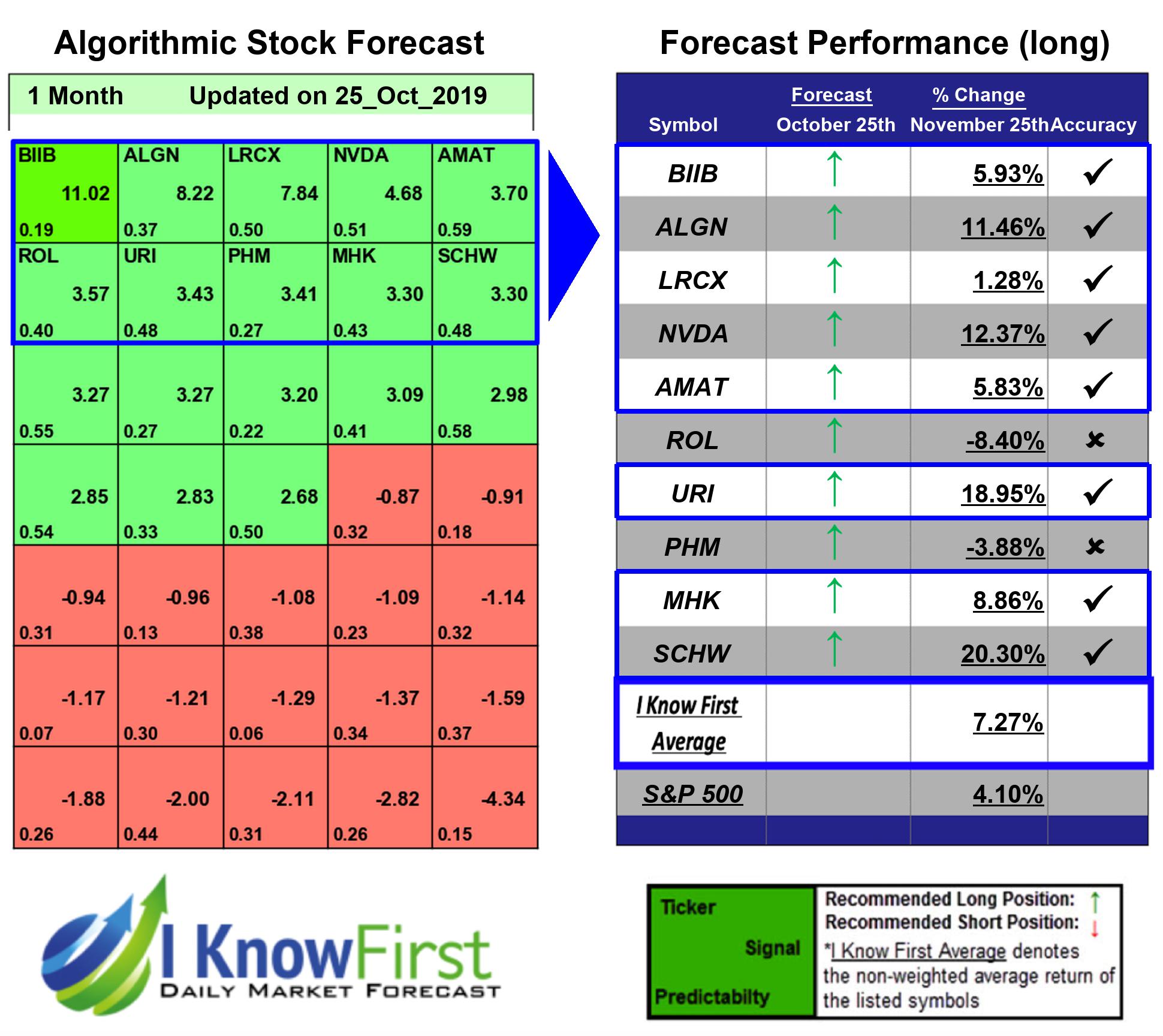

Top S&P 500 Stocks Based on Algorithmic Trading: Returns up to 20.3% in 1 Month

Top S&P 500 Stocks

This top S&P 500 stocks forecast is designed for investors and analysts who need predictions for the whole S&P 500 (See S&P 500 Companies Package). It includes 20 stocks with bullish and bearish signals and indicates the best S&P 500 Companies stocks to buy:

- Top 10 S&P 500 stocks for the long position

- Top 10 S&P 500 stocks for the short position

Package Name: S&P 500 Companies

Recommended Positions: Long

Forecast Length: 1 Month (10/25/2019 – 11/25/2019)

I Know First Average: 7.27%

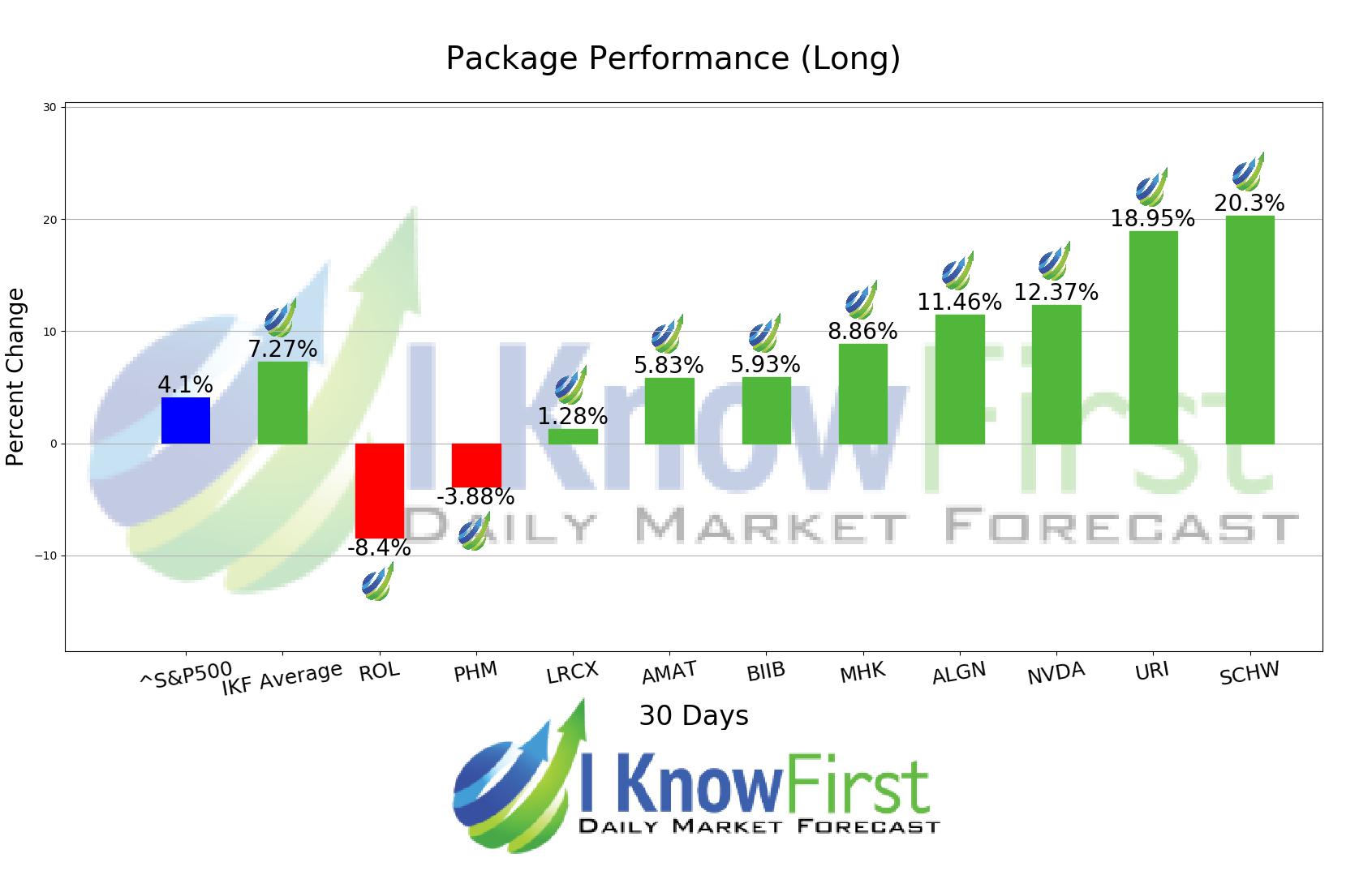

Several predictions in this 1 Month forecast saw significant returns. The algorithm had correctly predicted 8 out 10 stock movements. The highest trade return came from SCHW, at 20.3%. Additional high returns came from URI and NVDA, at 18.95% and 12.37% respectively. The package saw an overall yield of 7.27% versus the S&P 500’s return of 4.1% implying a market premium of 3.17%.

The Charles Schwab Corporation (SCHW), through its subsidiaries, provides wealth management, securities brokerage, banking, money management, custody, and financial advisory services. The company operates through two segments, Investor Services and Advisor Services. The Investor Services segment provides retail brokerage and banking services, retirement plan services, and other corporate brokerage services; and stock plan services, compliance solutions, and mutual fund clearing services, as well as engages in the off-platform sales business. The Advisor Services segment provides custodial, trading, and support services; and retirement and corporate brokerage retirement services. The company provides brokerage accounts with cash management capabilities; third-party mutual funds through the Mutual Fund Marketplace, including no-transaction fee mutual funds through the Mutual Fund OneSource service, which includes proprietary mutual funds, plus mutual fund trading, and clearing services to broker-dealers; exchange-traded funds (ETFs), including proprietary and third-party ETFs; and advice solutions, such as managed portfolios of proprietary and third-party mutual funds and ETFs, separately managed accounts, customized personal advice for tailored portfolios, and specialized planning and portfolio management. It also offers banking products and services, including checking and savings accounts, certificates of deposit, first lien residential real estate mortgage loans, home equity loans and lines of credit, and Pledged Asset Lines; and trust services comprising trust custody services, personal trust reporting services, and administrative trustee services. The company serves individuals and institutional clients in the United States, the Commonwealth of Puerto Rico, London, and Hong Kong. The Charles Schwab Corporation (SCHW) was founded in 1971 and is headquartered in San Francisco, California.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.