Tesla Stock Predictions: Cash-in Your Profits On TSLA

The Tesla Stock Predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

The Tesla Stock Predictions article was written by Motek Moyen Research Seeking Alpha’s #1 Writer on Long Ideas and #2 in Technology – Senior Analyst at I Know First.

Summary:

- The stock-picking Artificial Intelligence of I Know First still touts a super bullish one-year forecast score for Tesla.

- My takeaway is that we should play it safe. Cash-in your profits on TSLA right now. After this, wait for cheaper windows to make another re-buy.

- The lingering COVID 19 pandemic is a headwind for Tesla this year. The huge cash position of Tesla won’t save it from a pandemic-induced recession.

- The cheapness and oversupply of oil in the global market means companies/individuals are now less enthusiastic about electric vehicles.

- As long as there is no vaccine for the coronavirus that causes COVID 19, Tesla will it find challenging to deliver 500k cars in 2020.

I made my last buy recommendation for Tesla (TSLA) last October 27. Back then, TSLA was trading below $330. On that old write-up, I argued Tesla’s stock will reach $380 by January 2020. I was ecstatic when TSLA breached $600 by January. On the other hand, I got scared when this market darling stock skyrocketed to over $900 by February. The over-amorous emotion on TSLA this earlier year is dangerous. I strongly endorse taking your profits on TSLA now while the stock still trades above $600.

I know Tesla is worth more than $380. Unfortunately, I am still haunted by the very costly lesson over 3D Systems (DDD). A very sexy growth stock but heavy cash-burner like TSLA is vulnerable to global headwinds. The continuing lack of real cure and/or vaccine against the COVID 19 virus is a lingering headwind for TSLA this year. A monthly spending budget of more than $700 million will rapidly reduce/deplete the $8.8 billion that Tesla used to have after it sold new secondary shares last February.

A cash burner stock that runs out of cash or lenders is a dangerous investment. The best solution is to sell TSLA now and buy other beaten-down stocks. The rollercoaster emotions of investors will eventually give us a cheaper buy-in window for TSLA.

Pandemics Could Be Fatal To Overvalued Businesses

Yes. Tesla is a great momentum growth bet. However, we cannot deny that it is now overvalued. This is due to excessive optimism. Tesla is now the most valuable car company because the stock market fell madly in love. Love, like all other emotions, is arbitrary or impermanent. The big -8% drop yesterday is a clear warning sign that TSLA’s appeal is declining.

More worrisome, Tesla still touts a higher valuation than Amazon (AMZN). Amazon is one of those few firms that are actually benefiting/flourishing during the pandemic and yet it is less appreciated than Tesla. Tesla is clearly not getting any boost from quarantines.

Prolonged factory shutdowns and closures of retail car shops convinced me that Tesla will find it challenging to deliver 500k cars this year. Worst, the massive job losses due to COVID 19 pandemic are another strong headwind. Learned investors are not going to push TSLA to above $800 again when they know that this pandemic increased U.S. unemployment to 22 million. Recent job losses in America is very bad for Tesla. Going forward, there is now a lesser number of potential buyers of new cars in Tesla’s most important and biggest market, the United States.

Unless Tesla offers substantial discounts during this pandemic, I doubt if it could do $4 billion in U.S. quarterly sales (for the remaining quarters of 2020). Sad but true, Pres. Trump’s failure to implement strict quarantines will further aggravate America’s worsening COVID 19 plague.

Many banks and lending institutions are also becoming more strict. They will only extend loans to keep companies afloat. They won’t finance unnecessary corporate expenses like car leases. U.S. businesses that used to buy or lease dozens/hundreds/thousands of cars for their employees will no longer be dependable customers for Tesla and other car vendors. Due to the quarantine-induced stoppage in their operations, many companies will immediately impose a moratorium on new car leases/purchases.

The other medium-term tailwind is the oversupply of oil. Oil is so cheap now that even if travel restrictions are lifted, most people will continue to use their gasoline cars. My fearless forecast is that oil will continue to trade below $30 for most of 2020. The extension of quarantines means the oil glut will persist for much of 2020. Lastly, cheap gas prices are always a good reason to avoid buying electric cars.

In other words, the COVID 19 pandemic could hammer down Tesla’s 2020 sales to below $27 billion. An overfed market darling stock that can’t Wall Street’s revenue estimates is vulnerable to investor scorn. The obvious risk now is that TSLA could drop again to below $400. Sad but true, Tesla is an overfed stock. Betting too much on already bloated TSLA while there’s a pandemic is just bad. Better cash-in your exposure on Tesla before the herd sell-off mentality comes back.

Conclusion

Take your profits on TSLA immediately before the fickle, emotion-driven market takes it away. My fearless forecast is that there’s a near-zero chance that we will see TSLA bounce back to its February 2020 high of $968.99. The January/February honeymoon treatment for Tesla’s stock was excessive. It only showed many U.S. investors ignored the obvious warning from China’s COVID 19 lockdown in late January. TSLA only crashed to below $400 after the World Health Organization declared last March 11 that COVID 19 is a global pandemic.

My view might be wrong. China or American firms might come up with real cures for COVID 19 within the next few weeks/month. If this happens, a recession will be averted and TSLA might just meet its 500k car delivery target for 2020. I’m not infallible, TSLA might surprise us all again and shoot up to over $900 before 2020 ends.

Heed my intuition, you can take profit now on TSLA and use the money to buy other depressed stocks. You can also still hold on to your TSLA shares and hold them for a year. I Know First remains super bullish on Tesla’s stock. It gave it a one-year forecast score of 567.79.

Past I Know First Success with Tesla Stock Forecast

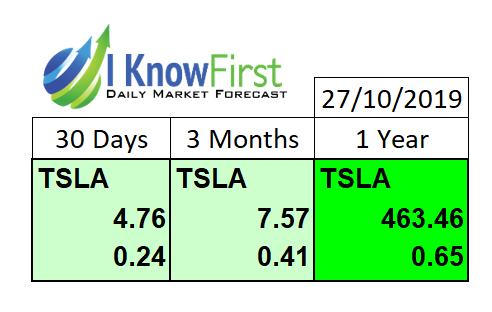

I Know First has been bullish on Tesla stock price in past predictions. On October 27, 2019, the I Know First algorithm issued a bullish Tesla stock forecast. The algorithm successfully forecasted the movement of Tesla’s shares and has risen by 17.48% until this week. See the chart below.

These bullish Tesla stock predictions were sent to the current I Know First subscribers on October 27, 2019.

Here at I Know First, our AI-based algorithm has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we have been providing daily stock market predictions, gold prediction, forex forecast, oil prices forecast, and, in particular, Apple stock news. Today, we are producing daily forecasts for over 10,500 assets. These forecasts generated by our quant trading tool are used by institutional clients, as well as private investors and traders to identify the best investment opportunities in the market.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.