Verizon Stock Forecast: Verizon Is A Cheap, Low-Beta Long-Term Investment

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- The earlier-than-expected global 5G roll-out should make Verizon’s stock more attractive to investors.

- Verizon can increase its 150 million subscribers by offering 5 or 10 gigabit wireless internet speed.

- Verizon has compelling reason to be one of the earliest adopters of 5G networks. For many years now, Verizon is assessed as the U.S. network with the fastest wireless speed.

- Verizon reviving the legendary Palm brand for 2018 smartphones can attract new prepaid and post-paid subscribers.

- VZ is attractive to long-term investors who like low-beta companies. VZ is also a consistent dividend giver.

People looking for a safe, low-beta investment should consider adding Verizon (VZ) to their long-term portfolio. Verizon is boring but it only has a beta of 0.67. Its TTM P/S valuation is only 1.53 and its Forward P/E is 10.23. This low valuation makes Verizon ideal for bargain hunters. Verizon is also an excellent dividend-income provider. Its 2017 dividend payment was $9.47 billion, which is slightly higher than the $9.26 billion it paid in 2016. Verizon currently has a 4.97% yield.

Verizon’s stock price of $47.53 is still well below its 52-week high of $54.77. Going forward, the earlier-than-expected roll-out of 5G infrastructure should gradually make VZ more attractive to investors. Offering gigabit 5G wireless internet speed can help increase Verizon’s 150.46 million subscribers.

(Source: TipRanks)

As per the chart above revealed, the average 12-month price target of TipRanks-tracked Wall Street analysts for Verizon’s stock is $56.20. This PT is achievable after institutional investors realize Verizon is likely to be one of the world’s first adopters of 5G.

Why Verizon Will Be An Early-Bird Mover In 5G

Retaining the loyalty of its more than 150 million subscribers requires Verizon to maintain its status as America’s provider of fastest wireless internet connectivity. Verizon became America’s largest wireless provider by virtue largely because of its continuously updated network infrastructure.

(Source: Wirefly)

Root Metrics’ 2H 2017 report also identified Verizon as still America’s fastest wireless/cellular data service provider. Verizon also tops Root Metrics’ list of most reliable U.S. carriers. In terms of reliability, Verizon got a RootScore of 96.3. Its closest rival, AT&T (T) received a reliability RootScore of 94.1.

(Source: RootMetrics)

Retaining the loyalty of its wireless subscribers compels Verizon to do a timely upgrade to the new 1-to-10 gigabit 5G standard. Tardiness could see Verizon losing customers to AT&T, Sprint (S), or T-Mobile (TMUS). T-Mobile is the most aggressive, it promised to deploy 5G in 30 U.S. cities this year.

Verizon gets most of its annual revenue from its wireless subscribers. Verizon’s wireless segment derived $87.51 billion in revenue. This is almost 3x as big as the wired segment’s revenue of $30.68 billion. Verizon clearly has substantial financial incentives to protect its leadership in U.S. wireless network services.

(Source: Statista)

Verizon plans to do capital spending of $17 billion this year. This includes the commercial deployment of 5G infrastructure. I hope 5G deployment could account 20% of that $17 billion. This way we’ll know if Verizon is serious in being a first-mover in 5G services.

Verizon-Exclusive Palm Android Phones Could Also Attract New Customers

Aside from 5G connectivity and smartphones, the other future thing that could boost Verizon’s subscriptions could be TCL’s Palm Android phones. Before there was an iPhone, Palm was the must-have brand for smartphones. Twelve years ago, Palm was the choice of the hip and cool crowd.

HMD Global sold 8.5 million Nokia Android smartphones last year. It proved that nostalgia is a powerful sales inducer. Verizon could also benefit from nostalgia marketing by selling Palm smartphones. China-based TCL Communications and Verizon are rumored to launch a Palm phone later this year. My guesstimate is Verizon could add 1 to 5 million new subscribers from its Palm smartphones.

The trick is for TCL to build models that cater to both budget-conscious and affluent U.S. residents. To make Palm smartphones more appealing, Verizon/TCL should also make them Android One compatible. Android One is Google’s (GOOGL) pure Android OS experience strategy. A Verizon Palm Android smartphone without the bloat of third-party User Interface and pre-loaded apps could become a commercial hit.

The other benefit of joining the Android One platform is that Google offers marketing support. Using its own resources, Google can advertise Verizon Palm smartphones.

Conclusion

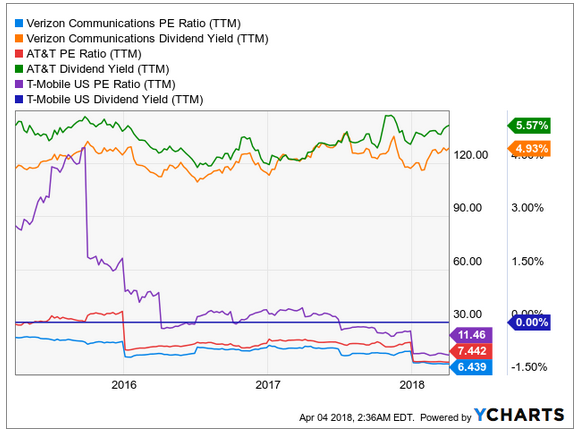

Based on their TTM P/E ratios, Verizon is cheaper to own than AT&T or T-Mobile. The dividend yield of Verizon is almost as good as AT&T. Income-focused investors should therefore consider adding Verizon to their portfolios. As long as Verizon can retain the loyalty of its 150 million subscribers, it can produce annual net income of $30 billion++ for the next five years.

Verizon’s positive one-year algorithmic market trend forecast score supports my buy rating for VZ. I Know First gave VZ a 1-year market trend score of 44.35. The predictability accuracy score of I Know First’s algorithm for Verizon is 0.49. It means I Know First’s algorithm has a decent track-record of correctly predicting VZ one-year market trend movements.

I Know First Algorithm Heatmap Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm. This allows users to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.