TPL Stock Forecast: A Resource-Based Company That Cannot Be Ignored

This “TPL Stock Forecast: A resource-based company that cannot be ignored” article was written by Zhou He – Financial Analyst at I Know First.

Highlights

- They are operating two business segments: Land and Resource Management and Water Services and Operations.

- Texas Pacific Land’s earnings per share have grown 11% annually.

- TPL’s net income of $129.8 million in the third quarter of 2022.

Overview

Texas Pacific Land Corporation (NYSE: TPL) is the corporate successor to the Texas Pacific Land Trust founded in 1888. TPL is one of the largest landowners in Texas and operates two business segments: Land and Resource Management and Water Services and Operations. The company’s Land and Resource Management division manages approximately 880,000 acres. The segment also owns 1/128 of a non-participating perpetual oil and gas royalty (NPRI) on about 85,000 acres and about 4,000 additional net royalties in West Texas. In addition, this segment is also engaged in the easement and commercial leasing activities, such as oil, gas, and related hydrocarbons, power line, and utility easements, and underground wellbore easements. Its Water Services and Operations segment provides full-service aquatic products. The department also holds royalties on water from its lands.

Factors leading profit growth

For many investors, high risk and high reward are too bold to feel right, and you may be more interested in profitable, growing companies such as Texas Pacific Properties. While profit is not the only metric that should be considered when investing, it is worth recognizing businesses that can consistently generate profits. If a company can maintain EPS growth long enough, its stock price should eventually follow. Therefore, it makes sense for experienced investors to pay close attention to a company’s EPS when conducting investment research. Over the past three years, Texas Pacific Land’s earnings per share have grown 11% annually.

TPL insiders already own a lot of stock, and they’ve been buying more, but the good news for common shareholders doesn’t stop there. CEO Tyler Glover’s pay is below the median for a similarly sized company. For companies with a market cap of more than $8.0b, Texas Pacific Land, median CEO compensation is about $13 million. Tyler, however, received $5 million in total compensation for the year leading up to December 2021. This is clearly well below average, so at first glance, this arrangement appears generous to shareholders and suggests a moderate pay culture. The level of CEO compensation is not the most important measure for investors, but when compensation is modest, it does support greater alignment between CEOs and common shareholders. Outstanding performance among shareholders with a total shareholder return of 320% over three years. So there may not be any concern at all about whether the CEO’s compensation is higher or lower than what is typical for a company of the same size.

Let’s see what trends the nine-month ended reports show.

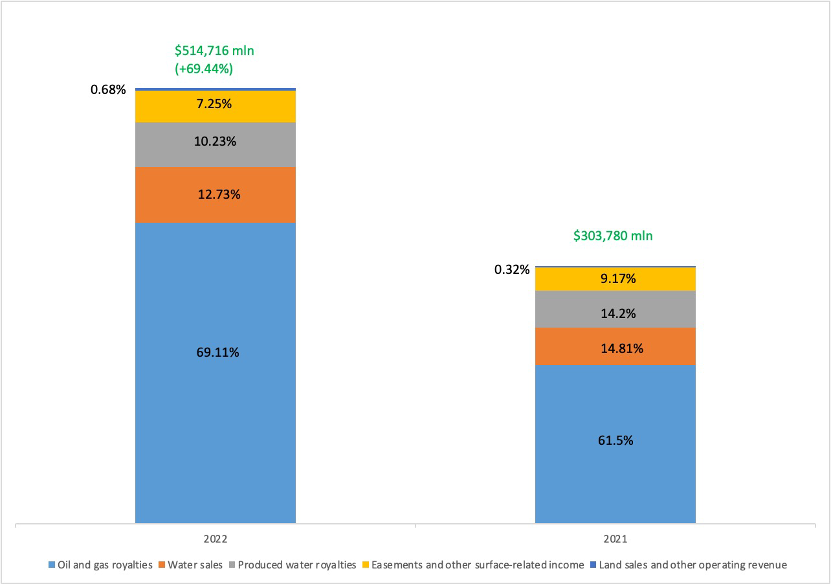

(Figure 1 – The Revenue Structure, Nine Months Ended on September 30 for 2021 – 2022)

On November 2, 2022, TPL announced its financial and operating results for the third quarter of 2022. The company reported a net income of $129.8 million in the third quarter of 2022, an increase of 54.9% compared to a net income of $83.8 million in the third quarter of 2021. The total revenue for the third quarter of 2022 increased by $67.4 million compared to the same period in 2021, primarily due to an increase of $51.2 million in oil and gas royalties, as well as water sales and produced water royalties The total increase was $8.9 million.

The average realized price for the third quarter was $63.42 per barrel of oil equivalent in the third quarter of 2022, compared to $46.07 per barrel of oil equivalent for the comparable period in 2021, subject to international circumstances. Water sales in the third quarter of 2022 increased by $4.9 million compared to the third quarter of last year, primarily due to a 10.3% increase in the number of barrels purchased and processed water sold. Produced water royalties increased by $4.

Company CEO Tyler Glover said ‘TPL continues to perform at a high level as each of our business segments, directly and indirectly, benefits from strong commodity prices and operator development activity in the Permian Basin, in addition to our continued search for new and innovative ways to leverage and monetize our huge surface footprint. ‘For example, in September this year, TPL signed an agreement with Samsung Solar 2 LLC to start evaluating the site selection of grid-connected cells located on the surface of TPL. These potential battery projects could improve grid reliability and encourage further renewable energy development.

Let us look at TPL’s performance across the Oil & Gas Industry. According to GuruFocus, TPL is one of the most profitable companies in the industry. TPL’s Operating Margin is the highest at 85.2 is better than 98.13% of companies in the industry. The Net Margin of 64.31% is higher than 93.98% of companies in the industry. ROA of 54.44% is better than 96.87% of companies. The ROE of 63.59% is higher than 89.93% of companies in the industry. The Revenue Growth Rate is better than 81.75% of companies in the industry.

(Figure 2: TPL vs Oil & Gas industry in TTM)

Let’s look at the company credit test and financial positions.

The Altman Z-score, which determines the result of a credit test, stays near the bored of the Grey and Safe zones. At the same time, TPL looks interesting in terms of the Piotroski F-Score. Piotroski F-score is a number between 0 and 9 used to assess the soundness of a company’s financial position. A score of 7 may indicate that the company’s financial situation is typical for a very healthy situation company.

TPL Stock Forecast: Conclusion

A positive for Texas Pacific Land is that earnings per share are growing. Even better, insiders are significant shareholders and have been buying more shares. This should prompt emerging investors to do more research or even add the company to watch lists.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts. The light green for the short-term forecasts is mildly bullish, while the darker green is a strong bullish signal for the one-year forecast.

Past Success with TPL Stock Forecast

I Know First has been bullish on the TPL stock forecast in the past. On May 12th, 2022 the I Know First algorithm issued a forecast for TPL stock price and recommended TPL as one of the best stocks to buy. The AI-driven TPL stock prediction was successful on a 1-month time horizon resulting in more than 35.89%.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.