Winning SIG Forecast: Signet Jewelers Is A Diamond In The Rough

The Path to Brilliance plan “is intended to reposition Signet to be a share-gaining OmniChannel jewelry category leader.”

– Signet Chief Executive Officer Virginia Dossos

(Source: Wikimedia Commons)

(Source: Wikimedia Commons)

Signet Jewelers Ltd. (NYSE: SIG) is one of the biggest diamond jewelry retailers and is the parent company of many smaller jewelry chains such as Jared, Zales, Kay, and more. On June 6, the I Know First algorithm issued a bullish 14 day forecast for SIG with a signal of 24.00 and a predictability of 0.19. In accordance with the forecast, over the 14 days from June 6 to June 20, the stock price increased by 34.02%.

The stock surged on June 6 after the release of the company’s Q1 2019 earnings report. The company surpassed analyst expectations with revenue of $1.48 billion, a 5.5% YoY increase. This is especially significant because revenue is still growing for the company despite store closures and a difficult diamond retail environment. There are a few factors that contributed to the strong revenue: increased promotions and a calendar shift in timing of Mother’s Day, the increased sales from the acquisition of James Allen, and favorable currency exchange rates. Additionally, in Q1 of last year, many of the company’s subsidiaries had comps down by over 10%. In comparison, this quarter comp sales were only down by 0.1%. In the earnings call, CEO Virginia Drossos explained that the company will face a tougher Q2, but still expects total sales between $5.9 billion and $6.1 billion. On top of this, eCommerce increase by 81% on a reported basis led by James Allen which increased by 29%

The company has put in place a new 3 year transformation plan entitled the Path to Brilliance to build a strong foundation for the future. While the company is only 2 months in, the initiatives are clearly already showing strong results based on the Q1 earnings. The plan has 3 main priorities:

- Customer first- will look at consumer preferences to align products with changing consumer preferences.

- Omnichannel- will work to integrate the in person and online shopping experiences and increase conversion rates on the company’s websites.

- Creating a culture of agility and efficiency- will allow the company to decrease operating costs and increase profitability.

The company plans to build on a successful start to their plan in the next 2 years.

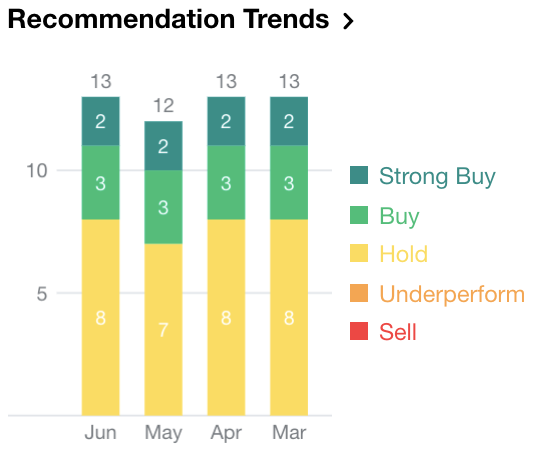

Analyst Recommendations

The majority of analysts had a buy rating with a few choosing to buy the stock.

I Know First AI Algorithm Bullish Prediction For SIG

On June 6th, the I Know First Algorithm issued a bullish 14 day forecast for SIG which came to fruition, highlighting the accuracy of the I Know First machine learning algorithm.

Current I Know First subscribers received this bullish SIG forecast on June 6, 2018.

Signet’s stock price has plummeted 75% over the past 3 years, so the increase in stock price and implementation of the Path to Brilliance plan will hopefully be the start to a turnaround for the stock.

How to read the I Know First Forecast and Heatmap

Please note-for trading decisions use the most recent forecast.