Tesla Stock Predictions: Greater Efficiency Is Compelling Reason To Go Long On Tesla

This Tesla stock predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

This Tesla stock predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Tesla Stock Predictions Summary:

- I reiterate my March 3 buy recommendation for Tesla. In spite of -12% YoY lower Q3 revenue, the stock is again trading above $326.

- Investors like it that greater efficiency is helping Tesla become more profitable. Reduced manufacturing and material costs makes Tesla a better long-term investment.

- Tesla is now generating most of its sales from its cheapest car model, the Model 3. It still managed to deliver a better-than-expected Q3 GAAP net profit of $143 million.

- Tesla manufactured and delivered almost 80k Tesla 3 models in Q3 2019. Tesla’s future prosperity is now insured – Tesla is now a legitimate consumer car vendor.

- Another tailwind is Tesla 3rd generation Solar Roof. Tesla is now poised to become the world’s best installer of solar power roofing.

My March 3 decision to endorse Tesla (TSLA) as a buy is now paying-off profitably. The stock back then was trading below $278. Tesla’s stock price is now $328. Most investors loved the better-than-expected net income numbers of Tesla Q3 2019 earnings report. The recent rally on TSLA is because many investors now believe Tesla’s emergence as Model 3-centric car company is truly sustainable and profitable.

Tesla’s stock’s 6-month price return is now at 32.51%. If Q4 2019 turns out to be profitable, I expect TSLA to trade at $380 by early January next year.

The FY19 Q3 revenue is down -12% YoY but Tesla still managed to generate a GAAP net income of $143 million (Non-GAAP net income is $342 million). Tesla is now generating most of its sales from its consumer car, the Model 3, but GAAP automotive gross margin is now higher at 22.8%. Greater efficiency in car manufacturing is making it cheaper for Tesla to produce and deliver its electric cars.

Tesla is now trading above $325 because investors now believe Tesla can become prosperous from being a vendor of low-cost electric cars. Selling $35k to $45k Model 3 electric vehicles can be a sustainable and profitable revenue growth driver for Tesla. The Q3 net income of $143 million is testament to this emerging reality. Tesla is now a global vendor of budget-friendly cars and is adeptly ramping up production capacity for the Model 3.

Greater Model 3 Production and Delivery Rate

You should go long on TSLA (or buy more shares) because the company is now capable of producing and delivering almost 80k Model 3 cars per quarter. Tesla’s Model 3 production rate grew 50 YoY in Q3. If this growth rate sustains, Tesla will be producing and delivering 120k Model 3 cars by Q2 2020. By early 2021, the quarterly production could be at 180k Model 3 cars.

Tesla’s higher valuation this week is justified. Like other car companies, the future prosperity of Tesla is really dependent on how fast it can deliver the greatest number of Model 3 cars. Greater adoption of electric cars will only happen when they become affordable even for lower middle-class people.

Tesla’s brand power can become more profitable if it is used to sell affordable electric cars. My takeaway is that it is more attractive for a customer to buy a $35k Tesla car than a $35k Nissan or General Motors (GM) brand of electric car.

Tesla’s stock can break the $400 price barrier if it can produce and deliver 120k Model 3 per quarter. Greater efficiency coming from scaled out production should also help improve the quarterly net income of Tesla.

Tesla’s Other Tailwind, Solar Roofs

Tesla is no longer just an electric car company. It is now also at the vanguard of clean renewable power. The long-term valuation of Tesla will not only depend on how many cars it can sell at a profit. It will also be influenced on how many Solarglass roofs and PowerWall solar battery packs it can sell.

The latest version 3 of Solarglass roof is apparently cheaper and faster to install. This should help Tesla’s subsidiary SolarCity attract more customers for its solar power roofing system. The more Solarglass roofs that SolarCity can sell, the more Tesla PowerWall battery packs can be sold.

Tesla touts it aims to install 1,000 roofs per week. The version 3 of Solarglass roofs will be available in 25 U.S. states. It is also suitable for over 100 million homes located in different places around the world. Competition means selling solar roofing systems is not going to be a high-margin business. However, it is highly profitable for Tesla to sell PowerWall battery packs. It can even be more profitable than selling Model 3 cars.

Tesla’s PowerWall 2 battery starts at $6,700 each plus $1,100 for the backup Gateway 2. Tesla also charges $1,000 to $3,000 installation fee for the PowerWall 2. Tesla’s stock could trade above $350 pretty quickly if and when Musk announces Tesla is installing 10k PowerWall 2 batteries per month. There is serious money to be made in solar power installation. The global solar power industry is growing at 30.7% CAGR.

Conclusion

Investing in Tesla is a high-risk/high-reward adventure. Holding TSLA shares is a rollercoaster ride. This stock is sensitive to rumors and earnings surprises. However, we cannot deny that Tesla is evolving as a profitable electric car, solar power, and lithium ion battery company.

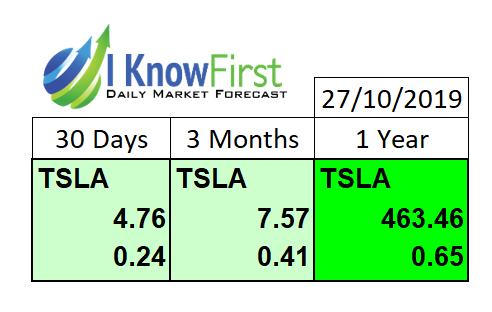

Consistent profitability is now expected from Tesla. Tesla still has more than $5.3 billion in cash and cash equivalents. Some of this money can be used to further improve the efficiency in manufacturing the Model 3. The commercial success of the Model 3 is a compelling reason to go long TSLA. My buy recommendation for Tesla is supported by its super bullish 1-year algorithmic market trend score. TSLA got a score of 463.46 from I Know First’s stock picking AI. This is more than 4x the bullish threshold score of 100.

How to interpret this diagram.

Past Success With Tesla Stock Prediction

I Know First has been bullish on Tesla stock price in past predictions. On June 16, 2019, the I Know First algorithm issued a bullish Tesla stock forecast. The algorithm successfully forecasted the movement of the Tesla’s shares and have risen by 52.68% until today. Moreover, in accordance with the AI based Algorithm forecast, shares of electric-car company Tesla jumped on last Friday (October 24). The stock had 2 large rallies on Thursday and Friday bringing it up nearly 29% in two days in line with the I Know First algorithm’s forecast. See chart below.

These bullish Tesla stock predictions were sent to the current I Know First subscribers on June 16, 2019.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market forecast, gold prediction, currencies predictions and, in particular, Apple stock forecast. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.