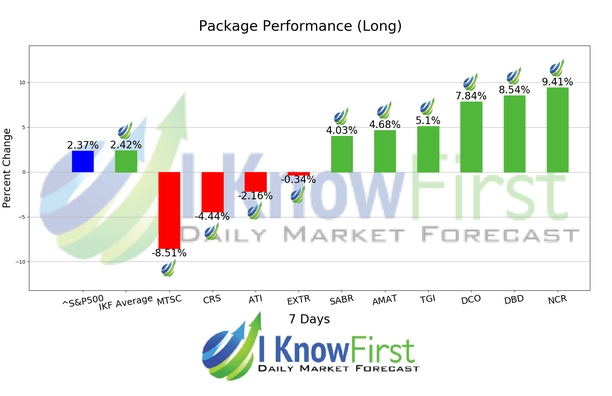

Top Tech Stocks Based on a Self-learning Algorithm: Returns up to 9.41% in 7 Days

Top Tech Stocks

This Tech Stock forecast is based on stock picking strategies for investors and analysts who need predictions for the 10 best tech stocks in the Technology Industry (see Tech Stocks Package). It includes 20 stocks with bullish and bearish signals:

- Top 10 Tech stocks for the long position

- Top 10 Tech stocks for the short position

Package Name: Tech Stocks Forecast

Recommended Positions: Long

Forecast Length: 7 Days (11/24/2020 – 12/1/2020)

I Know First Average: 2.42%

The algorithm correctly predicted 6 out 10 of the suggested trades in the Tech Stocks Forecast Package for this 7 Days forecast. The top performing prediction from this package was NCR with a return of 9.41%. Further notable returns came from DBD and DCO at 8.54% and 7.84%, respectively. The package saw an overall yield of 2.42% versus the S&P 500’s return of 2.37% implying a market premium of 0.05%.

NCR Corporation (NCR), a technology company, provides products and services that enable businesses to connect, interact, and transact with their customers worldwide. The company operates through four segments: Financial Services, Retail Solutions, Hospitality, and Emerging Industries. The company offers financial-oriented self-service technologies, such as automated teller machines (ATM), cash dispensers, software solution, cash management and video banking software, and customer-facing digital banking services, as well as professional services related to ATM security, software, and bank branch optimization. It also provides retail and hospitality oriented technologies, such as point of sale terminals and point of sale software, bar-code scanners, and other retail-oriented software and services; self-service kiosks and related operating software; and hardware, software, professional, and support services that enable check and item-based transactions to be captured, processed, and retained. In addition, the company develops, produces, and markets two-sided thermal papers, paper rolls for receipts in ATMs and point of sale solutions, inkjet and laser printer supplies, thermal transfer and ink ribbons, labels, laser documents, business forms, and photo and presentation papers. Further, it provides maintenance and support services; site assessment and preparation, staging, installation and implementation, systems management, and complete managed services; predictive services; cloud solutions and hosted services; and online, mobile, and transactional services and applications, as well as resell third-party networking products and related service offerings in the telecommunications and technology sectors. The company serves financial institutions, retailers and independent deployers, restaurants, food service companies, entertainment and sports venues, hospitality, and travel industries. NCR Corporation (NCR) was founded in 1884 and is headquartered in Duluth, Georgia.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.