U.S. Steel Stock Forecast: Innovating Steel

Gina Guinasso is a Financial Analyst at I Know First.

Gina Guinasso is a Financial Analyst at I Know First.

U.S. Steel Stock Forecast

Summary

- The Steel industry will continue to benefit greatly from improvements in market conditions in the U.S. and recent favorable trade rulings, and it should continue to additionally improve as demand for steel grows and supply from producers over sea fall.

- U.S. Steel Corporation laid-off about 25% of their non-union workers, total estimated number of former employees is 1,500.

- In alternative materials, there are significant advances to improving material efficiency, durability, and cost of products. Involvement in many industries hopes to provide benefits of diversification.

- Innovation has been shown through new developments in technology and waste elimination, both are aimed to significantly improve efficiency.

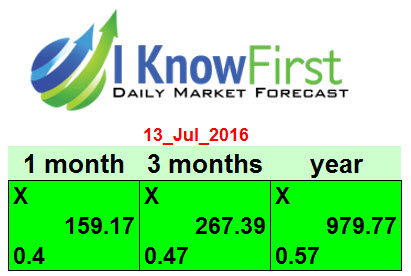

- Stock predictions are bullish from the I Know First Algorithm; strong buy recommendation for 1 Month, 3 Month, and 1 Year predictions.

The I Know First’s Stock Forecasting Algorithm accurately predicted a buy position for the U.S. Steel Corporation (X) over a 14 day time period starting July 4th, returning 18.88%, significantly outperforming the S&P 500 which returned a mere 3.04%.

Team Playing C.E.O. is Leading US Steel Corporation to Victory

Mr. Mario Longhi is the President and Chief Executive Officer of United States Steel Corporation. His extensive international experience includes having been recognized as the global benchmark in the aluminum industry. He earned a Bachelor’s Degree in Metallurgical Engineering in 1977 and holds a Master Graduate Degree in Metallurgical Engineering; both are from the Institute Maua de Tecnologica in Sao Paulo.

Mr. Mario Longhi believes U.S. Steel Corporation has deduction from his employees as they remain focus to address issues they control and substantially improved the business model and increased earning power. Injuries to employees reduced. The company focus will remain on the long-term health and stability even if the market conditions are unstable.

Mr. Longhi takes pride in being an engaged leader and is self-identified as a curious person with experience adapting to constant change. Prioritizing and keeping focused on essentials are the two key views he has on running a successful company.

Fair Trade

U.S. Steel Corporation will continue to fight for fair trade around the world. Fairly traded steel imports remain at high levels. Market distorting practices by foreign governments and the steel companies are driving the current import level, rather than current market demand.

Since Great Britain voted to exit the EU, steel markets had shown an increase in stability. For the month of June, U.S. Steel was up about 16.5%. The S&P was basically flat in the same month. The Brexit signaled an upside for US Steel.

Flat-rolled steel products make up around 70% of U.S. Steel’s production, positioning the company in a less diversified market position than their competitors. This resulted in U.S. Steel being hit harder when the market is changing than competitors because they have more commodity type products than value added products.

In June 2016, the United States International Trade Commission (ITC) ruled that cold-rolled steel products (from countries like China and Japan) and imports of corrosion-resistant steel products (from China, India, Italy, Korea, and Taiwan) since they were being sold in the United States at below fair value. The governments of China, India, Italy, and Korea were singled out for subsidizing their steel industries. This ruling allows for duties to be imposed on imports from those countries and allows the U.S. to impose countervailing and anti-dumping duties on cold-rolled steel imports.

On June 24, 2016, Mr. Longhi issued a statement in response to the International Trade Commission (ITC)’s affirmative decision on corrosion-resistant steel imports. According to Longhi “United States Steel Corporation is pleased with the International Trade Commission’s affirmative decision regarding corrosion-resistant steel imports. The domestic steel industry has suffered dramatically due to the increase in unfairly traded imports, but today’s decision is an encouraging step toward a level playing field.”

U.S. Steel has benefited from improvements in market conditions in the U.S. and favorable trade rulings, and it should continue to improve as demand for steel grows and supply from producers oversea fall.

Even politicians are stepping in and involving themselves in the steel industry. “I want trade deals, but they have to be great for the United States and our workers,” Republican presidential nominee Donald Trump said in a speech on June 22. “We don’t make great deals anymore, but we will once I become president.” A few weeks prior, Secretary Hillary Clinton received a significant labor endorsement from the United Steelworkers union claiming to fight for fair trade and opposed to the Trans-Pacific Partnership (TPP) which is accused of taking jobs away. In Washington D.C., legislators had elected local leaders, and government officials at several agencies are listening to the case of steel in hope that trade laws will improve. For the steel sector, the more light was shed on their issues, the more attention they received.

Lay-off’s

In April and May 2016, U.S. Steel Corporation laid off around 25% of its salaried workforce consisting of managers, supervisors, and other white-collar workers not represented by the United Steel Workers union. The layoffs took place at U.S. Steel’s headquarters at Pittsburgh and at plants like Gary Works and the Midwest Plant in Portage. United Steel Workers District 7 Director Mike Millsap said “It’s all non-bargaining unit — supervisors, engineers, lawyers,” he said. “This is just about them taking care of their cost issues. They’re trying to reduce their costs.” Union workers were not affected.

“This is part of the ongoing adjustment to staff levels and operations due to challenging market conditions, including fluctuating oil prices, reduced rig counts, depressed steel prices and unfairly traded imports,” said U.S. Steel spokeswoman Sarah Cassella. Laid-off workers can still have benefits under the company’s supplemental employment program.

U.S. Steel Corporation reported having 21,000 employees nationally in its most recent annual report to the Securities and Exchange Commission, About 18,000 employees were represented by the Union Steel Workers union. It was estimated that the company laid-off around 750 of the 3,000 salaried employees who aren’t represented by the union. About 800 additional former employees that were laid off were workers in Alabama and Texas as a result of the low oil prices and crippled demand for tubular steel used in drilling. Current estimate is around 1,500 workers have been laid off so far in 2016. Labor makes up around 25 percent of U.S. Steel’s operating cost.

Even U.S. Steel’s Chief Executive Officer Mario Longhi accepted an overall compensation decline by 35% in 2015 after the company lost $1.5 billion. Longhi’s total compensation fell to $8.6 million last year, as compared to $13.2 million in 2014, according to U.S. Steel’s proxy statement filed recently with the U.S. Securities and Exchange Commission. The CEO’s base salary actually rose from $1.1 million in 2014 to $1.4 million last year, as his 2015 salary was tied to company profit earned in 2014. But he saw a $1.7 million decline in the value of his stock compensation because of the dramatic fall in the company’s stock price in 2015. Longhi did not receive an incentive award for 2015 because the Pittsburgh-based steelmaker failed to meet financial targets. Other top executives also missed out on cash incentives after the company failed to hit cash flow and earnings goals.

Industries

U.S. Steel Corporation is unique in the sense it operates in several industries. In the automotive industry: there are new regulations and the company will need to improve miles per gallon usage for vehicles. In the alternative materials industry: there have been significant advances to improving material efficiency, durability, and cost. Alternate materials are growing very fast and unexpectedly. Within the larger part of the business, Steel Industry: it is a deeply scientific organization. Often overlooked but the mathematical models that are required to deal with a blast furnace, and the rolling, the fineness that needs to be in a controlled process for it to be perfect. U.S. Steel has been and will continue to be creating those conditions in order to innovate with the customers. The company also is in the energy, construction, and industrial industries, which tend to be solid and less volatile. Being involved in many industries hopes to provide benefits of diversification.

Innovation

Like many other companies, U.S. Steel is improving their innovation. Digitization is the process of converting information into a digital format. In this format, information is organized into discrete units of data (called bit s) that can be separately addressed (usually in multiple-bit groups called byte s). U.S. Steel is using digitization in two main ways. The first one is simulation: the importance of you being able to simulate processes with as much accuracy as you can. It’s aimed to save time on the development of new things, and to eliminate a lot of waste that results when trying to come up with a new way of accomplishing a task. The second way is the learning of deposition of metal on something else, such as coatings on products.

Conclusion

To be competitive in an increasingly global marketplace, companies must have a global outlook and presence. U. S. Steel continually looks for opportunities to strengthen the company’s existing presence internationally and strives to meet and set world-class standards in everything it does. Each and every one of those segments has its own idiosyncratic ways in which things work, affecting U.S. Steel Corporation. U.S. Steel Corporation is focusing on the striving to act on opportunities to improve the business, especially in operations and research and development.

U.S. Steel Corporations struggled in recent years. However, their outlook is good. Global overcapacity in the steel industry had led to a significant rise in steel imports to the United States, while the drop in oil prices has reduced demand for steel, particularly in the energy industry. With new regulations of domestic demand increasing, and imports of supply decreasing the outlook looks good for U.S. Steel Corporation.

I Know First’s algorithm forecasts how stocks are going to perform during certain time periods of 3 days, 7 days, 14 days, 1 month, 3 months, and a year. In the case of U.S. Steel Corporation (X), the middle row represents the signal strength and the bottom number represents the predictability indicator, the historical correlation that is heavily weighted on the algorithm’s recent predictions are represent a very strong buy. As the time period lengthens the algorithm signal becomes a much stronger buy. To learn more about the platform please click here.