The U.S. Housing Market Forecast: Continuous Downturn Followed by A Thaw in 2024

This U.S. Housing Market Forecast article was written by Yuwei Zhou – Financial Analyst at I Know First.

Highlights

- The U.S. NAHB/Wells Fargo Housing Market Index declined continuously for 10 months

- 30-year fixed-rate home loan has more than doubled this year, to 6.9%

- FOR’s growth has slowed down since Q2 2021

- The housing market is going to stabilize and grow in 2024

Overview

Federal Reserve tightened the monetary policy several times this year, this totally cooled down the housing market in the U.S. NAHB/Wells Fargo Housing Market Index declined continuously for 10 months, will it go worse? How will the current downturn affect the economy? This article states the reason, conduction, and mechanism of the recent housing recession. At the end, the paper provides the U.S. housing market forecast.

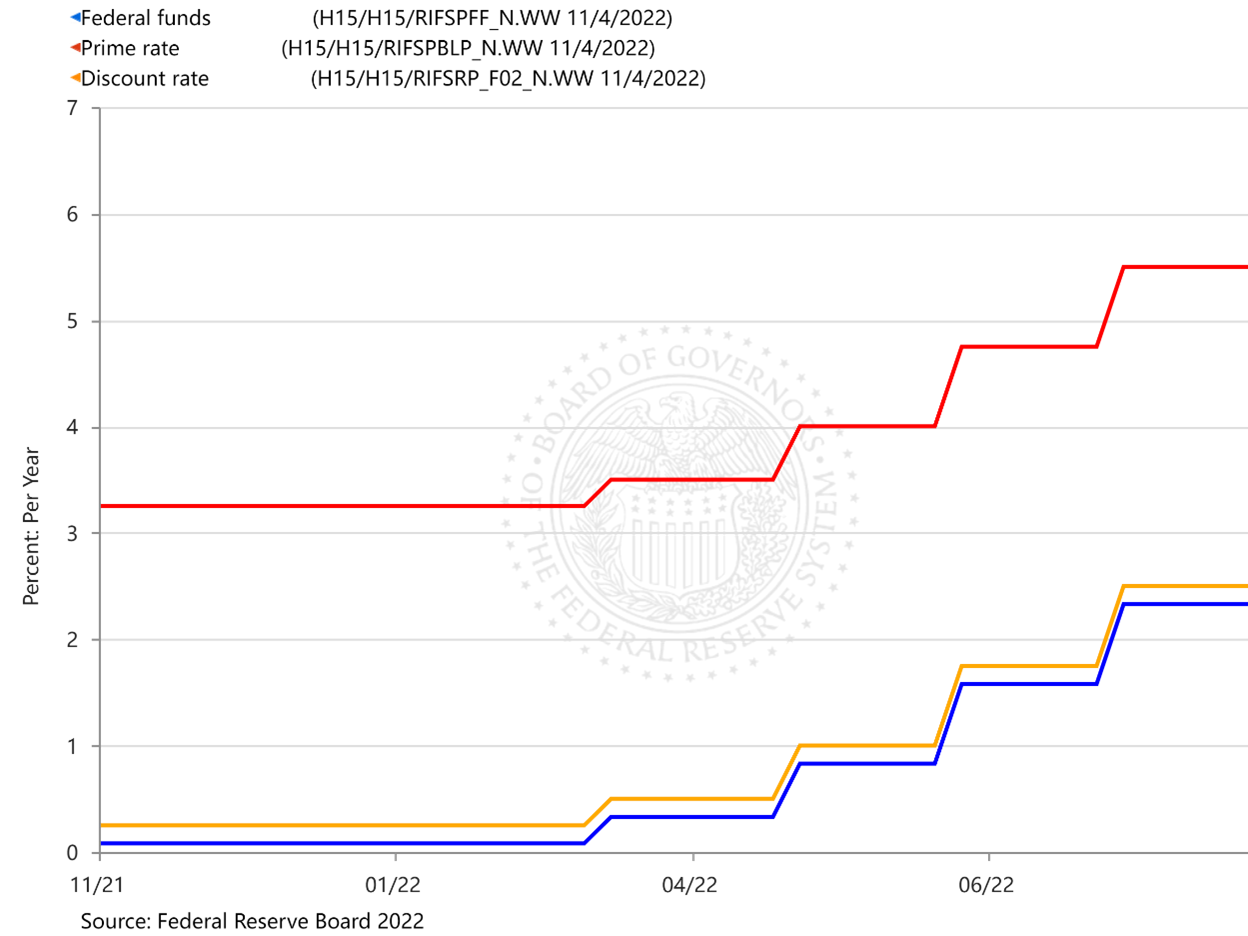

The U.S. Housing Market Forecast: Conservative Monetary Policy Has Worsened the Housing Recession

Since the conflict between Russia and Ukraine in early 2022, the world economy has been in turmoil. The international markets have become more risk-averse, and hot money has poured into the United States to avoid risk. The Fed has begun raising interest rates since March to stabilize the economy, setting the stage for a continuous housing slump. The average interest rate on a 30-year fixed-rate home loan has more than doubled this year, to 6.9%, according to Freddie Mac, as markets have reacted to hotter-than-expected inflation and a more conservative Federal Reserve.

Household Debt Service and Financial Obligations Ratios (FOR) growth has also slowed down since Q2 2021. This measure, which is intended to capture the share of household after-tax income obligated to debt repayment (such as mortgages, HELOCs, auto loan payments, and credit card interest), is calculated as the ratio of aggregate required debt payments (interest and principal) to aggregate after-tax income. Flatted FOR shows that the householders were less eager to borrow money, which also indicates the cool-down in the housing market.

Declined for 10 Months? More Pain Ahead!

The housing market, with its hyper-sensitivity to the economic cycle, fell victim to the U.S. gradual tightening monetary policy, as the Federal Reserve kept putting the brakes on an overheated economy. NAHB/Wells Fargo Housing Market Index fell to 38 this October, with a trend that continuously went down from the beginning of 2022. That index is designed to take the pulse of the single-family housing market. Although the West housing rally held firm until March, October HMI was the lowest of the four U.S. market segments (Northeast, Midwest, South, and West), having dropped below the 30 mark.

Due to the raised interest rate and the run-up in home prices resulting from insufficient inventory in the resale market, house buyers’ affordability declined. At the same time, raising the price of new construction sets the market back in terms of reducing the deficit.

“Most (housing) markets are likely to experience at least a single-digit price decline, given declines in housing affordability.” Robert Dietz said like that. The housing share of the gross domestic product is more than 16%. The decline in the housing industry may cause redundancy from realtors to mortgage bankers, then spread to the whole economic entity. Robert Dietz expects that the slowdown that we see in housing right now is going to spread to the rest of the economy at the beginning of 2023.

Investing in Home Builders Stocks with I Know First

I Know First provides predictions for Home Builders stocks based on the AI algorithm for six horizons: 3-day, 7-day, 14-day, 1-month, 3-months, and 1-year. Below, we can observe the performance of the prediction of the Home Builders stocks package which was sent to our clients (you can access our forecast packages here).

Package Name: Home Builders

Recommended Positions: Long

Forecast Length: 14 Days (10/21/22 – 11/4/22)

I Know First Average: 7.16%

I Know First’s State of Art Algorithm accurately forecasted 10 out of 10 trades in this Home Builders Package for the 14 Days time period. E was the highest-earning trade with a return of 18.58% in 14 Days. DHI and KIM also performed well for this time horizon with returns of 11.97% and 11.45%, respectively. This algorithmic forecast package presented an overall return of 7.16% versus the S&P 500’s performance of 2.86% providing a market premium of 4.30%.

The U.S. Housing Market Forecast: Conclusion

I agree with Robert Dietz, a top housing economist, that the housing market is going to experience continuous cooling down during 2023, and then stabilize and grow in 2024. The deficit in single-family housing will show up then, and the town-house construction share is likely to increase due to demand. I Know First provides a forecast package for short-term and long-term periods to help our clients to find the most promising investment opportunities in the U.S. housing market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.