UAL Stock Forecast: Buy United Airlines Stock While Its Down

This United Airlines (NYSE: UAL) stock forecast article was written by Jessica Kremer – Analyst at I Know First.

This United Airlines (NYSE: UAL) stock forecast article was written by Jessica Kremer – Analyst at I Know First.

Summary

- Airlines are all still struggling to recover from COVID-19, with some believing they will not fully rebound until scientists discover a vaccine.

- Despite this, passenger capacity is expected to increase to 25% of its 2019 level in July, compared to 10% available capacity in May and June.

- Although the company reported an adjusted net loss of $639 million and pre-tax loss of $1.0 billion in Q1, during the month of June the stock has increased, leading me to my buy option.

UAL stock is currently trading at $48.60, a 107% increase from its low of $23.38 on March 18. Many companies’ stocks are rebounding as worldwide economies reopen. However, some speculate that the airline industry may not return to normal until scientists discover a vaccine. Despite this, United Airlines has recently decided to resume about 130 domestic flights, contributing to UAL recent stock growth.

UAL Stock Forecast and COVID-19

The pandemic has affected all industries, with the pandemic hitting travel and airlines the hardest. Although travel may begin again soon, it will most likely not reach the same levels as before the virus. Many business trips have been cancelled, and so companies will no longer be filling business seats at the same rate. Airlines will also have to lose out on profit by implementing safety and sanitation procedures. Due to this, United Airlines has launched the Clean Plus initiative. This initiative combines Clorox and the Cleveland Clinic to inform and guide United’s new cleaning, safety and social distancing protocols. Specifically, airports will use Clorox products as disinfectant while the Cleveland Clinic will advise on new technology and training development. These necessary changes reflect the ability for the company to adapt to COVID-19, and prompts confidence in its stock.

United also received a bailout from the government via the CARE Act. This bailout will give United $3.5 billion through a direct grant and about another $1.5 billion through a low interest rate loan. This $5 billion loan is meant to offset the revenue loss resulting from the virus.

Cutting Costs Through Reducing Employees

United Airlines has stated that they will be cutting costs by reducing their employee numbers. In adherence with the CARE Act, United has scheduled these cuts have for October 1. The company also plans to close three of their four international bases in October. United plans to shut down bases at Frankfurt, Hong Kong, and Tokyo, which will impact around 840 flight attendants. The company has told nonunion workers they will have to take 20 unpaid days off before Sept. 30. Ultimately, the company wants to cut to 30% of their workforce, or 3400 employees. Although unfortunate, cutting costs through reducing employees is significant. This will help increase the company’s cash, as well as reduce obligations, driving UAL stock growth.

These cuts come despite a government bailout that will give United a total of $5 billion. Although the company is in adherence with the bailout, non-union workers have filed a lawsuit regarding required unpaid days off.

UAL Stock Ability to Grow

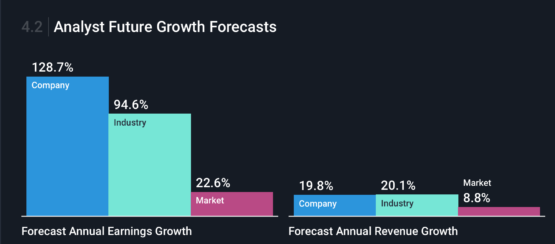

In a recent message from United, CEO Scott Kirby, announced changes to be made to United’s management. The most significant change is the hiring of the company’s COO, Greg Hart, as the new CEO. Kirby states that he hopes Hart will be able to “adjust the size of the airline, including labor costs, to meet demand and importantly, [and] be ready to bounce back quickly when the virus is defeated.” He also stated that the airline is working on unique ideas other airlines have not considered. This reorganizing of the company’s management can help bring innovation to the company. Looking at the earnings growth forecast, we can see that United is faring better than their competitors and the market. This change and future growth capabilities prompt my United stock forecast buy verdict.

In addition, the company entered into an agreement with a subsidiary of Bank of China Aviation Limited for lease financing of six Boeing 787-9 and 16 Boeing 737 MAX 9 aircrafts. United will sell and lease back these 22 planes. The aircrafts are scheduled to deliver in 2020, including two Boeing 787-9 aircraft that were delivered in April. The decision to purchase more planes demonstrates United’s confidence in growth, and reflects the future growth potential the airline has.

United Airline’s Recent Earnings

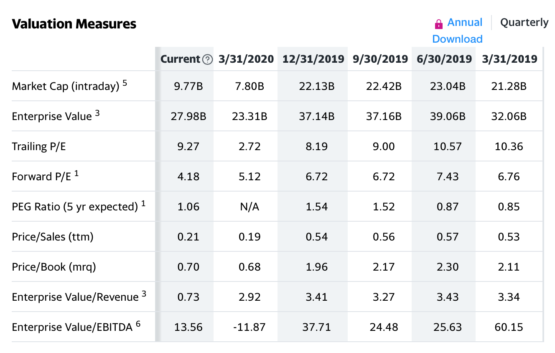

In addition, UAL stock dropped 70% this year, and it posted a massive $1.7 billion loss. The company is also expected to burn nearly $40-$45 million per day in Q2 2020 due to contracted flights. This cash burn could lower book value by $4.095 to $5.313 billion. This is apparent through the P/B ratio, where although price increased by around 54% since March 31, the ratio remained almost the same. In addition, this implies that the company will need significant liquidity as it rides out the pandemic. As of Wednesday, April 29, 2020 their liquidity was approximately $9.6 billion, including $2 billion under its undrawn revolving credit facility. With these numbers, the company should be able to offset the negative effects of the virus. In a May filing with the Securities and Exchange Commission United forecast that its scheduled July capacity would fall 75% from its year earlier level.

In addition, United stated that “scheduled capacity for May and June 2020 was reduced by approximately 90% from 2019 levels.” However, this number is expected to increase to 25% in July. This increase in capacity has contributed to growth. Since the beginning of June, UAL stock has grown about 50%. This growth has spurred confidence in the company and has impacted my buy verdict.

UAL Stock vs Competitors

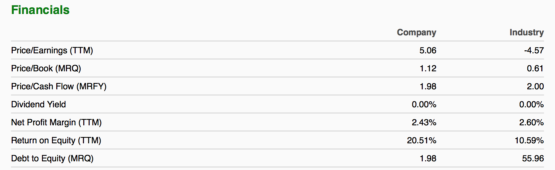

Although United may not have rebounded as well as other companies, all airlines are in a similar situation. However, airlines will never go out of business, and so it is important to buy now while the price is low. Looking at an industry comparison, United Airlines seems to be the most stable. Comparing United’s PE ratio, which demonstrates how the stock fares in comparison to their earnings, United is doing better than their industry average.

United has a lower debt to equity ratio than its industry average. This indicates that they have enough cash to cover their debts. Over the past five years, their debt to equity ratio has decreased from 3.825 to 1.98. Furthermore, UAL debt is able to be covered by operating cash flow, at about 29.3%.

Conclusion

My buy verdict stems from my confidence that the airline industry will rebound eventually. Travel is a modern-day necessity, and United fares better financially than most of its competitors. The company has also implemented many new changes in light of the virus. This changes, along with changes in management and their finances, prompt my confidence in the stock.

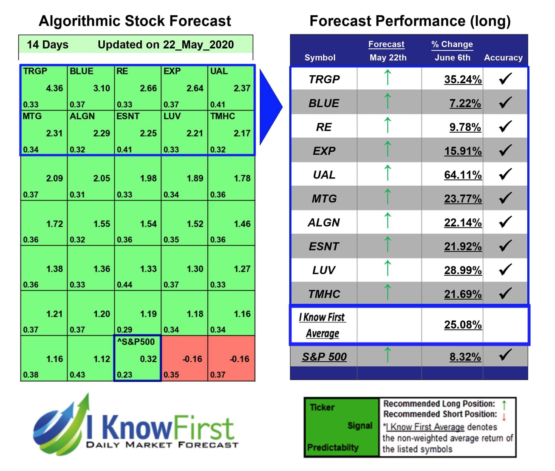

Finally, my buy verdict is strongly impacted by the prediction of the I Know First AI algorithm. This bullish forecast, along with the United’s stock’s recent momentum, further uphold my decision.

I Know First Past Success with UAL Stock Forecast

I Know First has been bullish on UAL stock forecast recently. We issued a bullish 14 day forecast for UAL on May 22, 2020. This forecast came with a signal of 2.37 and predictability of 0.41. This forecast proved successful, as UAL stock grew 64.11% during the two weeks. This same forecast also successfully predicted for Southwest Airlines (NYSE:LUV), which was able to grow 28.99% in the two week period. This success was highlighted in our most recent newsletter, in the letter from our CEO.

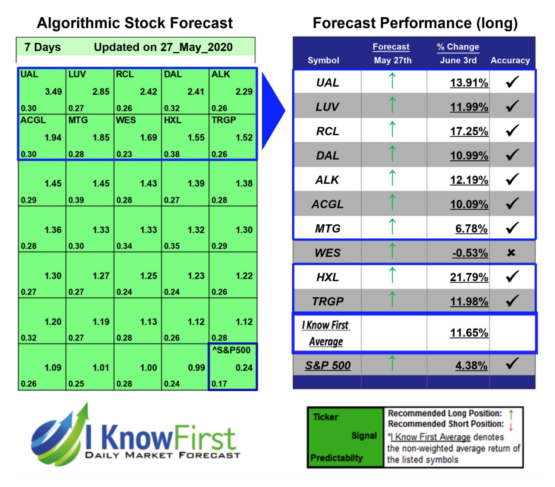

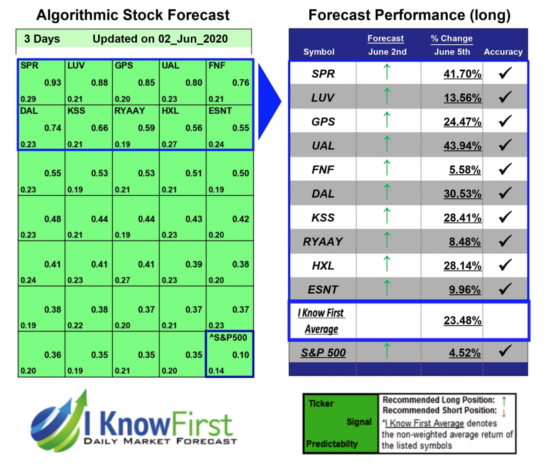

Other successful I Know First UAL forecasts can be seen on May 27, 2020 and June 2, 2020. On May 27, the I Know First algorithm issued a bullish 7-day forecast for UAL with a signal of 3.49 and a predictability of 0.30. After the 7 days, UAL stock grew 13.91%. On June 2, we issued a 3-day forecast with a signal of 0.80 and a predictability of 0.23. Following the three days, UAL stock gained 43.94%.

These same forecasts correctly predicted for Delta Airlines (NYSE: DAL), American Airlines (NASDAQ: AAL), and Southwest Airlines (NYSE:LUV). Our bullish forecasts was simultaneously successful for major industry players, demonstrating I Know First’s ability to predict for sectors as whole.

Here at I Know First, our AI-based strategy has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast