Robinhood Trading Using AI: Top Stock Picking Strategies to Boost Portfolio Now

This article is written by Hao Liu, Financial Analyst at I Know First.

This article is written by Hao Liu, Financial Analyst at I Know First.

Summary:

- Robinhood users are taking high risks for lack of investment knowledge.

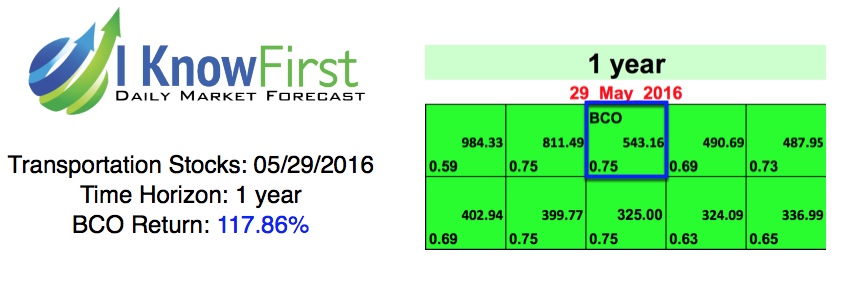

- I Know First can help Robinhood users alleviate risks by utilizing AI-powered stock forecasts.

- I Know First offers highly customizable forecasting solutions tailored to investor’s needs and riskiness.

Read The Full Premium Article

Read The Full Premium Article