TXN Stock Forecast: a Semiconductor Pioneer with Sustainable Growth

This TXN stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

This TXN stock forecast article was written by Yutong Li – Analyst at I Know First, Master’s candidate at Brandeis University.

Highlight:

- TXN stock has grown by 16.3% since January 2021

- The company has a strong financial footing with an ROE of 72.49% and an operating margin of 46.34%, outperforming 99.15% and 98.56% of companies in the semiconductor industry

- With Texas Instruments’ wide product range, expanding manufacturing capabilities, and strong financial position, the target price for TXN will hit $220 for the upcoming year

Overview of Texas Instruments Incorporated

Texas Instruments Incorporated is a global semiconductor company that designs, manufactures, tests, and sells semiconductors to electronics designers and manufacturers worldwide. It operates in two segments, Analog and Embedded Processing. The company has more than 80,000 products that help over 100,000 customers efficiently manage power, accurately sense, transmit data and provide the core control or processing in their designs, going into markets such as industrial, automotive, personal electronics, communications equipment, and enterprise systems. The company was founded in 1930 and is headquartered in Dallas, Texas. Since last August, Texas Instruments Incorporated (NASDAQ: TXN) has roared up 37.39% over this 1-year time period.

Texas Instruments: A Market-Leading Chips Manufacturer

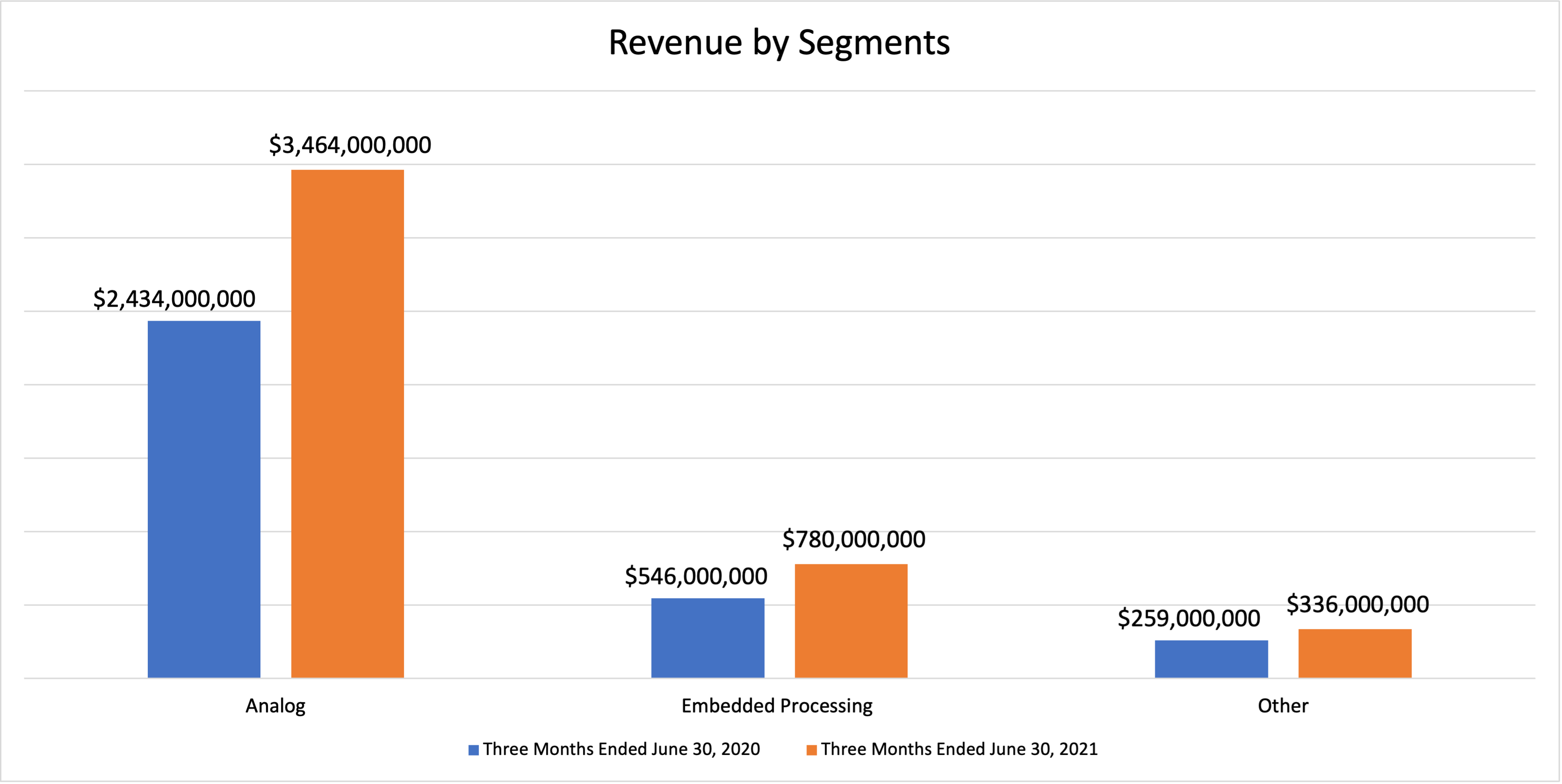

Texas Instruments Incorporated has been making progress for semiconductors to go into electronics everywhere and making its technology more efficient and more reliable. From the company’s 10-Q Form, Texas Instruments’ efforts have paid off and it has achieved notable revenue growth in Q2 2021 as compared to the same quarter last year. Its net revenue in Q2 2021 was $4.58 billion, with a rise of 41.4% year on year. And we can see its two primary operating segments both saw great revenue growth with 42.3% in Analog, and 42.9% in Embedded Processing.

(Figure 1: Revenue by Segments)

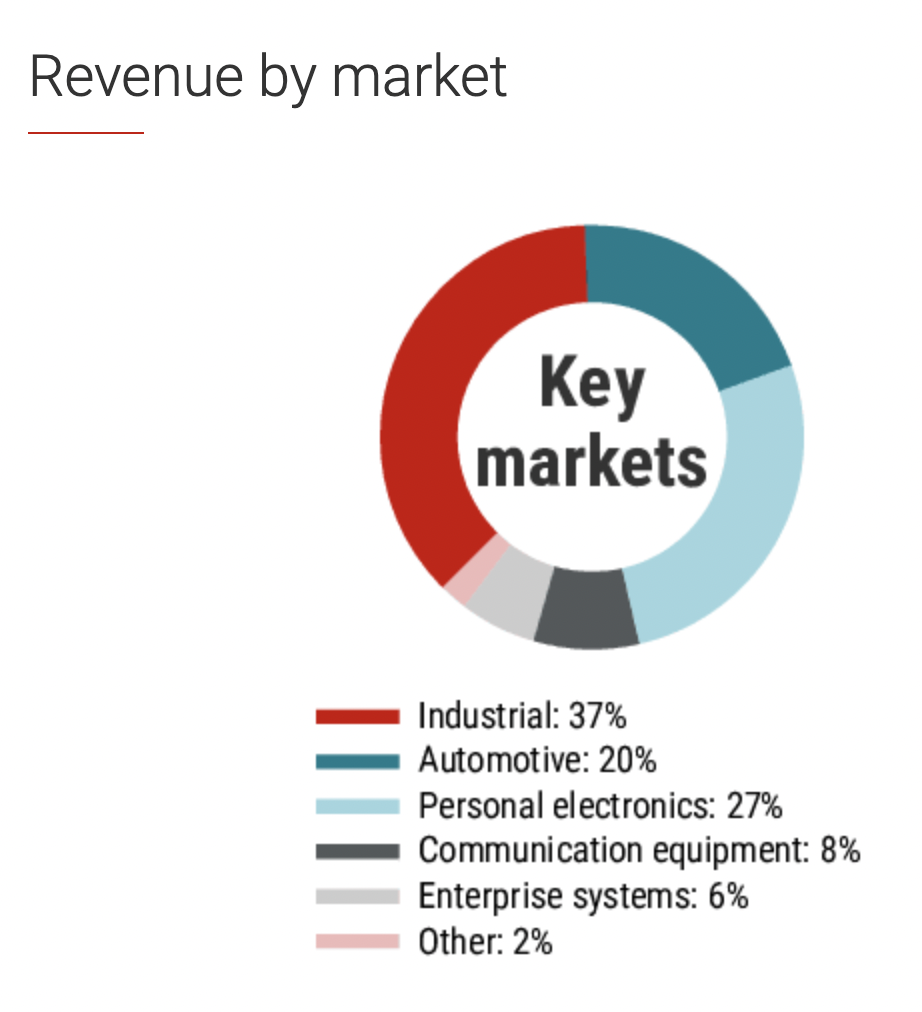

More importantly, Texas Instruments’ market has a great potential to grow even bigger considering its well-diversified product portfolio. As we can see in the below chart, the company’s largest markets are industrial, personal electronics, and automotive, which account for 37%, 27%, and 20% of its revenue respectively in 2020. And the rest 16% of its revenue was generated from the communications equipment segment, the enterprise system segment, and others. With this product diversification across markets, Texas Instruments can get control over multiple types of electronic devices without dependence on a single market or customer group for its revenue generation. It also means that the company can sell more chips into each market and each customer application, which increases the company’s profitability and makes Texas Instruments a versatile business with less risk and more opportunities ahead.

In addition, Texas Instruments is still expanding its manufacturing capabilities and investing more in its chip development. On June 30th, the company announced its plan to acquire Micron Technology’s 300-mm semiconductor factory (or “fab”) in Lehi, Utah, for $900 million. “This investment continues to strengthen our competitive advantage in manufacturing and technology and is part of our long-term capacity planning,” CEO Rich Templeton stated. Leading manufacturing capabilities on 300-mm wafers also offers Texas Instruments greater control of its supply chain and a 40% cost-cutting advantage over its competitors that mostly manufacture 200-mm wafers.

Another competitive advantage of Texas Instruments’ business model is the company’s extending reach of the market channels worldwide through TI.com, the global sales, and its application teams. The company now has 14 manufacturing sites worldwide with tens of billions of chips produced each year and has tens of millions of visits to TI.com annually. Based on the graph below, in Q2 2021, Texas Instruments has a striking sales growth in different regions across the world that makes up this 41.4% revenue boost compared to the same period of last year. Hence, this increase in global presence has helped the company obtain remarkable sales growth and this can also be an encouraging opportunity for Texas Instruments’ future expansion.

(Figure 2: Revenue by Geographic Regions)

Furthermore, according to this article, the development of artificial intelligence (AI), the internet of things (IoT), 5G, autonomous driving, etc. are expected to contribute more to the burgeoning semiconductor industry. Based on WSTS, it forecasts that the semiconductor market size would reach $527 billion dollars in 2021, up by 19.7% compared to 2020. And it also expects the worldwide semiconductor market growth to further grow by 8.8 percent to $573 billion in 2022. Thus, with new technology development driving the future of the semiconductor industry, Texas Instruments’ semiconductor business is projected to flourish further.

TXN’s Stable Dividend Growth and Robust Financial Position

According to Texas Instruments’ 10-Q Form of Q2 2021, the company has $6.5 billion free cash flow forming 38.7% of its revenue, which demonstrates that the company has enough cash to continually develop its products and to return value to its shareholders. Moreover, Texas Instruments is currently paying an annual dividend of $4.08 per share – up by 9.7% from last year, and the company has had this dividend rise for 17 consecutive years with an average bump of 21% per year, suggesting that the company is well performed and has room to pay shareholders higher dividends.

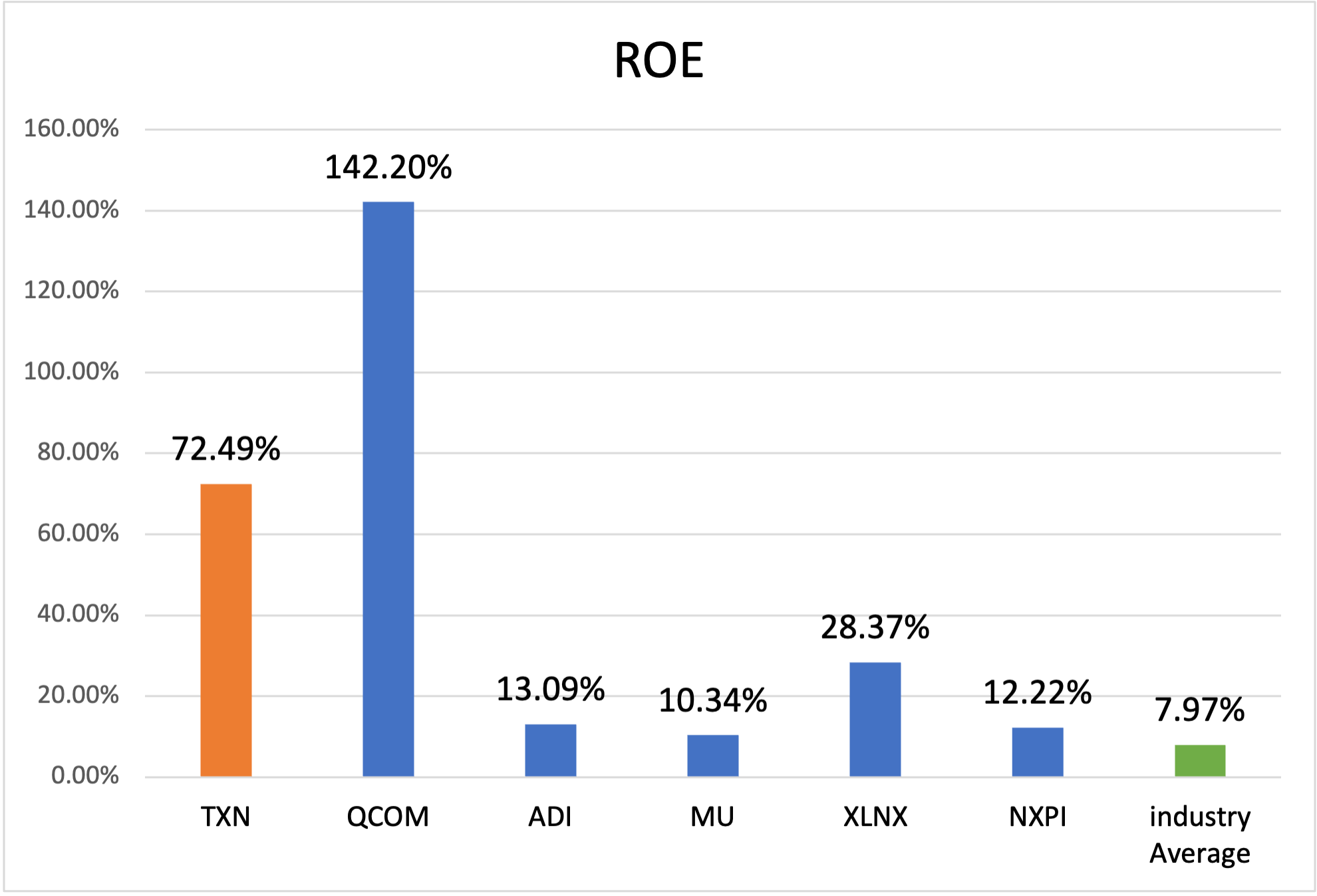

Next, we can choose several comparable companies of Texas Instruments Incorporated and the semiconductor industry benchmark to evaluate its financial competitiveness. These companies are Qualcomm Inc. (USD, QCOM), Analog Devices Inc. (USD, ADI), Micron Technology Inc. (USD, MU), Xilinx Inc. (USD, XLNX), and NXP Semiconductors NV (USD, NXPI).

According to GuruFocus, TXN’s ROE of 72.49% is higher than most of its peers and the industrial average. This number is also outperforming 99.15% of companies in the semiconductor industry. This can exhibit the company’s excellent profit generation ability from its equity.

(Figure 3: ROE)

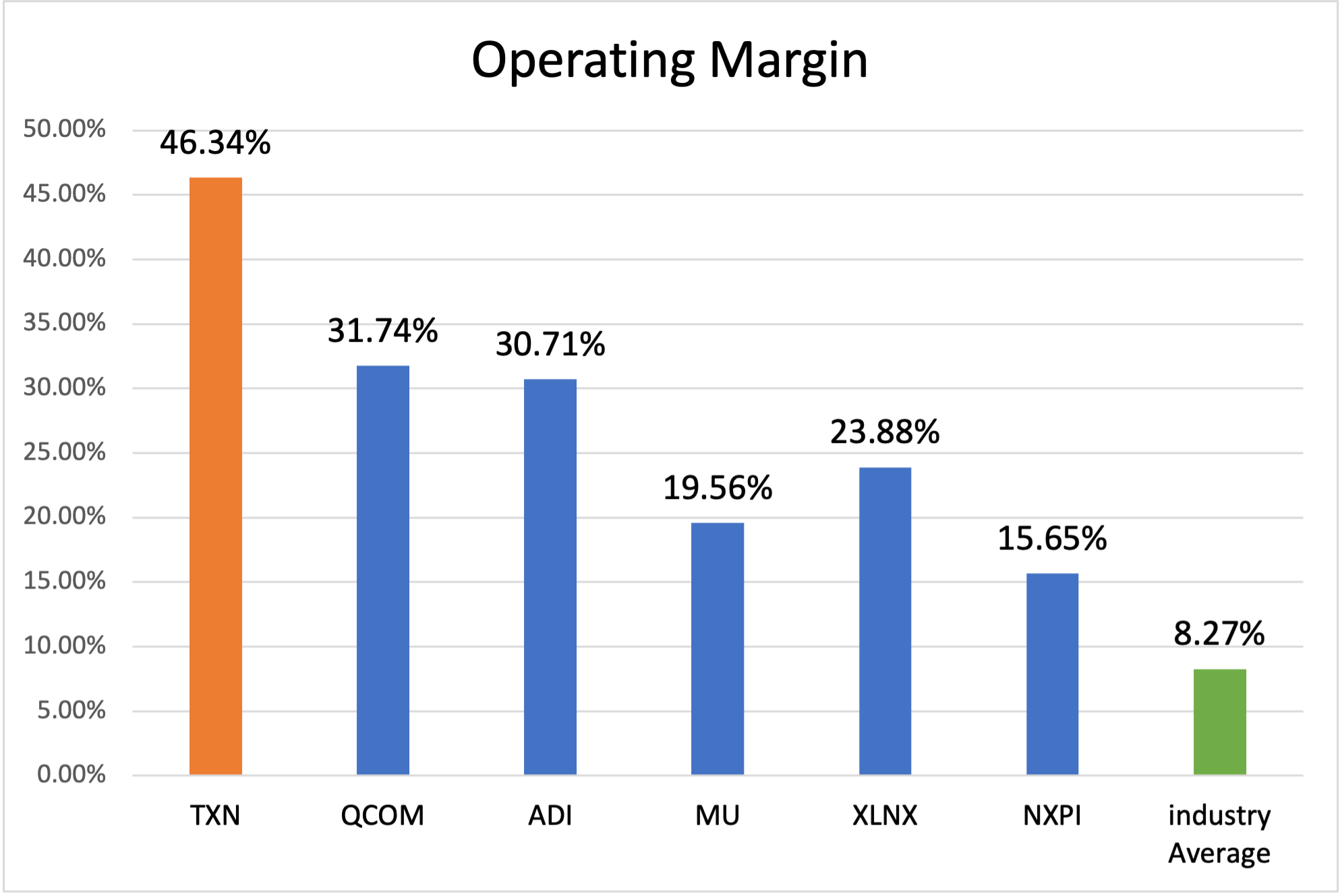

In addition, TXN has a notable operating margin of 46.34%, which is exceedingly higher than all its peers that we picked and the industry benchmark. This value is also ranked higher than 98.56% of companies in the industry, indicating that Texas Instruments is well managed with high profitability and less financial risk. Besides, we can see that TXN has a current ratio of 5.08. Even though this ratio is not the highest among all rivals that we selected, this value still surpasses 85% of companies in the industry, which can manifest the company’s superb liquidity and operational efficiency.

(Figure 4: Operating Margin)

(Figure 5: Current Ratio)

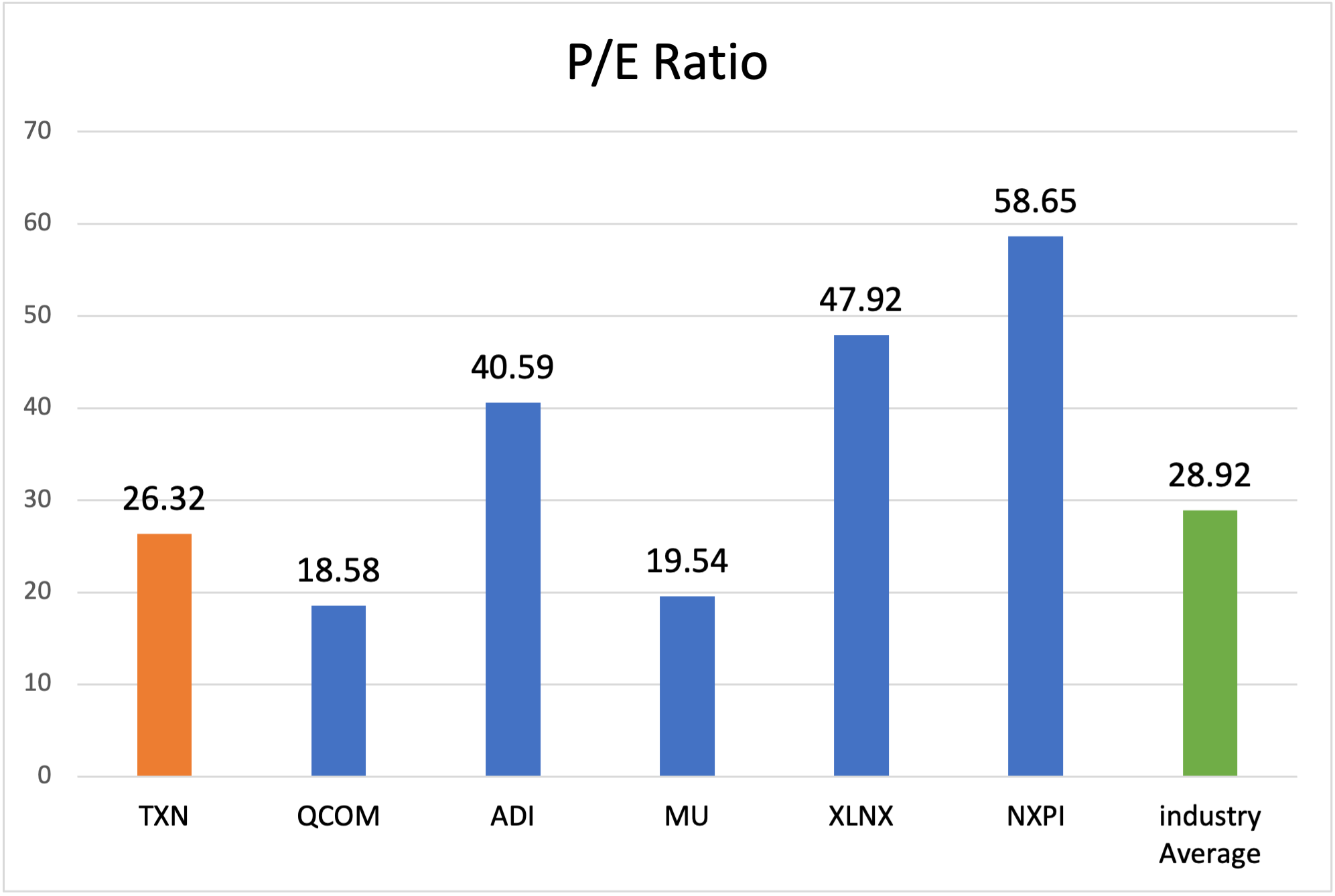

Furthermore, TXN’s current P/B ratio of 15.62 and P/S ratio of 10.48, and P/E ratio of 26.32 present as being slightly overvalued against the industry benchmark and many of its peers. Nevertheless, these price ratios can also represent the company’s fleeting growth and high profitability based on its resilient business model, growing global presence, and excellent financial performances as we mentioned.

(Figure 6: Price Ratios of Comparable Companies)

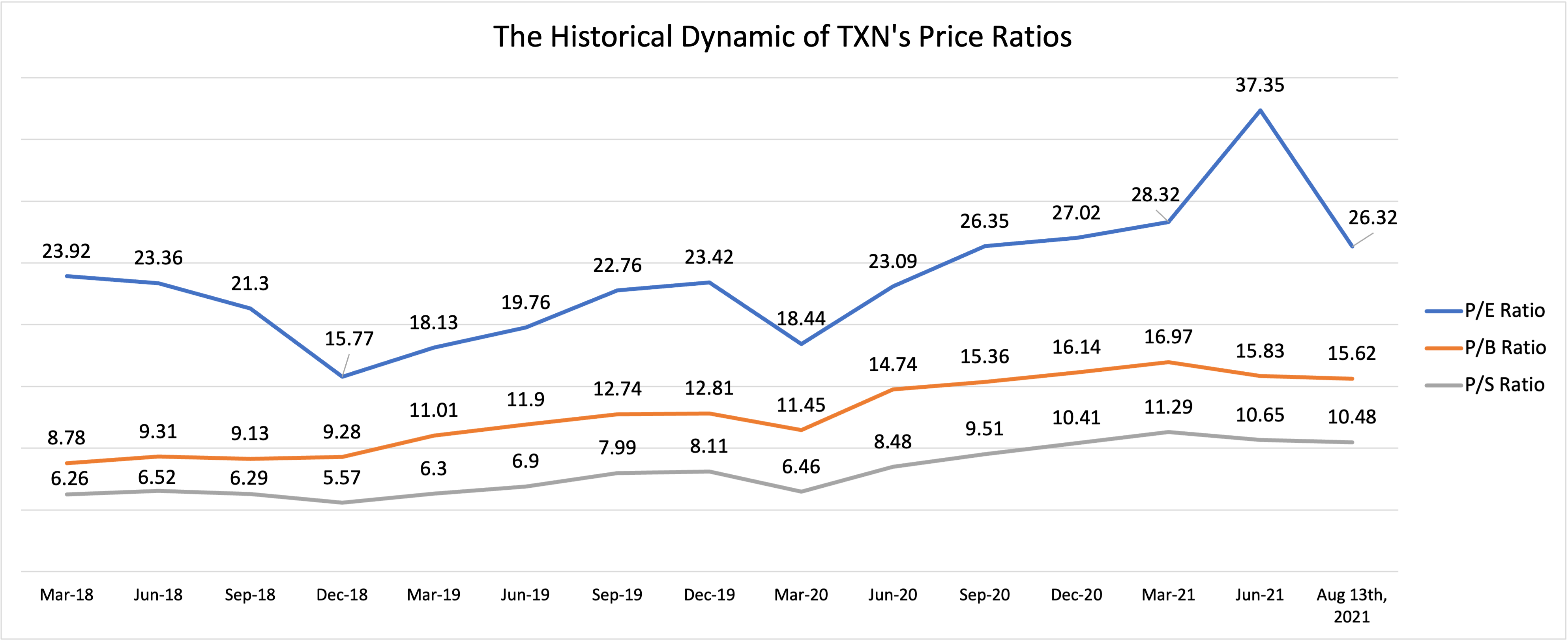

Plus, Figure 7 shows that all TXN’s price ratios have overall rising trends, which can also be seen as an indicator of its potential growth over time. Therefore, TXN still acts as a desirable stock for investors.

(Figure 7: The Historical Dynamic of TXN’s Price Ratios)

TXN’s Targeted Stock Price Hit $220 in 2022

From the above price chart, TXN’s current stock price is above its MA-100 (the orange line) and its MA-200 (the blue line), but below its MA-50 (the purple line). From a long-term perspective, TXN stock price has a stably increasing trend and it is also constantly above its MA-200 line and generally above its MA-100 line in this 1 year. All indicators can demonstrate TXN’s consistent long-term growth prospects and a buy recommendation for investors. Therefore, my target price for TXN in 2022 will hit $220 with a return of 16.6%, and it also has great potential to outstrip this target depending on the company’s product innovation and development, its continuing global expansion, and the future semiconductor market driven by technological developments, etc.

Conclusion

In a nutshell, Texas Instruments is a pioneer in the semiconductor industry and has been dedicated to opening new markets and making its products go into electronics everywhere. More notably, TXN stock is also a very safe and stable investment considering its well-diversified product range, low-cost manufacturing strategy, increasing global expansion, shareholder-friendly dividend growth, and solid financial competitiveness. Therefore, we can believe in Texas Instruments’ enduring growth ahead and its consistently leading position in the industry.

From I Know First’s forecast above, TXN stock has positive signals for all long-term time horizons from 1 month to 1 year, which can be an indicator for its potential growth. More notably, we can see a strong signal of 69.20 with high predictability of 0.63, suggesting again a strong-buy position of TXN.

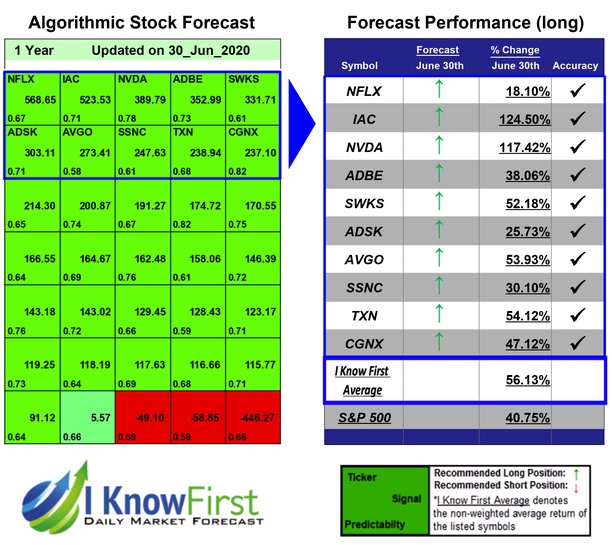

Past Success with TXN Stock Forecast by I Know First

On June 30th, 2021, I Know First’s Tech Giants Stocks Forecast package had accurately predicted 10 out of 10 stock movements on a 1-year forecasted period and achieved notable returns. TXN stock forecast was one among the recommended long-position stocks that saw a great return of 54.12%, outperforming the S&P 500 benchmark (40.75%) with a market premium of 13.37%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.