Bottom Up Stock Market Forecast for the main World Indices by using AI Powered Predictive Algorithm

Executive Summary

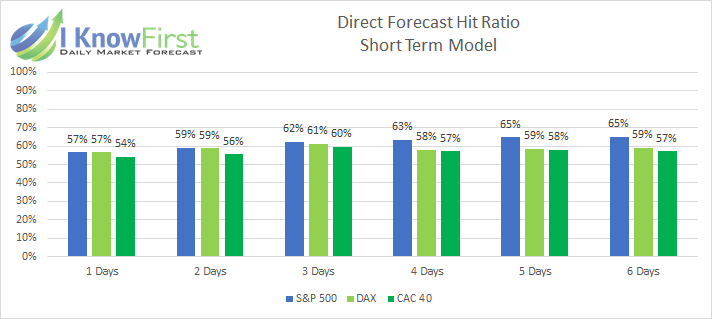

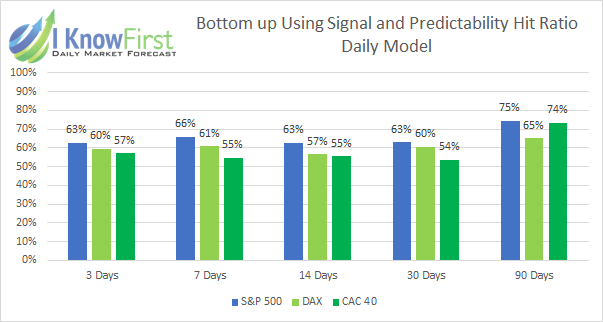

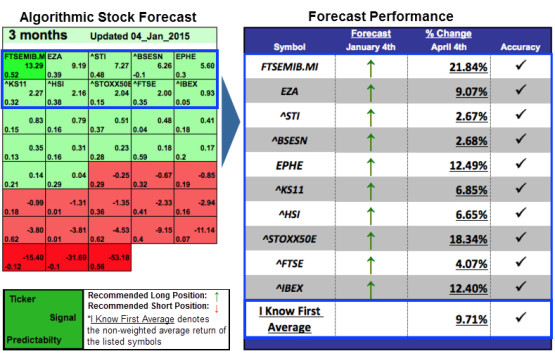

In this stock market forecast evaluation report, we introduced new bottom up signal generation methods using the I Know First AI Algorithm for the following world indices: S&P 500, DAX and CAC40. We compare the new bottom up signals’ performance with the direct forecasts’ performance generated for the indices using our short term model (1 to 6 days) and daily model (3 days to 3 months). Our analysis covers the time period from April 2, 2019, to April 3, 2020.

Bottom Up Forecast Evaluation Highlights:

- Short term model showed higher hit ratio than the Daily model for the 3 days’ time horizon for all indices analyzed.

- S&P 500 predictions showed higher hit ratio for all time horizons and methods than DAX and CAC40.

- Every method has hit ratios higher than 55% for the index’s predictions using Daily Model.