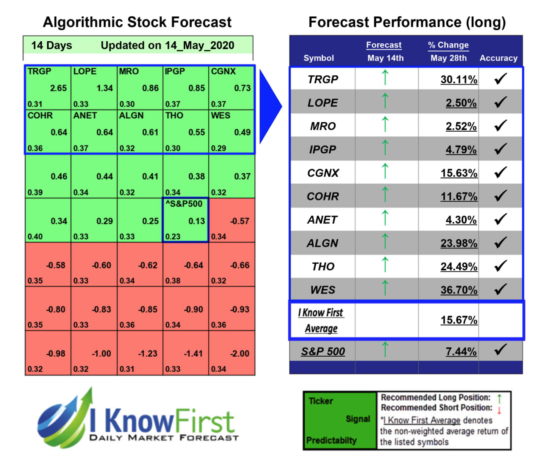

Winning Stock Forecast: WES and TRGP Surge by More 30% in 14 Days

Western Midstream Partners Increase by 36.70%

On May 14, I Know First issued a two week winning stock forecast for Western Midstream with the signal of 0.49 and the predictability of 0.29. Two weeks later, WES stock had risen to $9.47 a 36.70% increase, in line with our forecast.

This winning stock forecast resulted from changes in spending and COVID-19 effects. In their quarter one earnings call, the company announced a 45%, or more than a $400 million, reduction to their current year capital guidance. They also announced a $75 million reduction to current year G&A and operating and maintenance costs. This change would be accompanied with a 50% reduction to quarterly per unit distribution. As a result of these actions, they anticipated a 2020 adjusted EBITDA between $1.725 billion to $1.825 billion. The reduction in costs was realizable because the company was able to stop discretionary spending due to COVID-19. They also suspended salary increases for the remainder of the year.

The stock growth can be attributed to the oil price crash in March, which allowed for drastic yield increases. On April 20, WES cut their dividend by 50%, allowing them to further cut their expenditures.

Targa Resources Climb by 30.11%

On May 14, I Know First had also issued a winning stock forecast for Targa Resources with the signal of 2.65 and the predictability of 0.31. Two weeks later, TRGP stock has risen to $18.37, a 30.11% increase, in line with our forecast.

On April 16, 2020, TRC declared a quarterly dividend of $0.10 per share of its common stock for the three months ended March 31, 2020. This was a 90% cut, resulting from explosive yield prices attributed to the oil price crash in March. In the same financial results, TRC declared a quarterly cash dividend of $23.75 per share of its Series A Preferred Stock.

Targa also announced further reductions to its 2020 capital spending estimates to $700M – $800M,. This represents a 40% reduction to the initial 2020 expectations. The company further estimates $100M reduction to expected 2020 operating expenses and G&A expenses, prompting the winning stock forecast.

Current I Know First subscribers received this forecast on May 14.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.

Disclaimer

Before making any trading decisions, consult the latest forecast as the algorithm updates predictions daily. You can use the algorithm for intra-day trading. The predictability tends to become stronger with forecasts over longer time-horizons such as the 1-month, 3-month and 1-year forecasts.