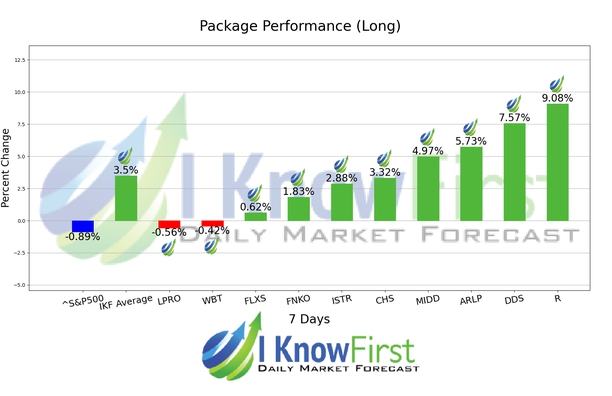

Top Mid Cap Stocks Based on Deep-Learning: Returns up to 9.08% in 7 Days

Top Mid Cap Stocks

This Best Mid Cap Stocks forecast is designed for investors and analysts who need predictions for the best companies with market capitalization between USD 500m and USD 50b. It includes 20 stocks with bullish and bearish signals:

- Top 10 Mid Cap stocks for the long position

- Top 10 Mid Cap stocks for the short position

Package Name: Best Mid Cap Stocks

Recommended Positions: Long

Forecast Length: 7 Days (4/28/22 – 5/5/22)

I Know First Average: 3.5%

In this 7 Days forecast for the Best Mid Cap Stocks Package, there were many high performing trades and the algorithm correctly predicted 8 out of 10 trades. The greatest return came from R at 9.08%. DDS and ARLP saw outstanding returns of 7.57% and 5.73%. The overall average return in this Best Mid Cap Stocks package was 3.5%, providing investors with a 4.39% premium over the S&P 500’s return of -0.89% during the same period.

Ryder System, Inc. (R) provides transportation and supply chain management solutions to small businesses and large enterprises worldwide. The company operates in three segments: Fleet Management Solutions; Dedicated Transportation Solutions; and Supply Chain Solutions. It offers fleet management solutions, including vehicles, as well as maintenance services, supplies, and related equipment for operation of the vehicles; commercial vehicle rental services; contract maintenance services; and contract-related maintenance services for trucks, tractors, and trailers. The company also provides diesel fuel accessing services; fuel services, such as fuel planning, fuel tax reporting, centralized billing, fuel cards, and fuel monitoring services; and sells its used vehicles through its 59 retail sales centers and Usedtrucks.Ryder.com Website. In addition, it offers dedicated services comprising equipment, maintenance, and administrative services of a full service lease with drivers, as well as routing and scheduling, fleet sizing, safety, regulatory compliance, risk management, technology and communication systems support, and other technical support services. Further, the company provides distribution management services, such as managing the flow of goods from the receiving to the shipping function; coordinating warehousing and transportation for inbound and outbound material flows; handling import and export for international shipments; coordinating just-in-time replenishment of component parts to manufacturing and final assembly; and providing shipments to customer distribution centers or end customer delivery points, as well as other value added services. Additionally, it offers transportation management services, such as shipment optimization, load scheduling, and delivery confirmation services through a series of technological and Web-based solutions; and knowledge-based professional services. The company was founded in 1933 and is based in Miami, Florida.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.