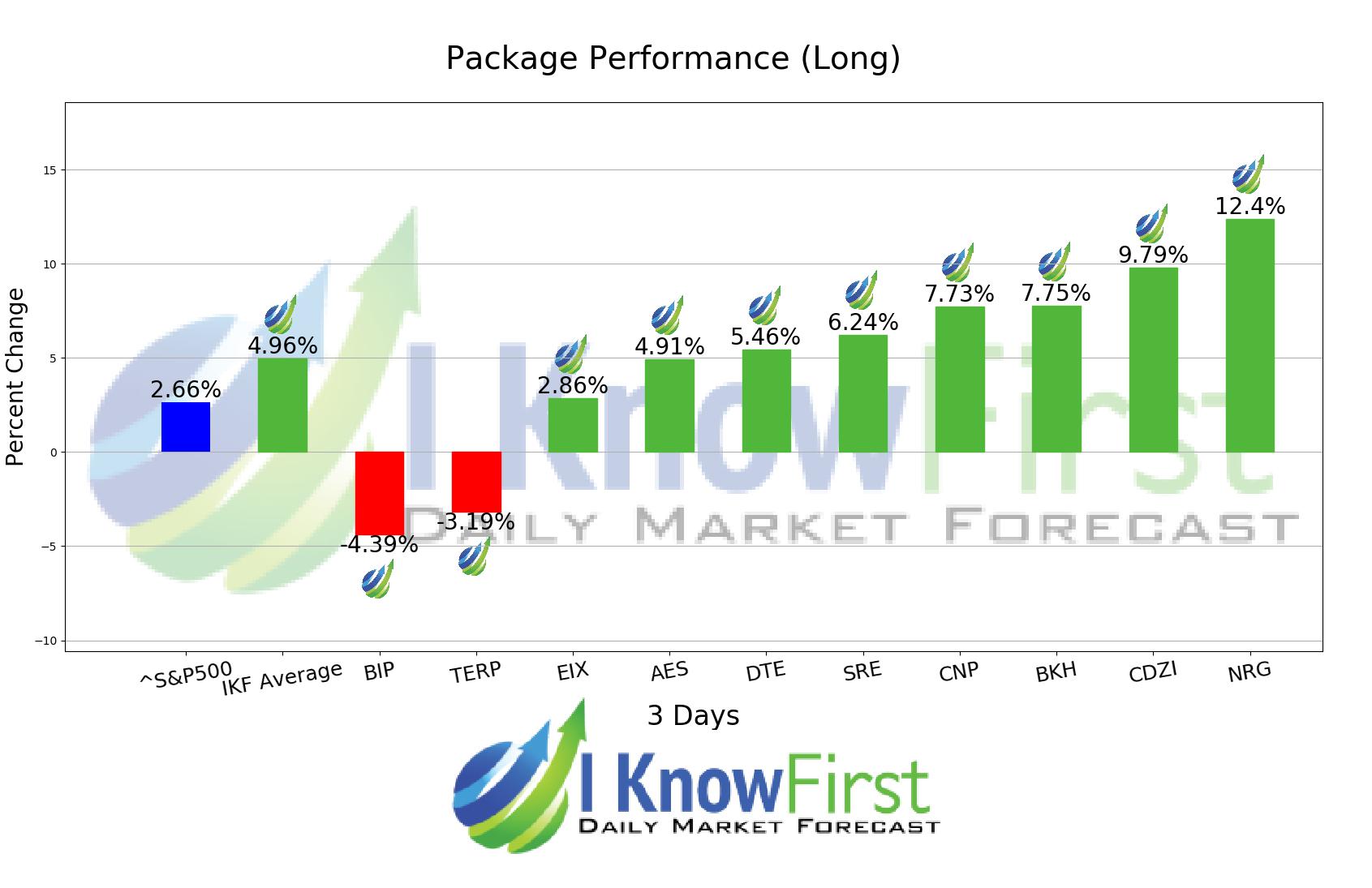

Undervalued Stocks Based on Algo Trading: Returns up to 12.4% in 3 Days

Undervalued Stocks

This Utilities Stocks forecast is designed for investors and analysts who need predictions of the best utilities stocks to buy for the whole Industry . It includes 10 undervalued stocks with bullish and bearish signals and indicates the best utilities stocks to buy:

- Top 10 Utilities stocks for the long position

- Top 10 Utilities stocks for the short position

Package Name: Utilities Stocks

Recommended Positions: Long

Forecast Length: 3 Days (3/26/2020 – 3/29/2020)

I Know First Average: 4.96%

During the 3 Days forecasted period several picks in the Utilities Stocks Package saw significant returns. The algorithm had correctly predicted 8 out 10 returns. NRG was the highest-earning trade with a return of 12.4% in 3 Days. Other notable undervalued stocks were CDZI and BKH with a return of 9.79% and 7.75%. The package itself saw an overall return of 4.96%, providing investors with a 2.30% premium above the S&P 500’s return of 2.66% for the same time period.

NRG Energy, Inc. (NRG), together with its subsidiaries, operates as a power company. The company provides electricity; system power, distributed generation, solar and wind products, backup generation, storage and distributed solar, demand response, energy efficiency, electric vehicle charging stations, and on-site energy solutions; carbon management and specialty services; and various energy services, such as operations, maintenance, technical, development, and asset management services. It owns and operates approximately 50,000 megawatts of generation. The company also offers retail energy, rooftop solar, portable solar, and battery products home services; and various bundled products, which combine energy with protection products, energy efficiency, and renewable energy solutions, as well as offers installation and contract management services for residential solar customers. As of December 31, 2015, it served approximately 2.77 million recurring and 624,000 discrete customers. In addition, the company owns, operates, and develops solar and wind power projects; develops, constructs, and finances a range of solutions for utilities, schools, municipalities, and commercial markets; and trades in electric power, natural gas, and related commodity and financial products, including forwards, futures, options, and swaps. As of December 31, 2015, it operated 90 active fossil fuel and nuclear plants, 16 utility scale solar facilities, and 36 wind farms and multiple distributed solar facilities. Further, the company transacts in and trades fuel and transportation services; directly sells energy, services, and products and services to retail customers under the NRG, Reliant, and other names; and provides steam, hot water, and chilled water, as well as electricity to commercial businesses, universities, hospitals, and governmental units. NRG Energy, Inc. (NRG) was founded in 1989 and is headquartered in Princeton, New Jersey.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.