Warren Buffett’s Portfolio: Investment Philosophy and Holdings

This Warren Buffett’s Portfolio: Investment Philosophy and Holdings article was written by He Xu – Financial Analyst at I Know First

Summary

- Warren Buffett seeks undervalued securities of companies that have solid fundamentals, strong earnings power, and the potential for continued growth.

- Warren Buffett focuses on companies’ ROE, debt-to-equity ratio, and profit margins for a long time when analyzing companies’ performance.

- Berkshire shares generated a compound annual return of 20.1 percent from 1965 to 2021, compared to 10.5 percent for the S&P 500.

Warren Buffett’s Investment Philosophy

Warren Buffett is probably best known for being one of the world’s most successful investors. Warren Buffett, a firm believer in the value-based investing model, has long held that people should only buy stocks in companies that have solid fundamentals, strong earnings power, and the potential for continued growth. People should seek securities with unjustifiably low prices relative to their intrinsic value. In other words, the value investor, like bargain hunters, seeks stocks that are undervalued by the market or stocks that are valuable but are not recognized by the majority of other buyers. On the other hand, he considers companies as a whole rather than focusing on the supply and demand intricacies of the stock market. As a result, he holds these stocks as a long-term investment, not for capital gain, but for ownership in high-quality companies that can generate earnings. He is concerned about the company’s ability to generate profits.

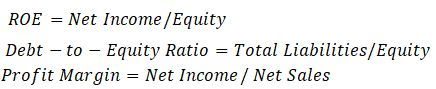

Warren Buffett focuses on some financial ratios when analyzing the company’s performance. ROE reveals the rate at which shareholders earn income on their shares. Buffett always looks at ROE to see if a company has consistently outperformed other companies in the same industry and looks at the ROE over the last five to ten years. Another important factor Buffett considers is the debt-to-equity ratio (D/E). Buffett prefers a small amount of debt so that earnings growth is generated by shareholders’ equity rather than borrowed money. Because a high debt-to-equity ratio can lead to volatile earnings and many interest costs. Next, investors should focus on companies’ profit margins by looking back at least five years. A high profit margin indicates that the company is running its operations efficiently, but increasing margins indicates that management has been extremely efficient and successful in controlling expenses. Buffett typically considers only companies that have been around for at least 10 years. Buffett usually only considers companies that have been in business for at least ten years. He has stated that he does not understand the mechanics of many of today’s technology companies and will only invest in a company that he fully understands.

Warren Buffett’s Portfolio and Returns

Some of his largest holdings include Bank of America, Apple, American Express, and Coca-Cola. Berkshire shares generated a compound annual return of 20.1 percent from 1965 to 2021, compared to 10.5 percent for the S&P 500. Berkshire has been a percentage point ahead of the S&P 500 over the last 20 years, with an annualized return of 10.3 percent versus 9.2 percent for the index. Buffett’s Berkshire Hathaway increased its stake in Chevron (CVX) by 316 percent in the first quarter of 2022, while also increasing its stake in Occidental Petroleum (OXY) in a possible bet that oil prices will remain high. According to a new regulatory filing, Berkshire continues to buy more OXY stock, adding another 1.94 million shares between July 14 and July 18. Buffett now owns 19.4 percent of the oil and gas exploration and production company. As of June 2022, top holdings based on regulatory filings from Buffett’s public holding company, Berkshire Hathaway include:

(Source: gurufocus.com)

Warren Buffett Stocks Forecast by I Know First Algorithm

Warren Buffett’s Portfolio is one of I Know First’s quantitative investment solutions. Investors generally utilize the I Know First advanced self-learning algorithm to take advantage of Warren Buffett’s proven investing strategy. The algorithm estimates the top 10 Warren Buffett’s stocks for long positions and short positions with forecast lengths of 3 days, 7 days, 14 days, 1 month, 3 months, and 1 year. Below, we can notice the example of the 1-month forecast which was provided to our clients on June 29th, 2022.

Package Name: Warren Buffett Portfolio

Recommended Positions: Long

Forecast Length: 1 Month (6/29/22 – 7/29/22)

I Know First Average: 11.30%

For this 1 Month forecast the algorithm has successfully predicted 10 out of 10 movements. The top-performing prediction in this forecast was AMZN, which registered a return of 25.65%. Other notable stocks were FND and AAPL with a return of 19.31% and 18.24%. The package itself saw an overall return of 11.30%, providing investors with a 3.22% premium above the S&P 500’s return of 8.08% for the same time period.

Conclusion

Warren Buffett is known for being a buy-and-hold investor, holding onto stocks for years, if not decades. Compared with S&P 500, Warren Buffett Stock Portfolio generates compounded excess annual return. I Know First’s algorithm helps successfully estimate the top ten stocks for the long and short positions from Warren Buffett’s portfolio.

To subscribe today click here.

Please note-for trading decisions and use the most recent forecast.