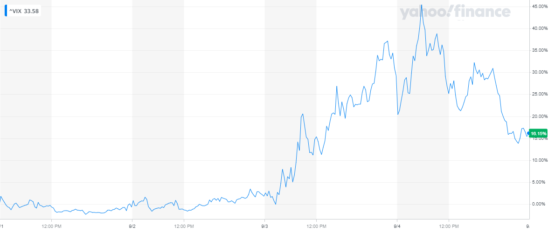

Volatility Ahead – VIX Index Surges as September Begins

The I Know First September 3rd AI algorithmic prediction was successful in foreseeing that VIX index would surge on this trading day and until today. In reality, the index went up by almost 26% on Thursday to 33.6, and slightly declined to 30.75 on Friday. It’s value remains higher than it’s closing value on Wednesday – around 26.

As more and more uncertainty about the future economic activity rises due to Coronavirus implications and new lock-downs worldwide triggered by the second wave of patients, the VIX predictions lead its way to the top of I Know First’s forecast

Dr. Lipa Roitman, Co-Founder & CTO at I Know First..

Dr. Lipa Roitman, Co-Founder & CTO at I Know First.. Michael Shpits, Financial Analyst at I Know First.

Michael Shpits, Financial Analyst at I Know First. Read The Full Premium Article

Read The Full Premium Article