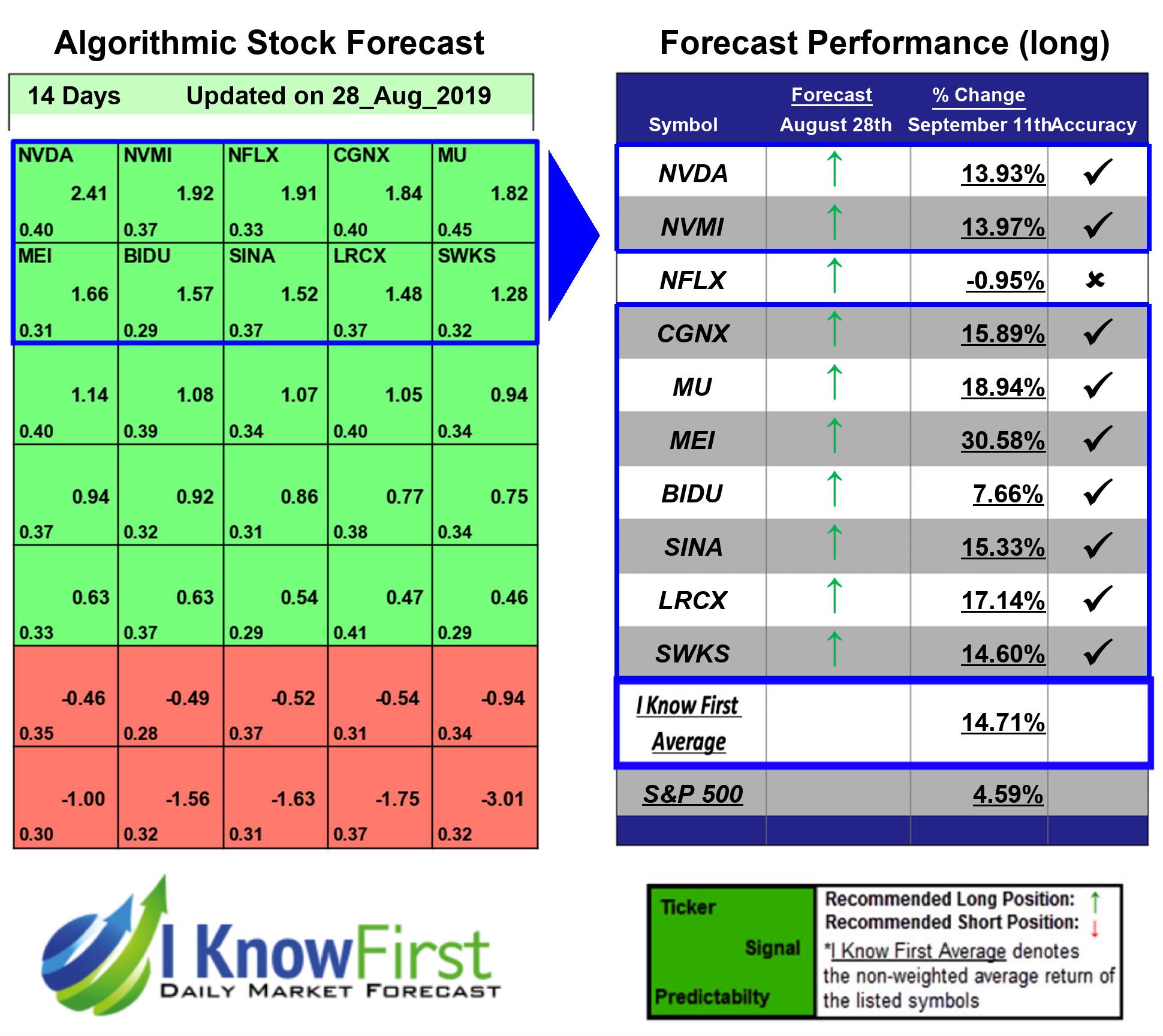

Tech Stocks Based on Deep-Learning : Returns up to 30.58% in 14 Days

Tech Stocks

This Tech Stock forecast is based on stock picking strategies for investors and analysts who need predictions for the 10 best tech stocks in the Technology Industry (see Tech Stocks Package). It includes 20 stocks with bullish and bearish signals:

- Top 10 Tech stocks for the long position

- Top 10 Tech stocks for the short position

Package Name: Tech Stocks Forecast

Recommended Positions: Long

Forecast Length: 14 Days (8/28/2019 – 9/11/2019)

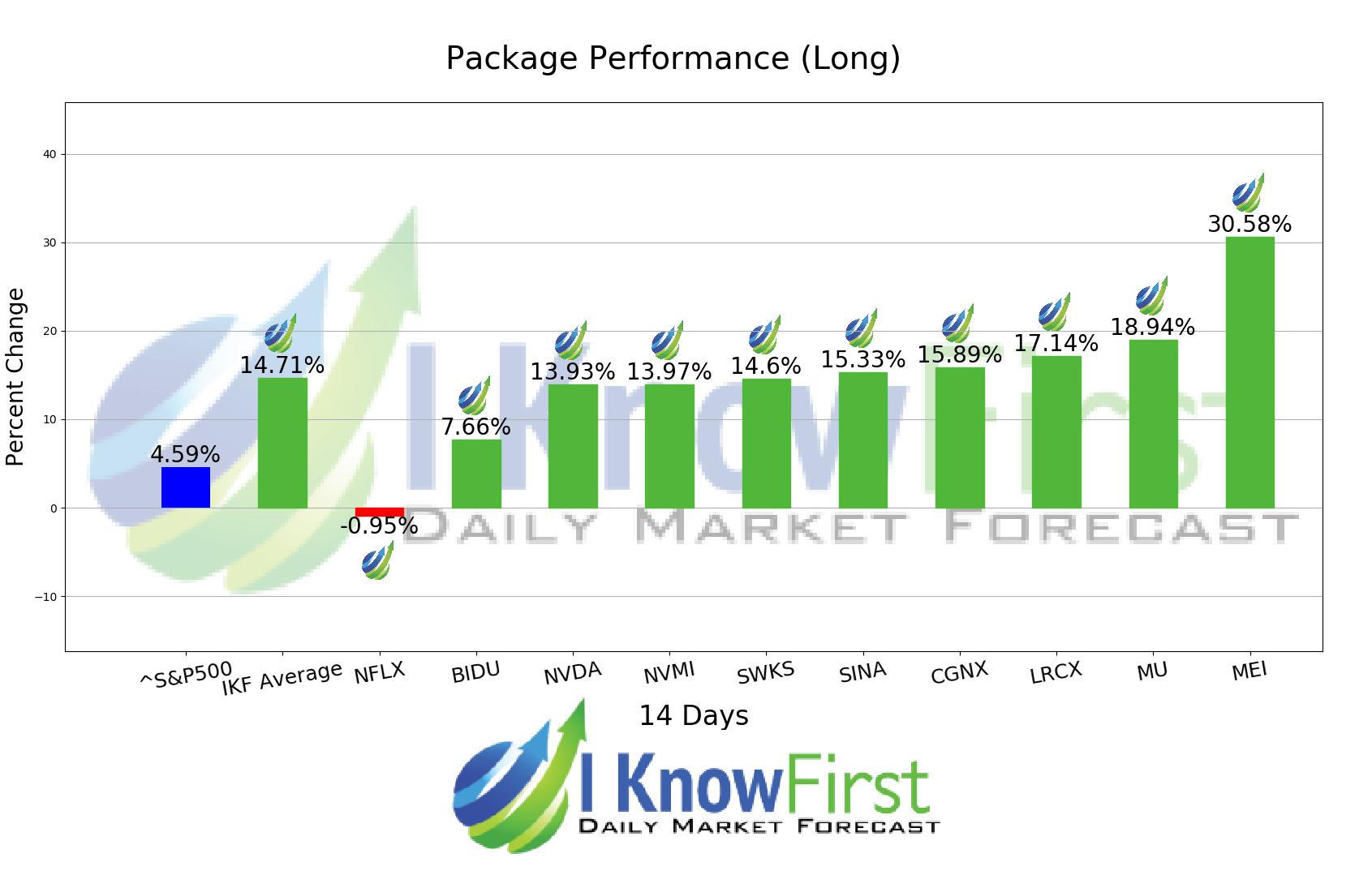

I Know First Average: 14.71%

9 out of 10 stock prices in this forecast for the Tech Stocks Forecast Package moved as predicted by the algorithm. MEI was the highest-earning trade with a return of 30.58% in 14 Days. Other notable stocks were MU and LRCX with a return of 18.94% and 17.14%. The package itself saw an overall return of 14.71%, providing investors with a 10.12% premium above the S&P 500’s return of 4.59% for the same time period.

Methode Electronics, Inc. (MEI) designs, manufactures, and markets component and subsystem devices in the United States and internationally. The company operates through Automotive, Interface, Power Products, and Other segments. The Automotive segment offers electronic and electro-mechanical devices, and related products to automobile original equipment manufacturers directly or through their tiered suppliers. Its products include integrated center consoles, hidden switches, ergonomic switches, transmission lead frames, and sensors, which incorporate magneto-elastic sensing and other technologies that monitor the operation or status of a component or system. The Interface segment provides various copper and fiber-optic interface and interface solutions for the aerospace, appliance, commercial food service, computer, construction, consumer, material handling, medical, military, mining, networking, point-of-sale, storage, and telecommunications markets. Its solutions consist of conductive polymers, connectors, custom cable assemblies, industrial safety radio remote controls, optical and copper transceivers, and solid-state field effect consumer touch panels; and services include the design and installation of fiber optic and copper infrastructure systems, and manufacturing active and passive optical components. The Power Products segment manufactures braided flexible cables, current-carrying laminated bus bars and devices, custom power-product assemblies, high-current low voltage flexible power cabling systems, and powder coated bus bars that are used in various markets and applications, including aerospace, computers, industrial and power conversion, military, telecommunications, and transportation. The Other segment offers medical devices, inverters and battery systems, and insulated gate bipolar transistor solutions. Methode Electronics, Inc. (MEI) was founded in 1946 and is headquartered in Chicago, Illinois.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.