Time to go bullish and long with YELP – Yearly Earnings Love Patience

The article was written by Gleb Zinkovskiy, a Financial Analyst at I Know First.

Yelp Inc. (NYSE: YELP) Stock Bullish Forecast for 2018

“In 2018, we are focused on increasing consumer usage through deepening our product experience in the Restaurants category and attracting advertisers through expanding sales channels and increased ad product flexibility.”

Jeremy Stoppelman, Yelp’s co-founder and CEO.

Summary

- Net revenue was $846.8 million, representing 19% growth over 2016. Excluding revenue from Nowait, Yelp Wi-Fi, and Eat24, net revenue grew 20% compared to 2016.

- Adjusted EBITDA was $156.6 million, compared to $120.1 million in 2016.

- Investments in Nowait and Turnstyle will result in $20-25 million loss in short term

- Net income per share attributable to common stockholders turned to $1.87 from $(0.06) in 2016, and is expected to stay positive in 2018

Yelp Inc. (Yelp) connects people with local businesses by bringing ‘word of mouth’ online and providing a platform for businesses and consumers to engage and transact. The Company offers local business review sites. Yelp provides a platform for consumers to share their everyday local business experiences with other consumers by posting reviews, tips, photos and videos, and to engage directly with businesses, through reviews, its Request-A-Quote and Message the Business features, and by completing transactions on the Yelp Platform. Yelp also provides businesses of all sizes with a range of free and paid services that help them engage with consumers. The Yelp Platform allows consumers to transact with local businesses directly on Yelp through Yelp Reservations, its online reservations product, and integrations with partners ranging from Shoptiques.com (boutique shopping) to GolfNow (tee time booking) to BloomNation (flower ordering).

Main outcomes

Yelp stock price performance on 8th February 2018 [Source: Yahoo Finance]

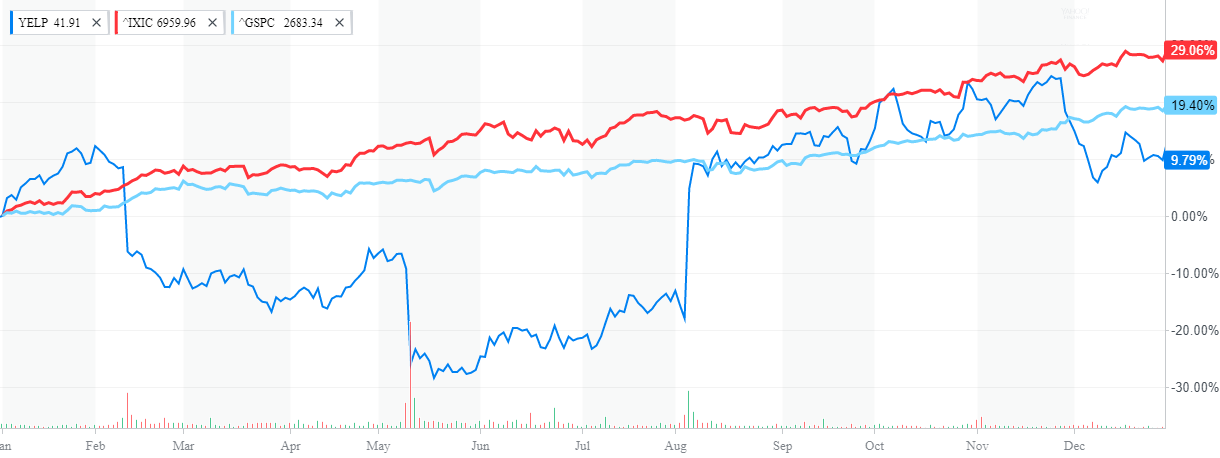

Yelp experienced ups and downs in 2017, still the company managed to improve its financial position until the end of the year with Net revenue of $846.8 million and Adjusted EBITDA of $156.6 million representing 19% and 30% growth in comparison to 2016 respectively. On 7th February the company held a conference call during which the financial statements and highlights were released to the public. Although the most of the indicators were improved over the last year and especially during the last quarter, the announced earnings of 19 cents per share topping the estimate of 5 cents per share representing the consensus among analysts in Wall Street’s at the start of 2017. At the same time, the company missed the forecasted bottom-line for revenue at $220 million with the reported revenue of $218 million. “We finished 2017 strong with rising growth in new advertiser acquisition and continued improvements in revenue retention from the prior year,” summarized Jeremy Stoppelman, co-founder and CEO. While most of the news reflected that the company actually beat their expectations with regard to EPS and revenue estimates (for few analysts), the statement of the CFO in respect of the anticipated operating losses to be incurred by the company as a result of upcoming investment into development of Yelp’s subsidiaries gave negative push on the stock price. Indeed, the performance of Yelp’s stock price on 8th February started with $41.21 per share and continued the day with rather negative than positive dynamics pushing down the price below $39 per share, resulting in a dramatic drop until the end of the day. The consensus analyst price target is $46.79, and the 52-week trading range is $26.93 to $48.40.

What’s behind numbers?

Yelp stock price performance in 2017 [Source: Yahoo Finance]

In accordance with the earnings report announced late last year, Yelp sold its delivery business Eat24 to GrubHub for $287.5 million in October 2017. Despite that, the company had to expand its operations beyond just review-oriented business, being a true innovation in 2004 which led it to one of the biggest early IPOs in its sector. As such, we Yelp brought in two new subsidiaries, namely Nowait and Turnstyle, in an effort to provide new level of service to its clients in the coming years.

The $40 million acquisition of the entirety of Nowait was paid in cash, and included the partial stake which Yelp acquired previously. The deal was closed on 28th February, 2017 and the purchase price was reflected in Yelp’s first quarter 2017 financial statements. Nowait is positioned as a strategic investment for Yelp and it integrated its waitlist experience into the Yelp app, enabling restaurants to share real-time seating availability and providing an easy way for hungry diners to get in line remotely. In practice , the Nowait system replaces paper lists or handheld buzzers with a simple experience delivered via smartphone, helping to drive more business for busy restaurants while meeting the needs of time strapped diners.

The acquisition of all of Turnstyle’s outstanding capital stock was made for approximately $20 million paid in cash. Turnstyle Analytics Inc. is a Wi-Fi marketing company that is pioneering the way local businesses use free Wi-Fi to connect with their customers. As stated in Yelp press release: “The addition of Turnstyle strengthens Yelp’s position as a leading customer acquisition platform for local businesses, expanding its offering to include simple, effective tools for customer retention and loyalty.” Based in Toronto, Canada, Turnstyle was founded in 2012 as a location-based marketing and analytics platform that provides Wi-Fi as a digital marketing tool to retain and reward customers. The service currently supports nearly 3,500 business locations worldwide. Turnstyle’s core technology allows consumers to tap into free guest Wi-Fi while helping businesses re-engage those customers in the future via email. Businesses can build highly targeted customer contact lists and access powerful analytics that provide insight into visit frequency and duration. Combining this offline data with Yelp’s extensive online and mobile search data will deliver a comprehensive intent-based marketing resource to local businesses.

The main message that follows from Yelp’s strategy which we observe now was best summarized by its CFO Lanny Baker: “We increased operating income in 2017, while achieving strong topline results aided by customer success initiatives. Looking to 2018, we plan to provide businesses greater control over their advertising messages and increased flexibility in contract term lengths. We are also focused on strengthening our competitive position in the highly-trafficked Restaurants category, and as a result, expect to incur operating losses of $20-$25 million related to Nowait, Yelp Reservations and Yelp Wi-Fi collectively in 2018 as we invest in their growth.”

Valuation analysis

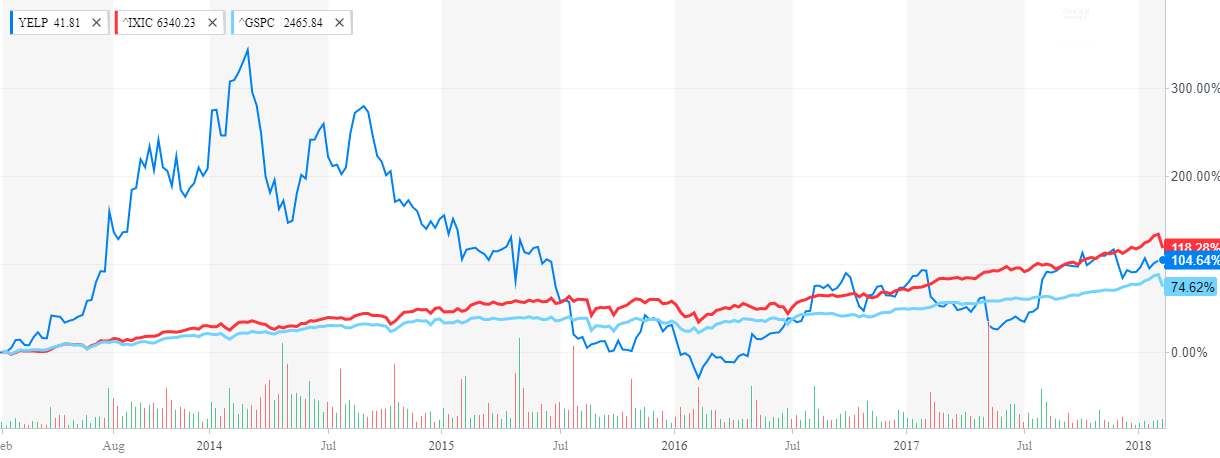

While there are few opinions being shared so far by financial analysts’ community in respect of the expected performance of Yelp in 2018, a common trend is that the strategies which the company pursued over the last 5 years were risky in respect of R&D and M&A investments giving sometimes significant increase in value, such as in 2014, but giving overall down sliding trend over last years.

Yelp stock price performance over the last 5 years [Source: Yahoo Finance]

However, we see that the company managed to drive its business model to satisfy the market needs and stayed in trend over the last 2 years. Whether the company will be able to demonstrate the same and improved performance as its officers announced – that’s the question our analysis addressed.

Although the press release on 7th February does not contain full disclosures and notes to the financial statements for the year ended 31 December 2017, a basic valuation analysis could be performed. Based on the balance sheet of the company as at 31 December 2017, we assume that the amount of Long term liabilities which is some $71 million, represent debt burden of the company and the amount of total equity is almost $1.1 billion. Coupled with the returns for 10 year US treasury bills of 2.83% and SP500 annual return of 4.55% the respective WACC for our further analysis amounted to 4%. In terms of DCF analysis if we assume that the company will perform as announced at the conference call and at least the same effective corporate income tax rates, both quarterly and annually, we can expect approximately $138 million of cash being available to investors in 2018. Finally, assuming that the weighted average number of common shares will continue to grow at the same rate as in 2017, the number will grow up to 86.721 shares and respective expected net income per share may vary from $0.97 to $1.60. Such figures will be lower by some 17% in comparison to 2017 figures stated by the management in the recent press release.

DCF analysis summary table [Source: I Know First]

Though, the numbers may not look appealing at the moment, one should account for that in 2016 the net income per share was $(0.06) and the management of the company turned it into $1.87 in 2017. It is also worth to wait for Q1 results in 2018 in order to see the extent of the investments being actually undertaken in respect of the new subsidiaries. As of now, the performance of the Yelp’s subsidiaries, namely Nowait & Turnstyle, during 2017 is not impressive in the context of their purchase prices. Based on the information from the press release, their combined results are approximately $5.2 million combined, making it less than 1% of the net revenue, while the short-term impact of such investments on the overall performance of the company will be approximately 15% of the projected net revenues in 2018. Although this strategy may have negative short term effect on the market price of the stock, it seems bearable for Yelp at the moment, as the company is apparently “cash-loaded” following the disposal of Eat24 and ready to spend it now for long-term investments.

I Know First Algorithmic Bullish Forecast for Yelp

Although the position of the company is complex with respect to its financials, I see the significant improvement of the net income per share by $2 in 2017 from 2016 as a positive signal for the market and shareholders. In addition to that, the company maintains good attitude to its active investment strategy in respect of its subsidiaries and improves client experience by integration of their services into Yelp’s current platform. My positive outlook on Yelp in 2018 resonates with I Know First’s forecast. I Know First currently maintains a bullish stance on Yelp for 2018 with signal strength 379.25 and predictability 0.7 for the 1-year forecast.

Past I Know First Success with Yelp

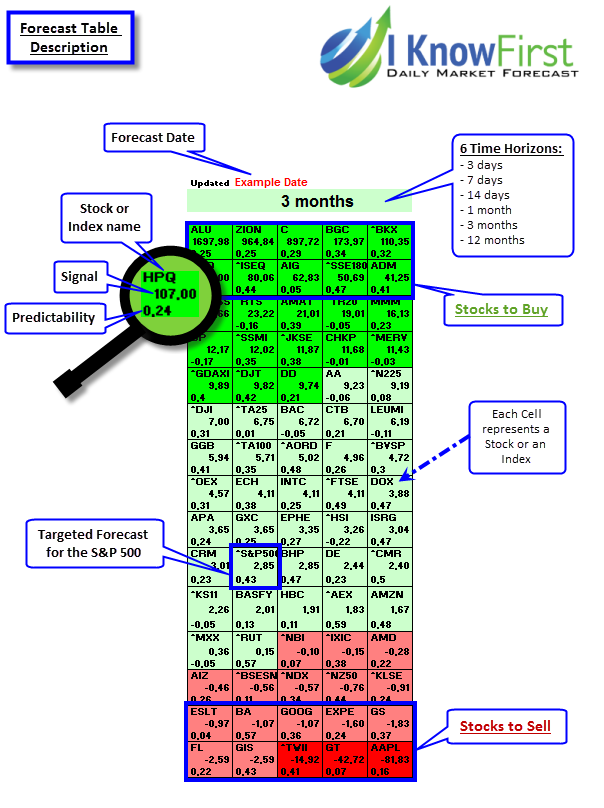

I Know First Algorithm has previously predicted the stock movement for Yelp such as in this forecast from July 12th to August 12th, 2016. The forecast showed a bullish signal of 7.82 and a predictability of 0.51 and achieved a return of 29.04% in 1 month.

Current I Know First subscribers received this bullish YELP forecast on July 12th, 2018.

I Know First Algorithm Heat-map Explanation

The sign of the signal tells in which direction the asset price is expected to go (positive = to go up = Long, negative = to drop = Short position), the signal strength is related to the magnitude of the expected return and is used for ranking purposes of the investment opportunities.

Predictability is the actual fitness function being optimized every day, and can be simplified explained as the correlation based quality measure of the signal. This is a unique indicator of the I Know First algorithm, allowing the user to separate and focus on the most predictable assets according to the algorithm. Ranging between -1 and 1, one should focus on predictability levels significantly above 0 in order to fill confident about/trust the signal.

________________________________________________________________________________

________________________________________________________________________________

________________________________________________________________________________