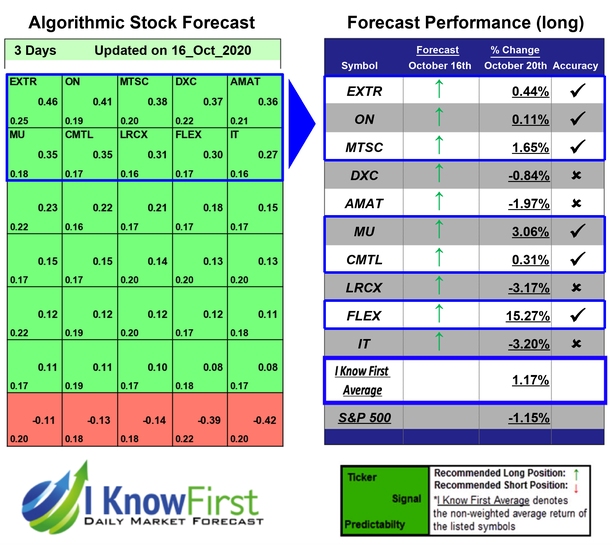

Tech Stocks Based on Artificial Intelligence: Returns up to 15.27% in 3 Days

Tech Stocks

This Tech Stock forecast is based on stock picking strategies for investors and analysts who need predictions for the 10 best tech stocks in the Technology Industry (see Tech Stocks Package). It includes 20 stocks with bullish and bearish signals:

- Top 10 Tech stocks for the long position

- Top 10 Tech stocks for the short position

Package Name: Tech Stocks Forecast

Recommended Positions: Long

Forecast Length: 3 Days (10/16/2020 – 10/20/2020)

I Know First Average: 1.17%

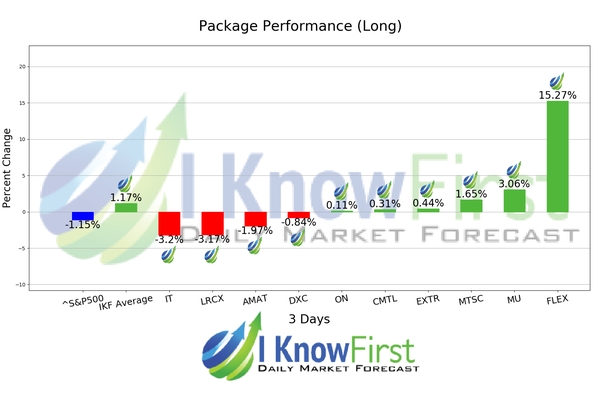

For this 3 Days forecast the algorithm had successfully predicted 6 out of 10 movements. The top performing prediction from this package was FLEX with a return of 15.27%. MU and MTSC saw outstanding returns of 3.06% and 1.65%. The package had an overall average return of 1.17%, providing investors with a premium of 2.32% over the S&P 500’s return of -1.15% during the same period.

Flex Ltd. provides design, engineering, manufacturing, and supply chain services and solutions to original equipment manufacturers worldwide. It operates through Communications & Enterprise Compute, Consumer Technologies Group, Industrial and Emerging Industries, and High Reliability Solutions segments. The company offers various services, including innovations labs for supporting customer design and product development services from early concept stages; collective innovation platform, an ecosystem of technology solutions; Lab IX, a startup accelerator program; centers of excellence solutions in critical areas; interconnect technology center for printed circuits; and CloudLabs that enable customers to accelerate a spectrum of cloud, converged infrastructure, and datacenter strategies. It also provides design and engineering services, such as contract design and joint development manufacturing services, which cover various technical competencies comprising system architecture, user interface and industrial design, mechanical engineering, technology, enclosure systems, thermal and tooling design, electronic system design, reliability and failure analysis, and component level development engineering; and systems assembly and manufacturing services. In addition, the company offers component product solutions that include rigid and flexible printed circuit board fabrication, and power supplies; after-market and forward supply chain logistics services; and reverse logistics and repair services, which comprise returns management, exchange programs, complex repair, asset recovery, recycling, and e-waste management for consumer and midrange products, printers, smart phones, consumer medical devices, notebook personal computers, set-top boxes, game consoles, infrastructure products. The company was formerly known as Flextronics International Ltd. and changed its name to Flex Ltd. in September 2016. Flex Ltd. was founded in 1990 and is based in Singapore.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.