Winning Stock Forecast: Calling CC returns up to 14.31%

Chemours Company (CC)

Source : prnewswire.com

In November the stocks of Chemours dropped by 13.7%. Although the company delivered a year-over-year increase in the EBITDA for all operating segments in the third quarter of 2018, shareholders are still worried about the uncertainty in the titanium dioxide industry in North America, as well as environmental litigation. As Chemours is a global leader in producing titanium dioxide, which is used to make coatings, plastics and paper, many stockholders are also worried about the slowing demand for these products. Experts assume that China will be a key driver in this market in the next years. Which is a major problem, as there is still the ongoing trade war between the US and China.

Even though the market is slightly weakening, Chemours remains an attractive stock. With an earning per share between $5.10 to $5.85 this year and earning a free cash flow of $650 million at the same time the stock stays very attractive. The market capitalization is less than $5 billion now, which is very cheap. You also must consider that Chemours is a strong growing company with a high growing cash flow. Moreover the company’s stock has a 3.5% yield as dividend, and have the potential to beat market expectation in the coming years.

I Know First’s Outlook

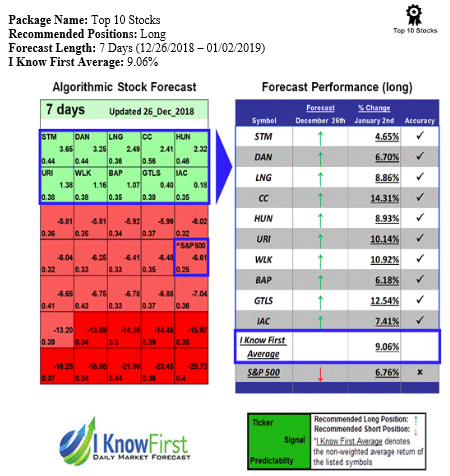

CC stock is among the most predictable assets by I Know First’s AI algorithm with a predictability of 0.56 and a singal of 2.41 and the above annual prediction provided an impressive result – the return totaled to 14.31%. Chemours stock was already mentioned in our previous winning stock forecast. In accordance with the our 7 days prediction for CC the stock price followed the below path:

Current I Know First subscribers received this bullish forecasts for CC on 26th December, 2018.

To subscribe today click here.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster.

The Company

The Chemours Company, incorporated on February 18, 2014, is a provider of performance chemicals. The Company operates through three segments: Titanium Technologies, Fluoroproducts and Chemical Solutions. The Titanium Technologies segment is a producer of titanium dioxide (TiO2). The Fluoroproducts segment is a provider of fluoroproducts, including refrigerants and industrial fluoropolymer resins. The Chemical Solutions segment is a North American provider of industrial chemicals used in gold production, oil and gas, water treatment and other industries. It delivers customized solutions with a range of industrial and specialty chemical products for markets, including plastics and coatings, refrigeration and air conditioning, general industrial, mining and oil refining. Its products include titanium dioxide, refrigerants, industrial fluoropolymer resins and a portfolio of mining and industrial chemicals, including sodium cyanide. As of December 31, 2016, the Company operates 26 production facilities located in 10 countries.