TSM Stock: Why You Should Still Go Long On Taiwan Semiconductor

The TSM stock article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The TSM stock article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary

- The new sanctions against Huawei means Taiwan Semiconductor was forced to stopped taking new foundry orders from it.

- This is a near-term headwind. Huawei is the no. 2 largest foundry customer of Taiwan Semiconductor. Huawei accounts for 15% to 20% of Taiwan Semiconductor’s revenue.

- TSM is still a buy because other Chinese phone vendors like Xiaomi, Oppo, and Lenovo can eventually make up for the lost business from Huawei.

- TSM also touts lower valuation ratios than its foundry customers Advanced Micro Devices and Nvidia. This is just wrong because TSM operates on a higher net income margin.

- Taiwan Semiconductor boasts an excellent balance sheet. Its total cash is $18.86 billion while its total debt is only $7.3 billion.

You should act on the current undervaluation of Taiwan Semiconductor Manufacturing’s (TSM) stock. The market is still not letting TSM bounce back to its 52-week high of $60.64 because of the new U.S. sanctions against Huawei. Taiwan Semiconductor has stopped taking foundry orders from Huawei because its afraid of violating the new sanctions. Taiwan Semiconductor will need to apply for a license from the U.S. government before it can do foundry contracts for Huawei/HiSilicon processors/semiconductor products.

The AI of Seeking Alpha’s Quant Rating has gone Neutral on TSM because of this new headwind. Huawei is TSM’s no. 2 foundry contract customer, accounting for 15% to 20% of its revenue.

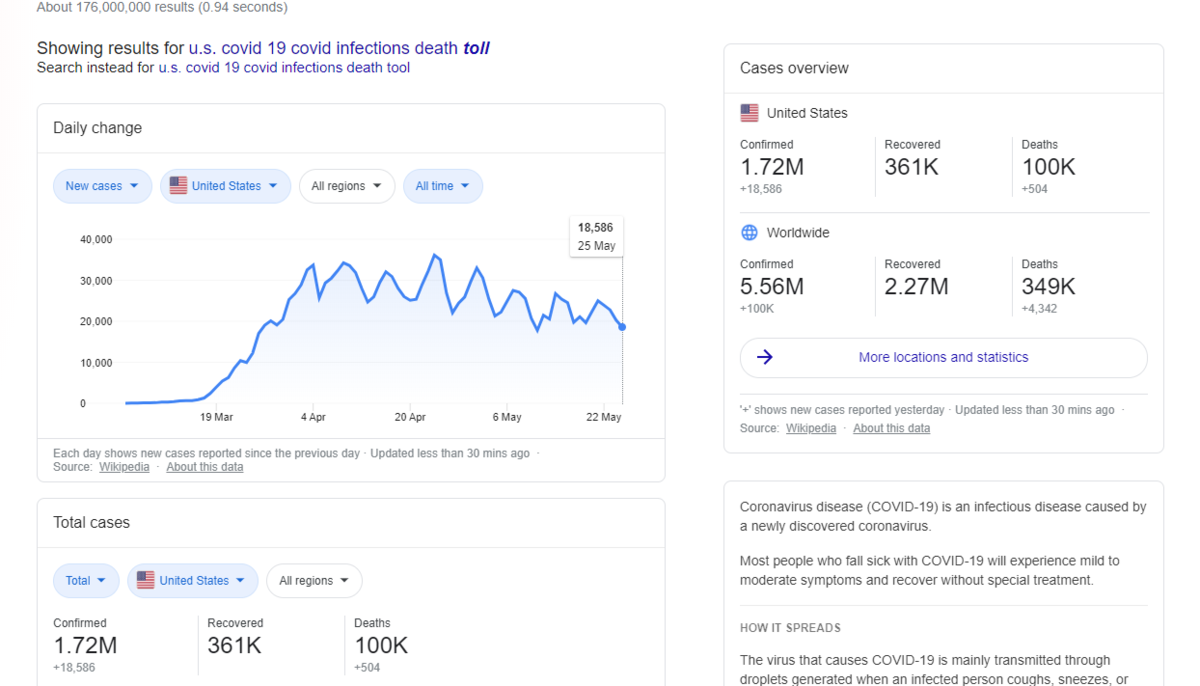

For the near-term, Taiwan Semiconductor’s stock is unlikely to breach $55 anytime soon. Trump is still increasing his virulent attacks against China. This is in spite of China’s new conciliatory announcements. Trump is up for re-election later this year. Trump is using his anti-China propaganda to win future U.S. votes. Trump is also covering his inept management of America’s tragic COVID-19 outbreak by blaming China. The chart below illustrates why Trump will make it very hard for Taiwan Semiconductor to get a license to manufacture HiSilicon processors for Huawei this year.

Other Foundry Customers Can Mitigate Loss of Huawei As A Client

Huawei is Trump’s favorite anti-China punching bag. Going forward, Taiwan Semiconductor will just have to find new replacement foundry contracts to replace the lost business from Huawei. TSM is therefore is still a buy because other top selling Chinese phone vendors like Huawei, Vivo and Oppo can increase their need for smartphone processors/flash storage requirements. Those three companies are heavy users of processors/semiconductor products from MediaTek, Samsung (SSNLF), and Qualcomm (QCOM).

Going forward, the smartphone industry will eventually overcome the COVID-19 headwind. TSM will also eventually bounce back to $60 within the next 12 months. The big drop in quarterly shipments of most phone vendors is Q1 2020 was because of shuttered Chinese factories during China’s worst COVID-19 outbreak months of February and March. Buy TSM now while it trades below $52. The second half of 2020 will deliver stronger smartphone and PC-related foundry production because Chinese factories are now back to full production status.

There’s a global pandemic that’s forcing people to work from home and stay at home. Aside from smartphone vendors, the work-from-home new normal and the big boost in gaming activities means Advanced Micro Devices (AMD) and Nvidia (NVDA) needs to order more foundry contracts from Taiwan Semiconductor. Without Huawei’s orders, TSM can accommodate 7nm manufacturing jobs for AMD’s Ryzen and Radeon GPUs. Expect additional order from Nvidia’s gaming and data center GPUs too.

Taiwan Semiconductor can also offset the lost business from Huawei through its partnership with China’s Zhaoxin Semiconductor. TSM is the contract manufacturer for the 16-nanometer x86 KaiXan KX-U678A processor for gaming and server PCs.

TSM Stock Is Undervalued When Compared To Its Peers

Buy TSM because the loss of Huawei as a foundry customer is not really debilitating to Taiwan Semiconductor’s future. I am still therefore optimistic that TSM will beat FY 2020 estimates of $40.69 billion revenue and EPS of $2.65. My own estimate is that FY 2020 will deliver EPS of $2.95. If this happens, TSM will gain more respect from investors. More bulls rallying behind TSM can push it to achieve 21 or 22x TTM valuation by early next year. Eight or twelve months from now, TSM could be trading at around $64.9. I got this forward price by multiplying 22x P/E with $2.95.

I could justify this high price target because TSM is greatly undervalued when compared to its peers in the semiconductor industry. Taiwan is the world’s largest foundry company and yet investors do not give it fair valuation. My takeaway is that the extremely profitable foundry business of Taiwan Semiconductor should give its stock a higher TTM P/E valuation. TSM deserves at least 22x P/E considering that it manufactures the processors and GPUs of overvalued AMD (129.48x TTM P/E) and NVDA (67.50x TTM P/E).

Taiwan touts a much higher net income margin than AMD, 34.50% versus 6.72%. Investors should put a higher valuation on a company that is clearly more profitable. Sad but true, TSM would be trading at 40x TTM P/E if it was an American company. Sad but true, American institutional and retail investors are persistently biased against non-American stocks.

The comparative chart below also illustrates that TSM has better profitability ratios than Nvidia. Taiwan Semiconductor also is a cash monster when you consider its $21.98 billion Cash from Operations metric. The low 5-year 6.79% revenue CAGR of TSM is forgivable because of its high-profitability. TSM could eventually become a consistent 10% revenue CAGR after its proposed $12-billion Arizona, United States factory starts operating. It is likely that Intel (INTC) will offload its processor manufacturing business to Taiwan Semiconductor’s 5-nanometer process factory if its located in the U.S.

Conclusion

TSM’s high-profitability is also why it is a decent dividend paying company. You should buy TSM because it is undervalued and its been increasing its dividend payments for the last 6 years. TSM’s dividend payments has a 5-year CAGR of 32.20%. Going forward, TSM’s annual dividend will be $2.2 by next year and $2.92 by 2022.

My buy rating for TSM stock is strongly influenced by its bullish one-year forecast from I Know First. The AI of I Know First shares my optimism that Taiwan Semiconductor can overcome the loss of Huawei as a contract foundry customer. There are many fabless semiconductor companies that will help Taiwan Semiconductor highly-profitable. Sad but true, TSM is emerging as a pseudo-monopoly on foundry contracts because GlobalFoundries still has no 7-nanometer manufacturing process.

It is safe to invest in Taiwan Semiconductor. Years of consistent profitability has given TSM a very healthy balance sheet. The chart below says TSM touts almost $19 billion in total cash. This is notably greater than its total debt of $7.38 billion. Since 2005, the high profitability of TSM is why it consistently delivered positive annual free cash flow.

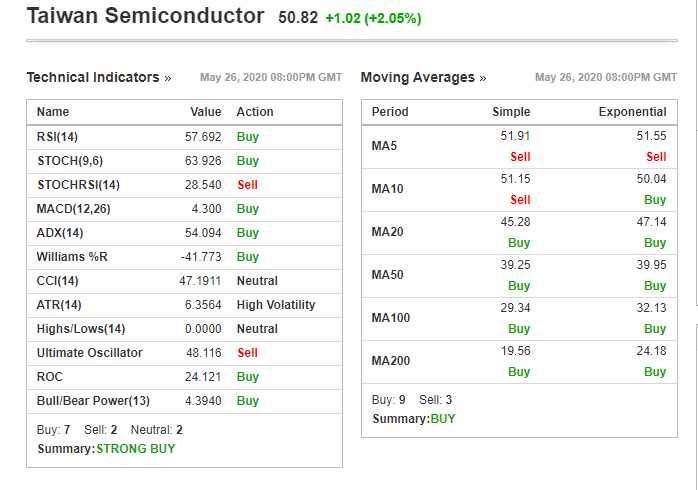

My buy rating for TSM is also backed by its bullish monthly technical indicators and moving averages. Go long on TSM and hold it for a year. This could turn out financially rewarding.

Here at I Know First, our stock market AI has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market forecast, as well as Forex forecasts, Apple stock predictions and, in particular, weekly news posted on Apple-stock-news.com. Today, we are producing daily stock market outlook for over 10,500 assets, including gold and commodities that are published on gold price predictions. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast