Warren Buffett Stock Portfolio Based on Data Mining: Returns up to 8.02% in 14 Days

Warren Buffett Stock Portfolio

This Warren Buffett Stock Portfolio is part of the Buffett’s Top 10 Package, as one of I Know First’s quantitative investment solutions. Investors generally utilize the I Know First advanced self-learning algorithm to take advantage of Warren Buffett’s proven investing strategy. The full Top 10 Warren Buffett’s Stocks Package includes the best stocks identified by the algorithm that are currently in Warren Buffett’s portfolio:

- Top 10 Warren Buffett’s stocks for long position

- Top 10 Warren Buffett’s stocks for short position

Package Name: Warren Buffett Portfolio

Recommended Positions: Long

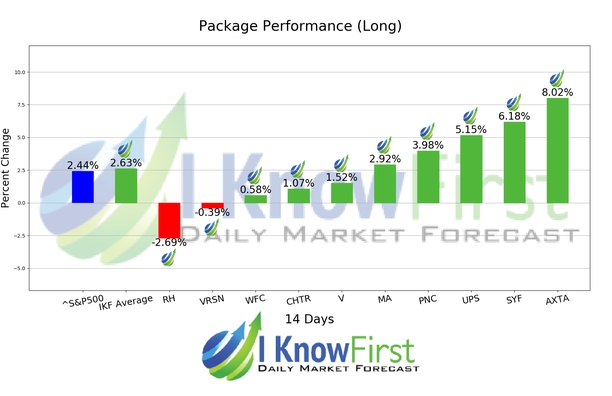

Forecast Length: 14 Days (9/22/2020 – 10/6/2020)

I Know First Average: 2.63%

This Warren Buffett Portfolio Package forecast had correctly predicted 8 out of 10 stock movements. The top-performing prediction in this forecast was AXTA, which registered a return of 8.02%. Other notable stocks were SYF and UPS with a return of 6.18% and 5.15%. The package saw an overall yield of 2.63% versus the S&P 500’s return of 2.44% implying a market premium of 0.19%.

Axalta Coating Systems Ltd. (AXTA), through its subsidiaries, manufactures, markets, and distributes high performance coatings products primarily for the transportation industry. It operates through two segments, Performance Coatings and Transportation Coatings. The Performance Coatings segment offers various waterborne and solventborne products and systems that are used to refinish damaged vehicles for independent body shops, multi-shop operators, and original equipment manufacturer (OEM) dealership body shops. This segment also provides functional and decorative liquid and powder coatings for use in various industrial applications, including architectural cladding and fittings, automotive coatings, general industrial, job coaters, electrical insulation coatings, HVAC, appliances, rebar, and oil and gas pipelines. It offers liquid coatings under the Voltatex, AquaEC, Chemophan, Lutophen, Stollaquid, and Syntopal brand names; and powder coatings under the brand names of Alesta, Nap-Gard, and Abcite. This segment sells and supplies its products directly to customers, as well as through a network of independent local distributors. The Transportation Coatings segment develops and supplies a line of coatings products, such as electrocoat, primer, basecoat, and clearcoat products for light vehicle OEMs for the coating of new vehicles; and various coatings systems for various commercial applications, including heavy-duty truck, bus, rail, and agricultural construction equipment. It sells and ships its products directly to light vehicle OEM customers. Axalta Coating Systems Ltd. (AXTA) has operations in North America; Europe, the Middle East, and Africa; the Asia Pacific; and Latin America. The company was formerly known as Axalta Coating Systems Bermuda Co., Ltd. and changed its name to Axalta Coating Systems Ltd. (AXTA) in August 2014. Axalta Coating Systems Ltd. was founded in 1866 and is headquartered in Philadelphia, Pennsylvania.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.