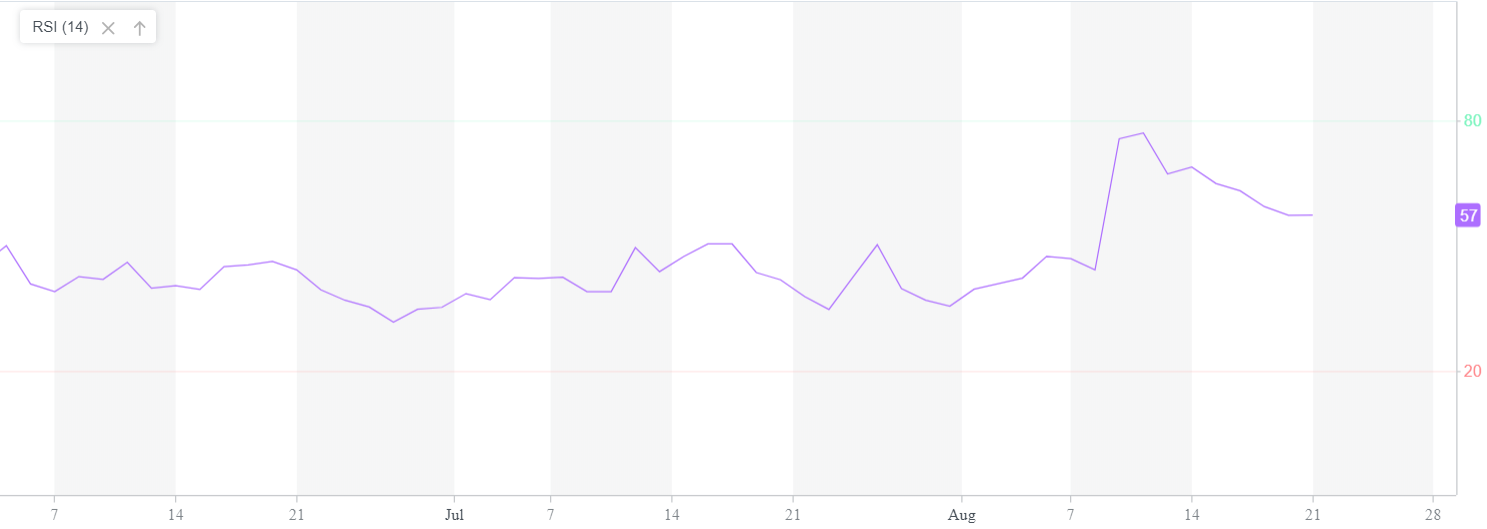

RSI, or relative strength index, measures the strength of price changes to find overbought or oversold stocks. Typically, an RSI of above 70 shows that a stock is overbought, and vice-versa for a stock under 30. Thus, Yelp has an RSI of 57, meaning it’s not overbought or undervalued, so no trend reversal will happen soon.

(Source: Yahoo Finance)

Fundamental Analysis

Comparing Yelp to it’s industry, global internet content and information, we can see it is performing substantially well. For starters, the industry median for equity to assets is 0.59, but Yelp has 0.92. This high ratio is a good sign for investors because if there was a case of the company liquidating, investors would be well set. The return on assets TTM (ROA) is 14.52 and the industry average is 12.47. However, the return on equity TTM (ROE) is lower than the industry’s 22.15 at 15.86. Since ROE is increasing, it shows that the company is becoming more efficient.

The PE ratio is rather low compared to the industry’s average. With a PE of 25.18 and an industry average of 63.10, it is clear that investors are either uncertain of upcoming earnings or they are paying too little. Nonetheless, the rest of the ratios show a good value for Yelp. Price to sales is more than $2 lower than industry average, demonstrating that investors are paying too little for Yelp’s true sales. Also, the price to book average of 3.40 is lower than the industry’s 6.53, so investors are paying less for the book value of Yelp than other stocks in the same industry.

So yes, there is some value to be have with purchasing Yelp. But, even more importantly, the financial strength and profitability is high for Yelp. The current ratio for Yelp is 13.68 and the industry average is 2.54. This high current ratio shows that the company has a great ability to pay short term obligations. Also, the gross margin of Yelp is almost 3 times the industry’s average at 92.75. Thus, the company is making great profit on sales.

Unfortunately, there is one problem with the firm’s growth. Comparing the return on capital to the weighted average cost of capital, there seems to be a problem with value. The weighted average cost of capital (WACC) is 8.57% and the price rate of change (ROC), a momentum indicator, is 4.22%. Since ROC is below WACC, growth is going to hurt value as the company will be paying out more than it earns with.

News

Yelp has begun compiling information about restaurants that violate health codes. This is a step to try and determine what truly the best restaurant to choose from is. I think that this is a great idea and that people will have to more heavily rely on Yelp in order to see the cleanest restaurants to eat at.

If you are from California, you are probably well aware that the cost of living in San Francisco is astronomical. Yelp has begun asking employees if they would like to relocate their city in order to find more reasonable housing. Although this isn’t breaking news for the stock, I think this is a great PR move and will surely help the company’s reputation.

Yahoo Finance Analyst Recommendation

An Increasing number of analysts are recommending you buy YELP. Out of the 33 analyst, 15 recommend buy, with four of those recommending a strong buy.

(Source: Yahoo Finance)

I Know First Bullish YELP Forecast

On August 23rd, I Know First Algorithm gave an extremely bullish 1 year forecast for YELP. The Algorithm assigned a strong signal of 544.76 and a predictability of 0.65.

Conclusion

Coinciding with the I Know First Algorithmic Forecast, I too forecast a bullish 1 year for Yelp. The company truly did show an outstanding Q2 2018. The increase in non-term contracts really seems to be working, as evident from the hike in advertisement revenue. So, as the company gets more grounded and continues to fully utilize those contracts, I can only imagine those numbers will grow.

Although the technical analysis doesn’t show a signal in either direction for the stock to be really going, there is some vital information in the fundamentals. Most of the financial ratios, when compared to the industry average, are extremely low. Thus, the stock is undervalued for what it should be worth. Right now would be a great time to buy the stock as the price is right and future growth is evident, as seen by capital expenditures increasing.

I Know First is currently bullish for the one year of YELP.

Past I Know First Success With Yelp

I Know First Algorithm has had success predicting the movement for Yelp. On this July 12th to August 12th, 2016, the algorithm forecaster a bullish signal of 7.82 and a predictability of 0.51. In that 1 month time frame, there was a return of 29.04%.

Current I Know First subscribers received this bullish YELP forecast on July 12th, 2018.

I Know First Algorithm Heat-map Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.