Warren Buffett Stock: Up to 61.27% Return in 1 Year

Warren Buffett Stock

This Warren Buffett Stocks Portfolio is part of the “Buffett’s Top 10” package, as one of I Know First’s quantitative investment solutions. Investors generally utilize the I Know First advanced self-learning algorithm to take advantage of Warren Buffett’s proven investing strategy. The full Top 10 Warren Buffett’s Stocks Package includes the best stocks identified by the algorithm that are currently in Warren Buffett’s portfolio:

- Top Ten Warren Buffett’s stocks for long position

- Top Ten Warren Buffett’s stocks for short position

Recommended Positions: Long

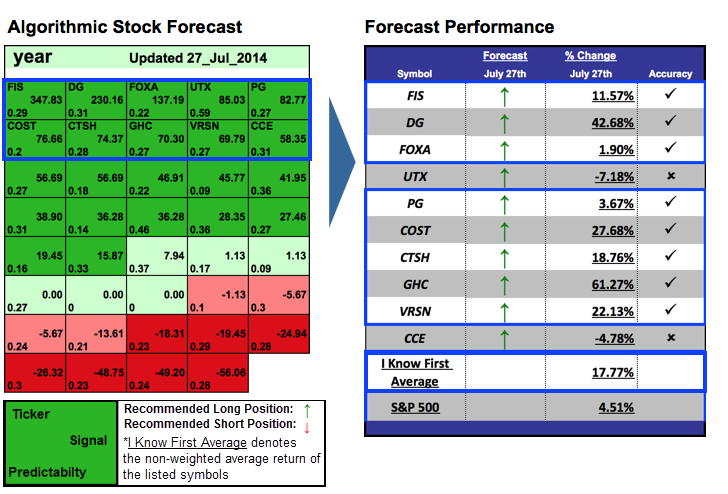

Forecast Length: 1 Year (07/27/14 – 07/27/15)

I Know First Average: 17.77%

In the recent 07/27/2015 forecast that was part of the Warren Buffett package, 8 of the 10 stocks for the long position increased in accordance with the algorithm’s prediction. The top performing stock for the long position was GHC with a spectacular return of 61.27%, while DG also had noteworthy returns of 42.68%. The average returns for the long position was 17.77%, well over 3 times greater than the S&P 500 return of 4.51% during the same time period.

Graham Holdings (GHC) posted the largest return over the year in the Warren Buffett package. Graham is one of the largest media companies in the world, posting 3.5 Billion dollars of revenue in 2013 due to its principal business divisions of Slate Magazine, Graham Media Group, Cable One, and Trove. Investors got very excited when Graham announced plans to spin off Cable One, which would allow Cable One new autonomy and an easier way of collecting capital.

How to interpret this diagram

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.