TTWO Stock Forecast: Take Two Interactive Has More Upside Potential

The TTWO stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The TTWO stock forecast article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- The stock of Take Two Interactive has risen almost 100% since my May 31, 2017 buy recommendation.

- I am still endorsing TTWO as a buy. The video games industry is getting a long-term boost from the COVID-19 pandemic.

- My fearless assessment is that TTWO deserves a 1-year price target of $170.

- The upcoming 21 mobile games from Take Two Interactive convinced me that TTWO is a long-term winner.

- The management’s five-year plan is to release 93 games, 47 of them are from existing titles. The rest will be newly-developed.

Take Two Interactive (TTWO) did not grow as fast as Tencent (TCEHY). However, TTWO’s stock price has risen almost 100% since my May 2017 buy recommendation. The big boost to video games from the ongoing COVID-19 pandemic has also helped TTWO achieve a YTD gain of +26.36%. The AI of Seeking Alpha’s Quant Rating System is Neutral on TTWO. On the other hand, my natural intelligence told me that TTWO is still a buy.

The upcoming 93 new games that will be released within the next 5 years convinced me that TTWO deserves a price target of $170. This pandemic-boosted, fast growing company’s stock is still not yet fully-priced. Refer to the chart below. TTWO has a lower forward GAAP P/E valuation than ZNGA and GLUU.

The relative undervaluation of TTWO against some of its video games peers is not a permanent anomaly. Majority of investors will eventually increase their appreciation of Take Two Interactive. TTWO touts a 5-year revenue CAGR of 23.32%. This rapid growth performance is in spite the fact that TTWO is not a serial acquirer. Unlike ZNGA’s acquisitions-fueled growth, TTWO relied on organic growth for the last five years. You should go long on TTWO because it is growing faster than NTDOY, EA, ATVI, GLUU and other gaming companies.

My takeaway is that TTWO deserves a higher forward P/E and EV/Sales valuation ratios because it is growing faster than its peers. A profitable company like TTWO that also outpacing the growth of its peers should be the one enjoying a forward EV/Sales valuation multiple of 7x.

Take Two also touts a strong balance sheet and cash flow. TTWO has almost zero-debt and $2 billion in total cash. These attractive features of TTWO makes it a strong buy.

TTWO Should Be In Your Growth Portfolio

I am a cult follower of video games stocks. We are heavily invested in TCEHY, ATVI, ZNGA, EA, and NTES. Going forward, TTWO is also an excellent long-term bet on the fast-growing $159.3 billion video games industry. The pandemic will likely boost the gaming industry’s CAGR to over 13% until 2030. The stay-at-home, work-from-home, learn-from-home new normal is compelling many people to become gamers.

Take Two Interactive and its subsidiaries tout a long list of video games that ensured its long-term prosperity. Take Two does not need to buy other companies to have new hit games.

Getting More Serious On Mobile

I am very bullish on Take Two because its management has 23 mobile games in the works. This is very important because mobile is the biggest and fastest-growing platform for video games. A more aggressive push on mobile games can improve the sales and profitability of Take Two Interactive.

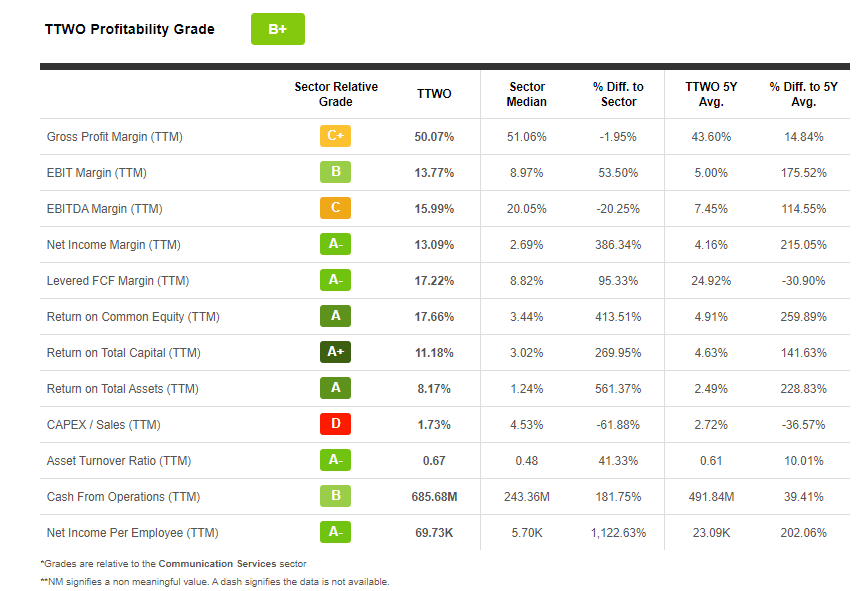

At the moment, TTWO is not flying higher above $65 because of its poor 5-year average net income margin of 4.16%. Yes, Take Two has managed to improved it profitability but its TTM net income margin is only 13.09%. My suspicion is that investors will push TTWO beyond $170 if it can achieve a TTM net income margin of 16% or higher. This is feasible. ATVI enjoys a net income margin of 24%. The 5-year average net income margin of EA is over 27%.

Conclusion

TTWO is not as profitable as its video games peers. This is why it is relatively undervalued and therefore a good-value buy opportunity. Management’s promise of 23 mobiles could lead to better profitability. Developing mobile games is obviously cheaper to do than making original or derivative AAA title PC or console games. Take Two can just copycat successful mobile games of Tencent, Activision, and Sony and it could become a leading mobile games publisher within the next three years.

If not, Take Two could also consider buying other companies with hit mobile games. ZNGA’s high valuation right now is due to its big-budget acquisitions.

My buy recommendation for Take Two Interactive is also thanks to its bullish one-year forecast from I Know First. The chart below also says the predictive AI of I Know First has a very high 0.82 predictability score on the one-year market trend of Take Two’s stock. This should be a very convincing clue that we should all go long on TTWO right now.

Past I Know First TTWO Stock Forecast Success

I Know First was successful with TTWO stock forecast. On April 19, 2020, the I Know First algorithm issued a 3-month bullish TTWO stock forecast and the algorithm successfully forecasted the movement of the TTWO stock. After 3 months, TTWO shares rose by 24.32% in line with the I Know First algorithm’s forecast. See chart below.

Here at I Know First, our algorithmic trading AI have modeled and predicted more than 10500 asset price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. We provide forecasts for institutional clients, as well as private investors to identify the best investment opportunities in the market. We have various packages of stock forecast, such as aggressive stocks, top tech stocks as well as exchange rate predictions, and Apple stock outlook. Today, we also predict gold price and commodity price.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast