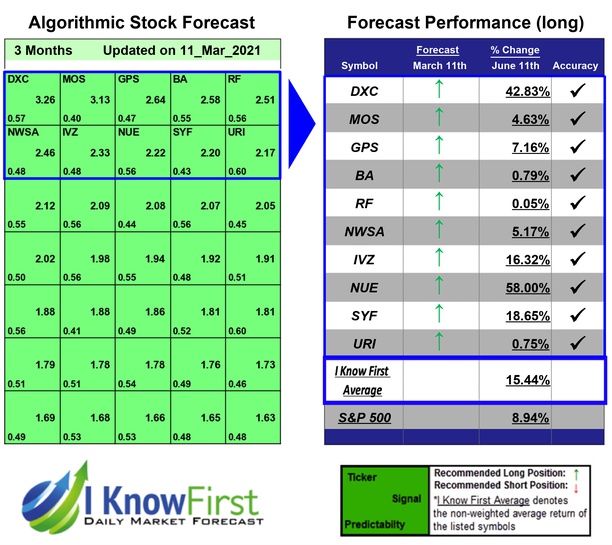

Top S&P 500 Stocks Based on Data Mining: Returns up to 58.0% in 3 Months

Top S&P 500 Stocks

This top S&P 500 stocks forecast is designed for investors and analysts who need predictions for the whole S&P 500 (See S&P 500 Companies Package). It includes 20 stocks with bullish and bearish signals and indicates the best S&P 500 Companies stocks to buy:

- Top 10 S&P 500 stocks for the long position

- Top 10 S&P 500 stocks for the short position

Package Name: Top S&P 500 Stocks

Recommended Positions: Long

Forecast Length: 3 Months (3/11/21 – 6/11/21)

I Know First Average: 15.44%

For this 3 Months forecast the algorithm had successfully predicted 10 out of 10 movements. The highest trade return came from NUE, at 58.0%. Further notable returns came from DXC and SYF at 42.83% and 18.65%, respectively. The package itself saw an overall return of 15.44%, providing investors with a 6.50% premium above the S&P 500’s return of 8.94% for the same time period.

Nucor Corporation (NUE) manufactures and sells steel and steel products in the United States and internationally. It operates through three segments: Steel Mills, Steel Products, and Raw Materials. The Steel Mills segment produces and distributes hot-rolled, cold-rolled, and galvanized sheet steel products; plate steel products; structural steel products comprising wide-flange beams, beam blanks, H-pilings, and sheet pilings; and bar steel products, such as blooms, billets, concrete reinforcing bars, merchant bars, and special bar quality products. This segment sells its products to steel service centers, fabricators, and manufacturers in automotive, energy, agricultural, heavy equipment, and transportation sectors. The Steel Products segment offers steel joists and joist girders, steel decks, fabricated concrete reinforcing and cold finished steel products, steel fasteners, metal building systems, steel gratings, and wire and wire mesh products to general contractors, fabricators, distributors, and manufacturers. Its products are used by contractors in constructing highways, bridges, reservoirs, utilities, hospitals, schools, airports, stadiums, and high-rise buildings. The Raw Materials segment produces direct reduced iron (DRI); brokers ferrous and nonferrous metals, pig iron, hot briquetted iron, and DRI; supplies ferro-alloys; and processes ferrous and nonferrous scrap metal, as well as holds working interest in natural gas drilling programs. This segment sells its ferrous scrap to electric arc furnace steel mills and foundries for use in manufacturing process; and nonferrous scrap metal to aluminum can producers, secondary aluminum smelters, steel mills, and other processors and consumers of various nonferrous metals. The company offers its products through its in-house sales forces, as well as internal distribution and trading companies. Nucor Corporation (NUE) was founded in 1940 and is based in Charlotte, North Carolina.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.