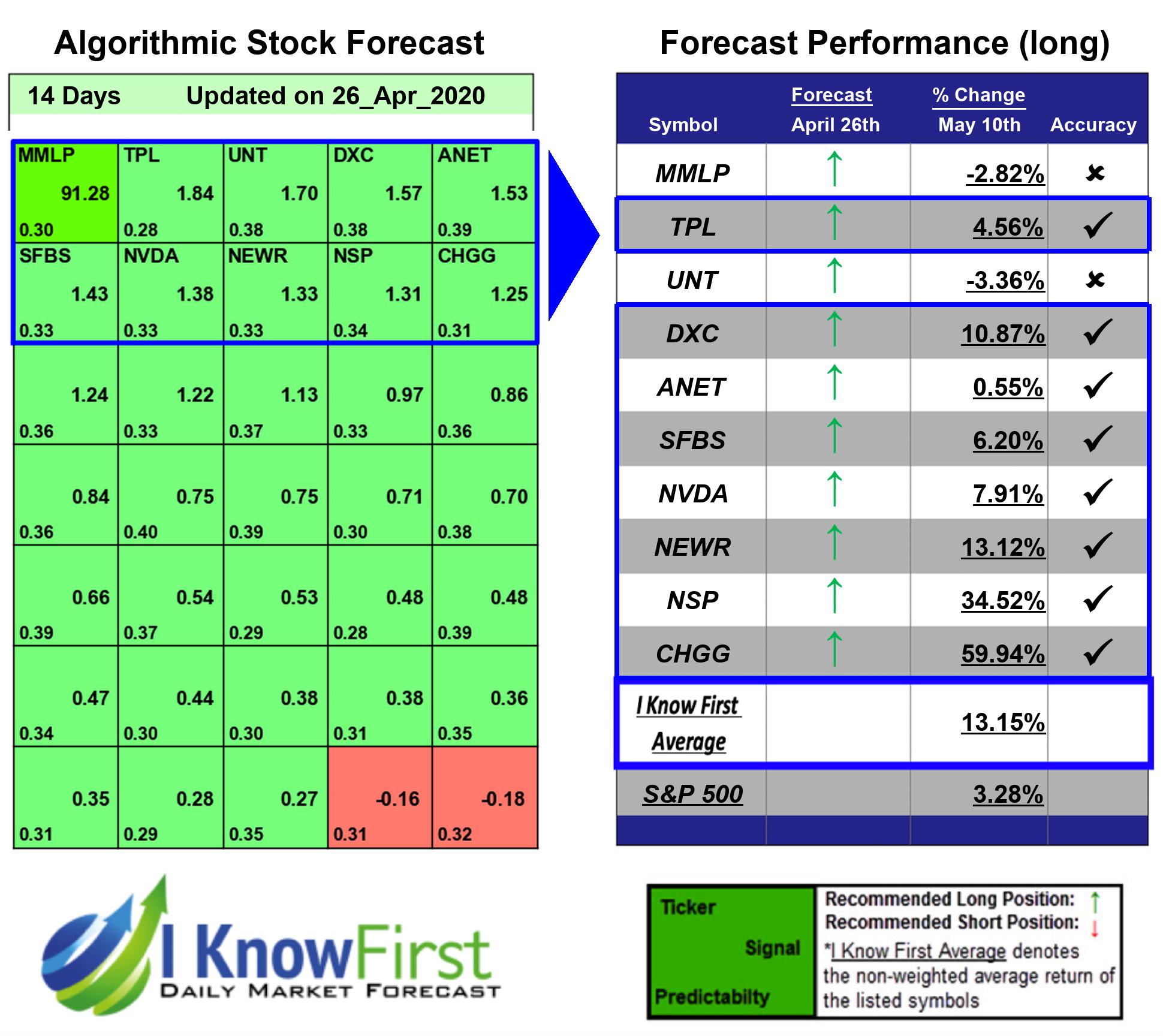

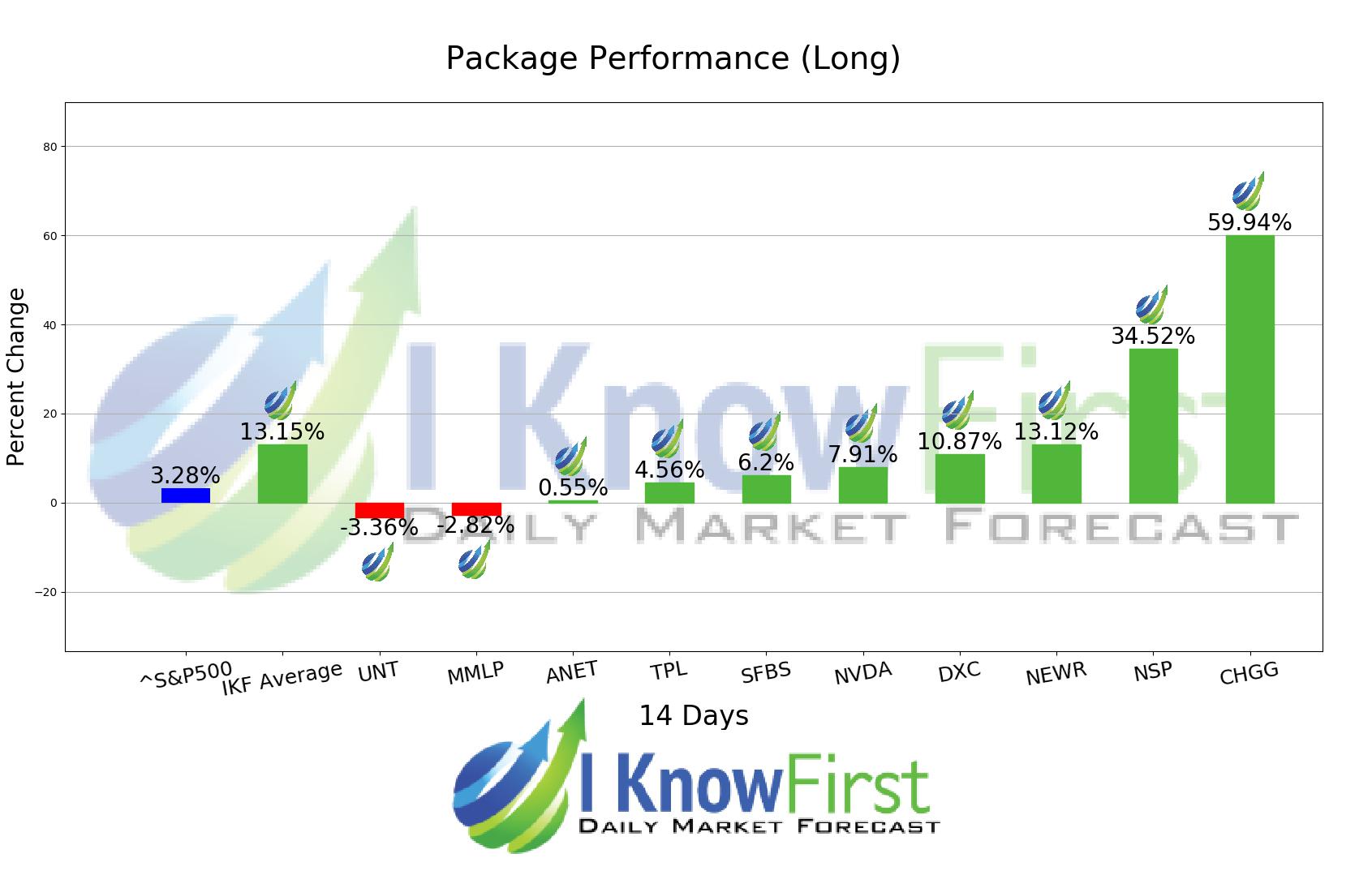

Trade Ideas Based on Stock Market Algorithm: Returns up to 59.94% in 14 Days

Trade Ideas

An insider is legally permitted to buy and sell shares of the firm – and any subsidiaries – that employs him or her. However, these transactions must be properly registered with the Securities and Exchange Commission (SEC) and are done with advance filings. You can find details of this type of insider trading on the SEC’s EDGAR database. This trade ideas algorithmic forecast is for stocks with recently reported insiders’ transactions.

An “insider” is any person who possesses at least one of the following:

- access to valuable non-public information about a corporation (for example a company’s directors and high-level executives)

- ownership of more than 10% of the company’s equity

Package Name: Insider Trades

Recommended Positions: Long

Forecast Length: 14 Days (4/26/2020 – 5/10/2020)

I Know First Average: 13.15%

This Insider Trades Package forecast had correctly predicted 8 out of 10 stock movements. The top performing prediction from this package was CHGG with a return of 59.94%. NSP, and NEWR had notable returns of 34.52% and 13.12%. With these notable trade returns, the package itself registered an average return of 13.15% compared to the S&P 500’s return of 3.28% for the same period.

Chegg, Inc. (CHGG) operates student-first connected learning platform that empowers students to take control of their education to save time, save money, and get smarter. It offers print textbook and eTextbook library for rent and sale; and provides eTextbooks, supplemental materials, Chegg Study service, tutoring service, textbook buyback, test preparation service, internships, and college admissions and scholarship services, as well as enrollment marketing and brand advertising services. The company has a strategic alliance with Ingram Content Group Inc. Chegg, Inc. (CHGG) was founded in 2005 and is headquartered in Santa Clara, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.